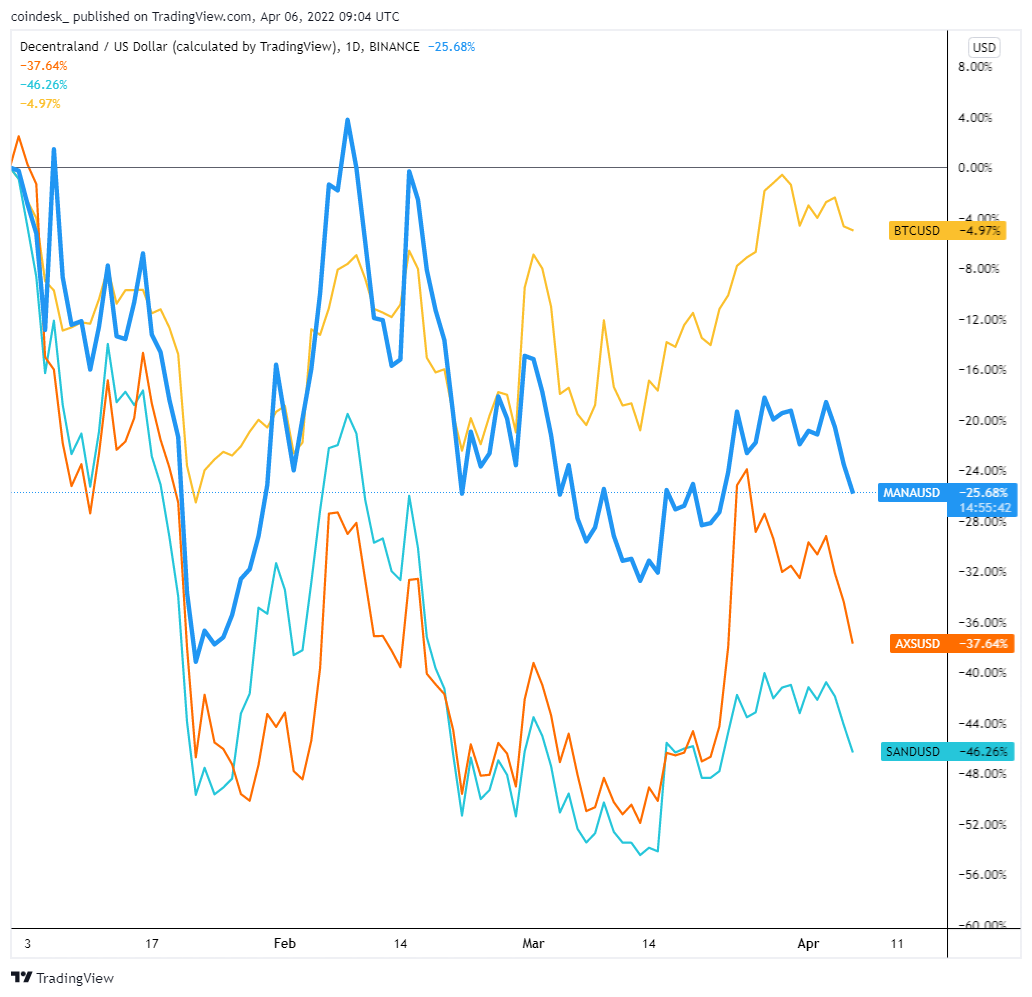

The metaverse, despite all the interest from venture capital and the world’s major brands, is struggling to attract users, and token prices have begun to reflect this. Tokens for the three major metaverse protocols, Decentraland's MANA, Axie Infinity's AXS and The Sandbox's SAND are all down year to date, and significantly underperforming bitcoin (BTC).

Token prices of the metaverse majors for the year to date. (TradingView)

While all three have seen significant interest from venture capitalists, who have allocated hundreds of millions to metaverse and GameFi, some market observers say the number of daily active users (DAU) doesn't reflect the level of investment.

“There is currently no organic engagement that retains players in the game – unlike traditional games like Fortnite, GTA, Candy Crush – where players are willing to pay to keep playing,” Web 3 analyst DeFi Vader wrote in an August note about Axie Infinity. “If one or a few of those games create organic engagement, then DAU growth may stop being mostly dependent on daily earnings.”

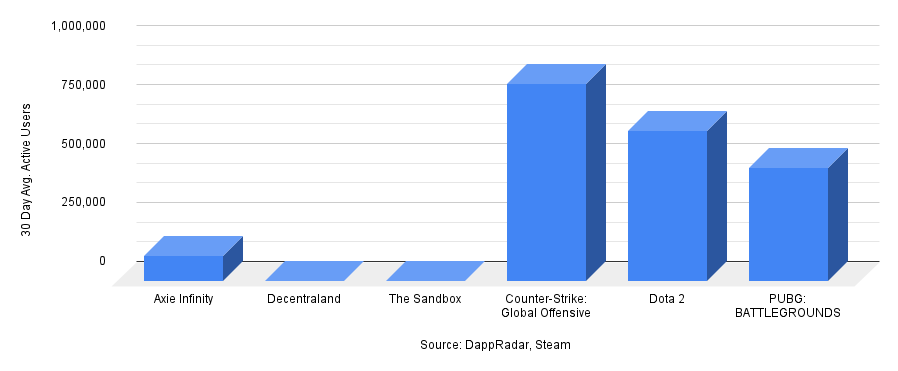

In the past 30 days, the number of Axie Infinity's average daily users has dropped 30% from the previous period to about 107,240, The Sandbox's has fallen 29% to 1,180 and Decentraland has lost 15% to 978 users a day on average, according to DappRadar data.

Comparing active users in metaverse games to popular PC games (DappRadar, Steam)

When compared to mainstream games on Steam – a digital gaming store – these numbers barely even register against titles like Counter Strike, Dota 2, and PUBG.

For Axie Infinity, it’s impossible to determine how many of these players are there just for fun, rather than as employees of guilds playing the game to earn yield for investors. The team behind Axie Infinity seems to understand this, and acknowledges that gameplay needs to improve for the game to grow organically.

Gamers, themselves, appear to be hostile to GameFi. Gaming giant Ubisoft’s non-fungible token (NFT) efforts fell flat and an industry survey published during the Game Developers Conference showed that most studios are not interested in embracing crypto or NFTs.

It’s likely the wider industry sees the monetization of game play as unattractive to would-be participants, explains Messari in a research note, asking rhetorically if the reader has ever met anyone that finds these games fun.

“First, the ability to purchase NFTs or in-game currency effectively creates pay-to-win game mechanics, a quality that most major franchises and successful games avoid,” Messari’s Mason Nystrom wrote in a March report. “The most successful games often share an element of skill, opting to create a competitive multiplayer gaming experience and avoiding a 'spam the credit card until you win' option.”

Still, there are those in the industry who say quality gameplay can go hand in hand with GameFi and the metaverse. In an interview with CoinDesk earlier this year, Red Door Digital’s See Wan Toong sees the crypto funding model as a way to ween games off reliance on being bankrolled by major studios.

The question remains whether this view will become mainstream.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C5GUMQU7TNH47GR7EMKLKH6QOU.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)