Good morning. Here’s what’s happening:

Prices: Bitcoin and other major cryptos see green, but market sentiment remains bearish.

Insights: Investors change their stablecoin preferences.

Technician's take: BTC is on track to register a positive momentum signal on the daily chart.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

Prices

Bitcoin (BTC): $30,466 +1.6%

Ether (ETH): $2,092 +3.1%

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Litecoin | LTC | +7.8% | Currency |

| Algorand | ALGO | +7.5% | Smart Contract Platform |

| Polygon | MATIC | +7.3% | Smart Contract Platform |

Biggest Losers

Bitcoin and other major cryptos see green

Bitcoin and other major cryptos were largely in the green late Tuesday as the market continued to solidify, but the small surge seemed more a temporary reprieve than sea change in bearish sentiment that intensified last week during the terraUSD (UST) stablecoin implosion.

The largest cryptocurrency by market capitalization was recently trading over $30,400, a more than 1% gain over the past 24 hours. Ether was up about 3% during the same period, maintaining its most frequent, recent perch above $2,000. ALGO and MATIC each rose over 7%. SOL, CRO and ADA recovered from midday drops and were up about 4%.

"The crash of [Terra’s] UST stablecoin has heralded the end of a momentous bull run," Yield App CEO and founder Tim Frost wrote in an email. "The market is 54% below" its "all-time high and won’t be climbing far any time soon as we face what looks set to be a painfully prolonged bear market."

Cryptos traced equity markets, which rose amid encouraging U.S. retail spending and industrial production reports and cautiously optimistic remarks by U.S. Federal Reserve Chair Jerome Powell. The tech-focused Nasdaq jumped 2.7%, while the the S&P 500 and Dow Jones Industrial Average rose 2% and 1.3%, respectively.

The U.S. Commerce Department said on Tuesday that retail sales had risen 0.9% in April, the fourth consecutive monthly increase and evidence that surging inflation has not completely damped consumers' appetites for goods and services. The report noted increased spending on electronics, cars and clothing, even as consumers spent less on gas, which has been a primary source of the recent months' cost run-ups. Meanwhile, the Federal Reserve said industrial production rose 1.1% in April, also its fourth straight monthly gain.

In remarks at The Wall Street Journal's Future of Everything Festival on Tuesday, Powell called “restoring price stability a nonnegotiable need." "It is something we have to do," he said, adding that he was hopeful the Fed could tame inflation without triggering huge increases in unemployment or a deep recession. "It is a challenging task, made more challenging the last couple months because of global events,” Powell said. “It is challenging because unemployment is very low already and because inflation is very high.”

Yield App's Frost said the collapse of UST was "nothing short of harrowing."

"Any thorough due diligence assessment would have revealed that this asset could not withstand a bank run," he wrote. "And withstand a bank run it truly did not."

Still, he added optimistically that other protocols would learn from the "UST disaster, lessons that will use the resulting bear market to develop the next generation of decentralized finance products. When we enter the next bull run, the fruits of their labor will be the world’s new financial system."

Markets

S&P 500: 4,882 +2%

DJIA: 32,654 +1.3%

Nasdaq: 11,984 +2.7%

Gold: $1,814 -0.6%

Insights

Investors change their stablecoin preferences

LUNA and UST’s collapse is still reverberating through the broader crypto market. Bitcoin has fallen significantly in recent months and is now seemingly stuck around the $30,000 mark.

The most significant impact on the market isn’t an evisceration of crypto pricing from the start of the year, a trend that the collapse accelerated, but rather a brewing crisis of confidence in the stablecoin sector.

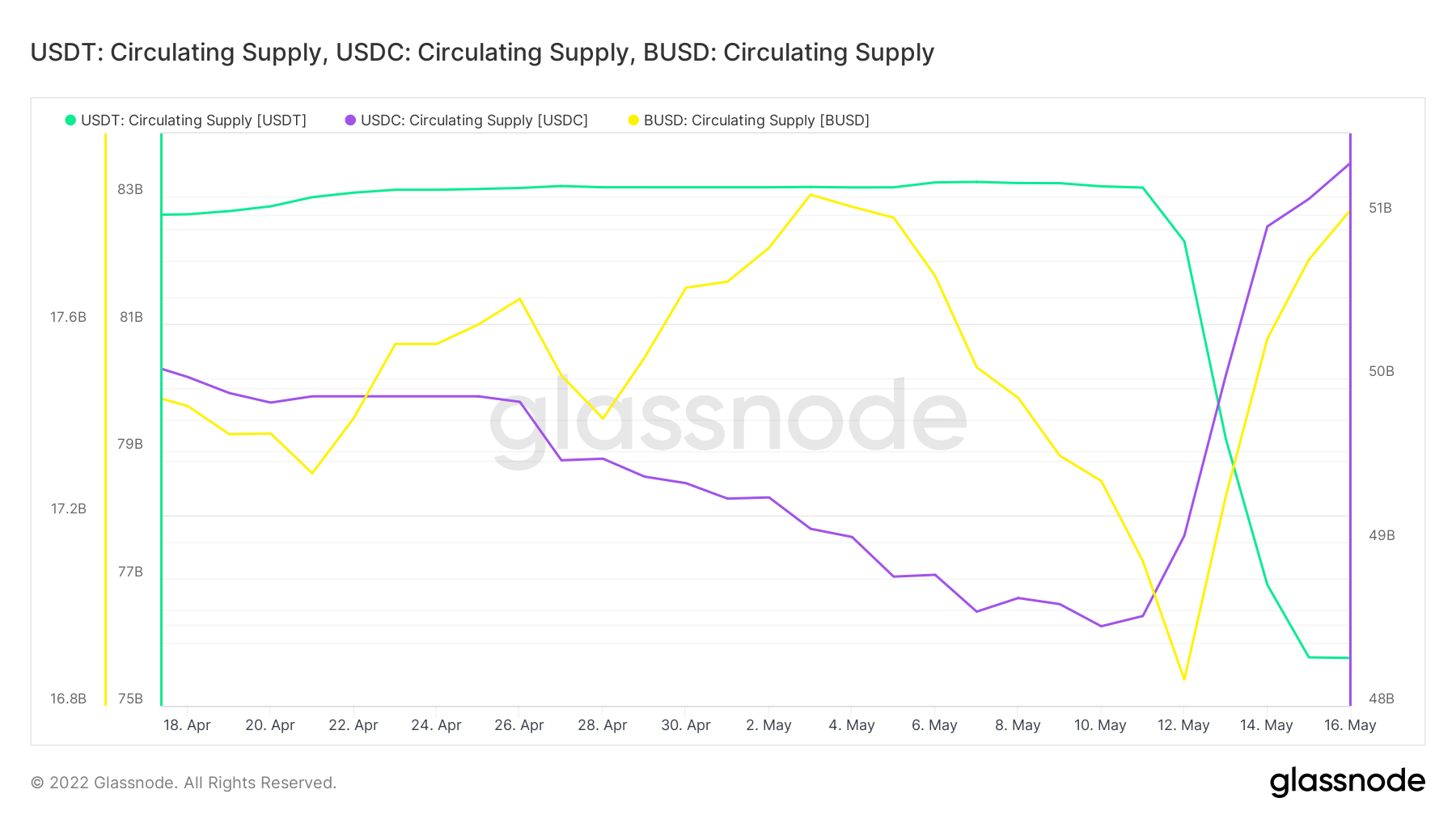

Data from Glassnode shows an inverse relationship between issuances of tether (USDT) and USD coin (USDC) as well as Binance USD (BUSD). Tether tokens are exiting circulation via redemption (being exchanged for cash) while more USDC and BUSD are being issued because of demand.

USDT/USDC circulating supply. (Glassnode)

“The redemptions of USDT were around $7.5 billion, whilst the supply of USDC grew by $2.64 billion and BUSD by $1 billion. So all in all we had around $3.64 billion in supply expansion, and $7.5 billion in contraction, meaning a net outflow of $3.76 billion,” James Check, an analyst at Glassnode, wrote to CoinDesk in an email.

DAI, another algorithmic stablecoin but structured differently than UST, also saw a decline in circulating supply by 24.4%, as $2.067 billion was burned.

“What we are potentially watching is a changing preference for which stablecoins the market prefers,” Check said.

Check suspects a large trader or traders used the momentum of the "UST depeg" narrative to lean on the USDT peg in the hopes it would generate downside fear, which he believes it did.

“We saw the distressed sale of the [Luna Foundation Guard’s] 80K BTC, and then a few days later, USDT pairs on some exchanges come under pressure, making for a perfect storm for a sophisticated short side trade,” he said.

But it’s important to note that despite all this, the USDT dollar peg quickly recovered. A large, rapid volume of redemptions happened in a short time, and the system kept functioning.

“As stablecoins become increasingly integrated as base layer infrastructure in the market, the shockwaves of a de-pegging event, especially in the largest stablecoin USDT will have widespread impacts,” Check wrote in a note published last week. “This event will also no doubt attract the regulatory spotlight at a greater pace and urgency.”

USDC has a long way to go before it ever has a change of "flippening" tether. But the data can’t be ignored: With a crisis of confidence brewing for stablecoins, it’s USDC (and BUSD) that the traders want, not tether.

Technician's take

Bitcoin daily chart shows support/resistance, with RSI on bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to trade around $30,000, which is near the bottom of a year-long price range. The cryptocurrency appears to be stabilizing, although resistance at $33,000 and $35,000 could stall an upswing in price.

BTC was roughly flat over the past 24 hours and is down by 24% over the past 30 days. The recent sell-off extended bitcoin's short-term downtrend despite oversold conditions on the chart.

Further, on the daily chart, BTC on track to register a positive momentum signal, per the MACD indicator for the first time since late March. Still, momentum signals remain negative on the weekly and monthly charts, which suggests limited upside from here.

Important events

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia wage price index (MoM/YoY/Q1)

CoinDesk TV

In case you missed it, here is the most recent episode of "First Mover" on CoinDesk TV:

Ernst & Young Principal and Global Innovation Leader Paul Brody joined "First Mover" to discuss the state of crypto following the UST and luna crashes. Also, can blockchain help to address the global supply chain crisis? Plus, Andre Portilho of BTG Pactual provided crypto markets analysis and Ron Hammond of the Blockchain Association discussed crypto regulation.

Headlines

How Not to Run a Cryptocurrency Exchange: At Japan's Liquid exchange, recently acquired by FTX, warnings were ignored, breaches unreported and employees berated and cursed at, insiders say.

Big-Money Investors Who Boosted Bitcoin’s Price Might Now Crash It: Everyone celebrated the arrival of institutional investors to the bitcoin market, as their rising adoption helped send prices soaring. Now, with correlations to traditional markets at an all-time high, fingers are pointing over the market swoon.

Terraform's Legal Team Quits Amid Terra Stablecoin Fallout: Marc Goldich, Lawrence Florio and Noah Axler left the Terra ecosystem backer in May, according to their LinkedIn profiles.

A16z Addresses Downturn in Inaugural State of Crypto Report: The report discussed Web 3 trends and why Ethereum remains the dominant blockchain.

Blockchain Investment Firm Fortis Digital Raising $100M Fund: The fund focuses on altcoins and requires potential investors to have a minimum $2.5 million net worth.

Longer reads

Meltem Demirors: 'If I Dress Like a Disco Ball, Let Me': She's a crypto OG. Stylish. Unapologetic. And a priestess of her own cult. Demirors is a speaker at CoinDesk's Consensus festival in June.

Today's crypto explainer: What Can You Buy With Bitcoin?

Other voices: Cryptoverse: Stablecoins wend wobbly way into the unknown (Reuters)

Said and heard

“Web 3’s open access eliminates the power hierarchy, enabling creators to take control of their businesses. Spencer (Dinwiddie] noted that 'our "New Money" conversations taught us about the pressing urgency for creators to be able to monetize directly, without the interference of a third-party,' and that newly developed, decentralized platforms provide more efficient avenues for transactions between creators and fans.” (Calaxy COO and co-founder Solo Ceesay) ... “We have both the tools and the resolve to get inflation back down,” [Federal Reserve chief Jerome] Powell said during an appearance at The Wall Street Journal’s Future of Everything Festival, adding that the Fed is tightly focused on the task. The central bank is raising interest rates as part of its most aggressive effort in decades to curb upward price pressures. “We need to see inflation coming down in a convincing way,” Mr. Powell said. “Until we do, we’ll keep going.” (The Wall Street Journal) ... "Retail sales – a measure of spending at stores, online and in restaurants – rose a seasonally adjusted 0.9% last month compared with March, the Commerce Department said Tuesday. That marked the fourth straight month of higher retail spending." (The Wall Street Journal)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/7ZKKPQWTGRFXLGGLD5XFH5MC7E.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5PVVPRTZRNBE5IG6CTHHPWYNVE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LDBUTV6UINESVN2K3WY2F3SYNU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PN2SE2FZFVG3ZPSQW2KBZYRG6Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OPZDNUGXP5GONKCYHWLXROPHHE.jpg)