Bitcoin (BTC) rose toward $40,000 during the New York trading day. The price rise offset a brief period of selling immediately after the U.S. Federal Reserve raised its policy interest rate by a half-percentage point, its biggest hike since 2000.

The Fed also approved plans to start reducing its bond portfolio, which will ease monetary stimulus that has contributed to the rise in speculative assets, including stocks and cryptos.

Just launched! Please sign up for our daily Market Wrap newsletter explaining what happens in crypto markets – and why.

The Federal Open Market Committee, which sets interest rates, stated that ongoing rate increases within the target range will be appropriate, which suggests another hike could occur at the Fed's meeting next month, albeit likely below 0.75 percentage points as some traders expected.

Rising rates typically precede slowing economic growth, which could weigh on asset prices. Still, during a press conference on Wednesday, Federal Reserve ChairJerome Powell stated that the U.S. economy remains very strong and could handle rising interest rates.

Most cryptocurrencies traded higher over the past 24 hours, tracking moves in stocks. Meanwhile, gold ticked higher as the U.S. dollar declined.

Latest prices

●Bitcoin (BTC): $39,878, +5.70%

●Ether (ETH): $2,955, +6.59%

●S&P 500 daily close: $4,300, +2.99%

●Gold: $1,886 per troy ounce, +0.90%

●Ten-year Treasury yield daily close: 2.92%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Embracing risk over the short term

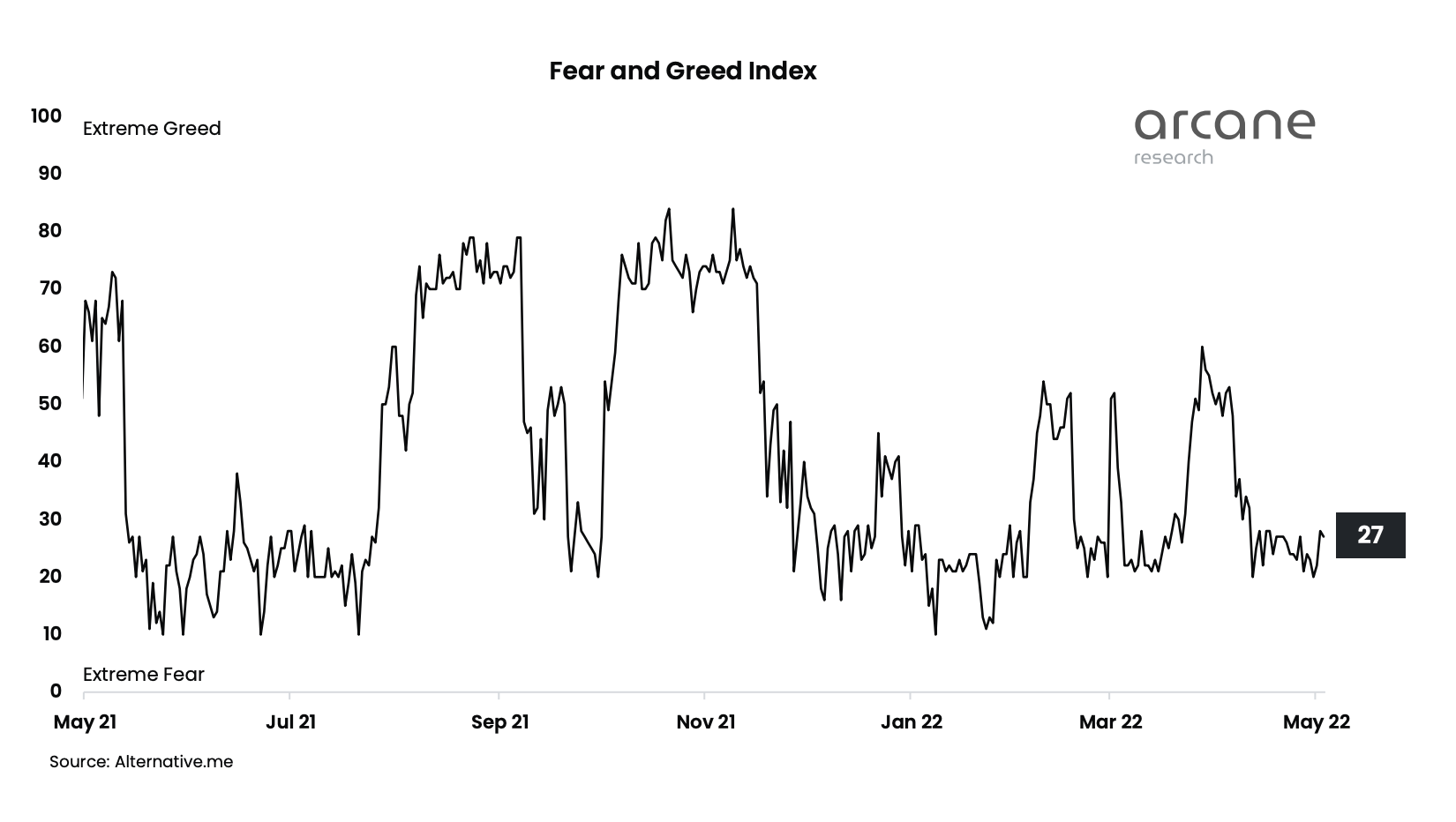

The bitcoin Fear & Greed Index ticked lower into "extreme fear" territory, indicating a lower appetite for risk among crypto traders.

The index has remained in "fear" territory over the past few months, marking a decisive shift in "extreme greed" sentiment in November of last year.

An increase in trader sentiment would require a rise in BTC's price, with a gradual increase in trading volume and volatility. Generally, high buying volumes in a positive market on a daily basis indicate bullish activity, according to Alternative.me, which constructs the index.

Bitcoin's dominance, or BTC's market capitalization relative to the total crypto market cap, accounts for 10% of the Fear & Greed Index.

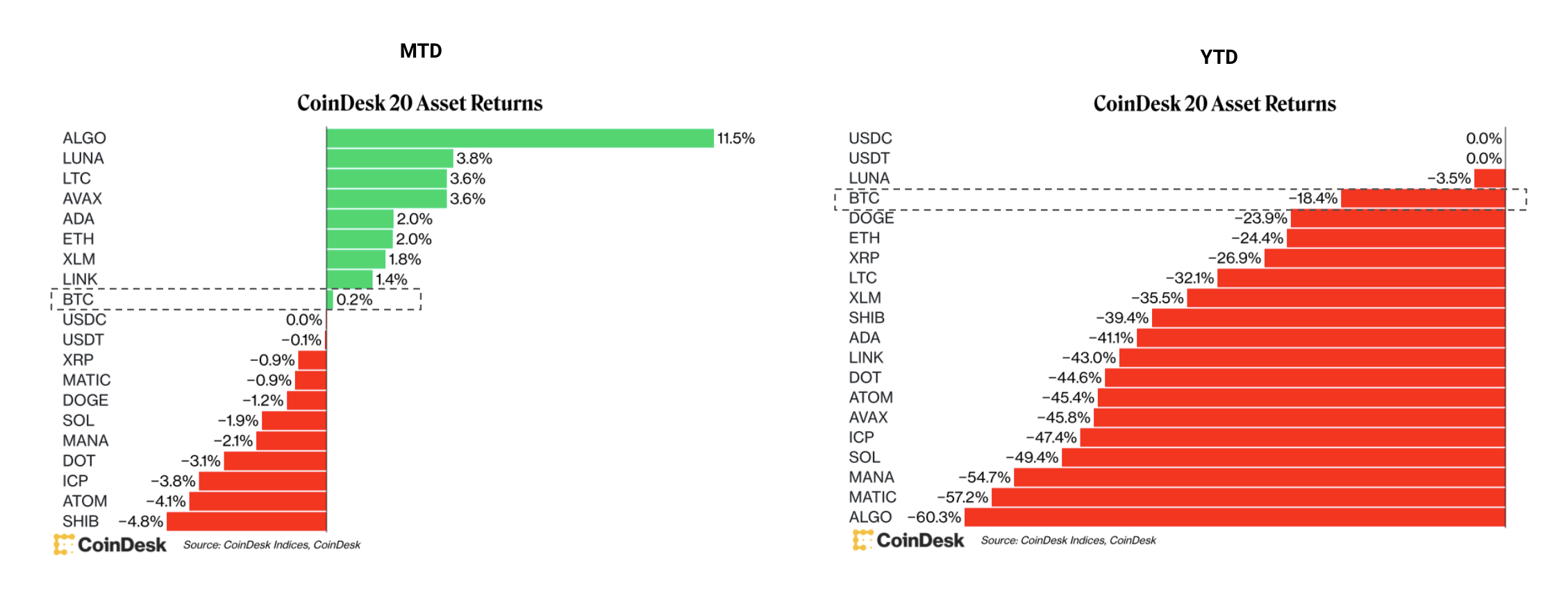

BTC is outperforming alternative cryptos (altcoins) so far this year, but gave up some of its lead in the past few days. That could point to improving sentiment among traders over the short term, especially as stocks and cryptos enter a seasonally strong period.

Bitcoin Fear & Greed Index (Arcane Research)

Crypto returns month to date (MTD) and year to date (YTD) (CoinDesk)

Altcoin roundup

- Starbucks teases Web 3 platform in NFT announcement: Starbucks (SBUX) plans to launch a series of non-fungible token (NFT) collections, according to a company blog post published Tuesday. The popular coffee chain says its NFTs will provide “unique experiences, community building and customer engagement,” complementing its current app-based digital ecosystem, according to the post. Read more here.

- Valkyrie launches Avalanche trust for TradFi exposure to AVAX token: Crypto investment firm Valkyrie said Wednesday it is launching an Avalanche Trust for traditional investors looking to gain exposure to the Avalanche ecosystem. According to people familiar with the matter, the trust has already secured $25 million. The Avalanche Trust launch comes two weeks after Valkyrie established a “Multi-Coin Trust” that invested in a basket of base-layer tokens including AVAX. Read more here.

- APE surges, sinks as Elon Musk teases with Bored Ape collage as profile picture: ApeCoin (APE), the native token of the Bored Ape Yacht Club (BAYC) ecosystem, surged and then sank during the European trading session as Tesla (TSLA) founder Elon Musk put up a collage of Bored Apes as his Twitter profile picture on Wednesday. Read more here.

Relevant insight

- California Governor Signs Executive Order to Spur Crypto Industry in the State: The order prompts the creation of a regulatory framework for blockchain technologies and crypto financial assets.

- Binance Secures Regulatory Approval in France: Binance's registration allows it to custody digital assets and operate a trading platform in the country.

- Kazakhstan Orders Crypto Miners to Register With Authorities: The Central Asian country is trying to clean up its mining industry in the face of energy shortages.

- Marathon Digital ‘Cautiously Optimistic’ About Meeting Early-2023 Hashrate Guidance as Delays Continue: The firm mined 299 bitcoins in April, a near 31% dip from the previous month, citing weather and maintenance issues.

- Terra to Provide UST Liquidity on Polygon-Based SynFutures: SynFutures processed over $266 million in trades over the past week.

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Cardano | ADA | +13.5% | Smart Contract Platform |

| Cosmos | ATOM | +13.3% | Smart Contract Platform |

| Ethereum Classic | ETC | +11.0% | Smart Contract Platform |

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IGSYREF4CRFA5PFTTNXLSVXG2I.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TPIELPTEOFCFBMZMK37FF3FBA4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OTPRGDCX2NFTBJUZWAJA2HDZXI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C7UC7UF4WRG73LR4SJTW7EQBNI.jpg)