Most cryptocurrencies advanced on Wednesday, shaking off some of the bearish sentiment over the past few days.

Bitcoin (BTC), the world's largest cryptocurrency by market cap, returned to above $40,000, while alternative cryptos outperformed. For example, THORChain's RUNE token rallied by 12% over the past 24 hours, compared with a 4% rise in BTC over the same period. AAVE, GRT and AVAX were all up by more than 8% on Wednesday.

Just launched! Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.

Stocks also traded higher on Wednesday while the 10-year Treasury yield pared earlier gains. Still, gold, a traditional safe haven asset, ticked higher, indicating some uncertainty among investors.

In crypto, some buyers have remained on the sidelines despite recent price bounces. "Investor spending behavior appears to be switching from dominance of loss realization, towards a modest amount of profit taking – 58% of bitcoin transaction volume is currently realizing a profit," Glassnode, a crypto data firm, wrote in a blog post.

Latest prices

●Bitcoin (BTC): $41104, +4.47%

●Ether (ETH): $3090, +3.82%

●S&P 500 daily close: $4447, +1.12%

●Gold: $1981 per troy ounce, +0.45%

●Ten-year Treasury yield daily close: 2.69%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

No cycle low yet

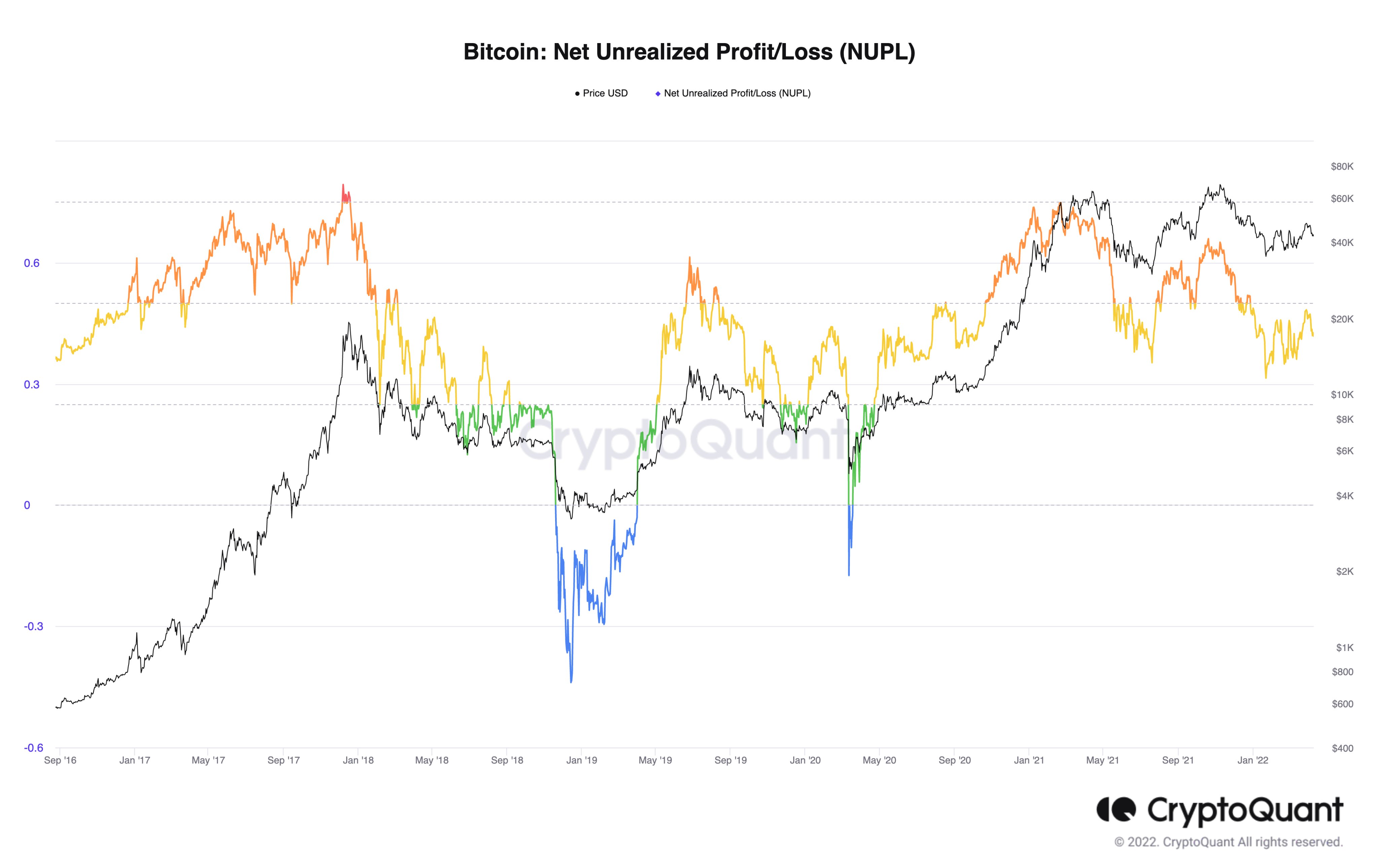

The chart below shows bitcoin's net unrealized profit/loss indicator (NUPL), which is used by some analysts to spot inflection points in BTC's price.

In theory, the market tends to approach a price low when a majority of BTC traders' positions are in a loss (token price has decreased below cost basis). The opposite is true when BTC trades far above the average traders' cost basis.

Currently, the NUPL indicator is neutral, similar to mid-2018 and mid-2020. The last major cycle high was seen around the January and November 2021 price peaks, which preceded the latest 50% sell-off in BTC's price. A price low, however, has not been triggered, which previously occurred on high volume down moves far below the average traders' cost basis around $30,000-$40,000 BTC.

For now, upside could be limited despite short-term price jumps.

Bitcoin net unrealized profit/loss (CryptoQuant)

Altcoin roundup

- Ethereum merge no longer expected in June: After a few weeks of speculation, Ethereum core developer Tim Beiko confirmed in a tweet Tuesday that the long-awaited Ethereum Merge will come later than expected. Instead of June, Beiko said that the network's transition to proof-of-stake is more likely to come “in the few months after.” In a tweet he said: “It won't be June, but likely in the few months after. No firm date yet, but we're definitely in the final chapter of [proof-of-work] on Ethereum,” according to CoinDesk’s Sam Kessler. Read more here.

- Terra's anchor protocol to launch on Polkadot DeFi hub Acala: Terra’s popular decentralized finance (DeFi) protocol Anchor is coming to Polkadot’s Acala network. The partnership comes as Polkadot looks to grow its DeFi adoption and Anchor expands into new blockchains. According to a press release, Acala and Karura, a Polkadot parachain, will expand Anchor’s collateral options for the UST stablecoin with liquid DOT (LDOT) and liquid KSM (LKSM), according to CoinDesk’s Tracy Wang. Read more here.

- Tether’s USDT stablecoin enters Polkadot ecosystem with Kusama launch: Tether (USDT), the largest of the dollar-pegged stablecoins with a market capitalization of over $80 billion, is launching on Kusama, a system of parallel blockchains that serves as Polkadot’s “canary network.” Stablecoins are a hot topic right now, with recent news of BlackRock (BLK), the world’s largest asset manager, taking an interest in USDC, Tether’s closest rival in terms of circulating supply, according to CoinDesk’s Ian Allison. Read more here.

Relevant reads

- Listen: While You Were Out Partying, I Studied Bitcoin Development: With bitcoin steady as the race among central banks to hike interest rates heats up, and a brief peek at what the bitcoin developers are saying, CoinDesk’s Markets Daily is back with the latest news roundup.

- Luna Foundation Guard Adds $100M in BTC to UST Reserves: LFG's balance now sits at $2.26 billion, 75% of which is bitcoin.

- Speculative SHIB Market Sees Increased 'HODLing': Holders remain unfazed and have been buying the token in recent weeks, an analytics firm said.

- Fireblocks and Fintech Major FIS Bring DeFi to Capital Markets: FIS’s client list of 6,400 asset managers, banks and brokers will have access to platforms like Aave Arc with more institution-friendly DeFi pathways to come.

- Luno Forges Multimillion-Dollar Partnership With London Entertainment Venue KOKO: Madonna, Prince, Stormzy, H.E.R., Amy Winehouse and Kanye West have performed at the northwest London location. (Luno is a CoinDesk sister company.)

Chinese Banking Associations Target NFTs: As the market heats up, the tokens are increasingly under the microscope in China.

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FCI74BNFKNAA5OHJ3RN4NG2ZXE.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)