There has been a change in the thinking of the large crypto investors known as whales. Data shows USD coin (USDC) has become the stablecoin of choice on the Ethereum blockchain, not the larger tether (USDT).

In crypto, whales are the biggest cryptocurrency holders – institutional investors, exchanges, deep-pocketed individuals – who are capable of moving large amounts of tokens and swaying market prices. Analysts closely watch their activity to spot trends and anticipate large price movements.

Data from CoinMetrics, a blockchain analysis firm, shows wallet addresses on the Ethereum blockchain that hold more than $1 million USDC surpassed the number of wallets that hold USDT, still the largest stablecoin by market cap.

“In the current market condition, a lot of people view USDC as the safer, preferred stablecoin," Edward Moya, trading platform Oanda’s senior market analyst, told CoinDesk.

CoinMetrics looked at blockchain data since May 9, when UST lost its peg to the U.S. dollar. The firm identified 147 Ethereum wallet addresses that increased their USDC balance by at least $1 million while decreasing their USDT balance by at least $1 million. Among them, there were 23 that added at least $10 million USDC and disposed of $10 million USDT. Many of these addresses are exchanges, custodial services or decentralized finance protocols, the report added.

The report also said USDC’s advantage over Tether's USDT in so-called free float supply – the number of tokens that investors hold – on the Ethereum blockchain hit an all-time high on Tuesday among all holder groups.

"This likely reflects the fact that only large holders are generally privileged to redeem USDT and mint new USDC to capture an arbitrage," Kyle Waters, analyst at CoinMetrics, wrote in the report. "But it might also be the case that some large accounts are de-risking their holdings, turning to the perceived assurances of USDC’s monthly attestations and full-reserve backing."

Tether, the company behind USDT, reduced its commercial paper holdings by 17% from $24.2 billion to $20.1 billion in the first quarter, according to its latest, quarterly, attestation report of the assets backing the stablecoin. However, it also said $286 million of its assets were being held in non-U.S. Treasury bonds with a maturity of less than 180 days.

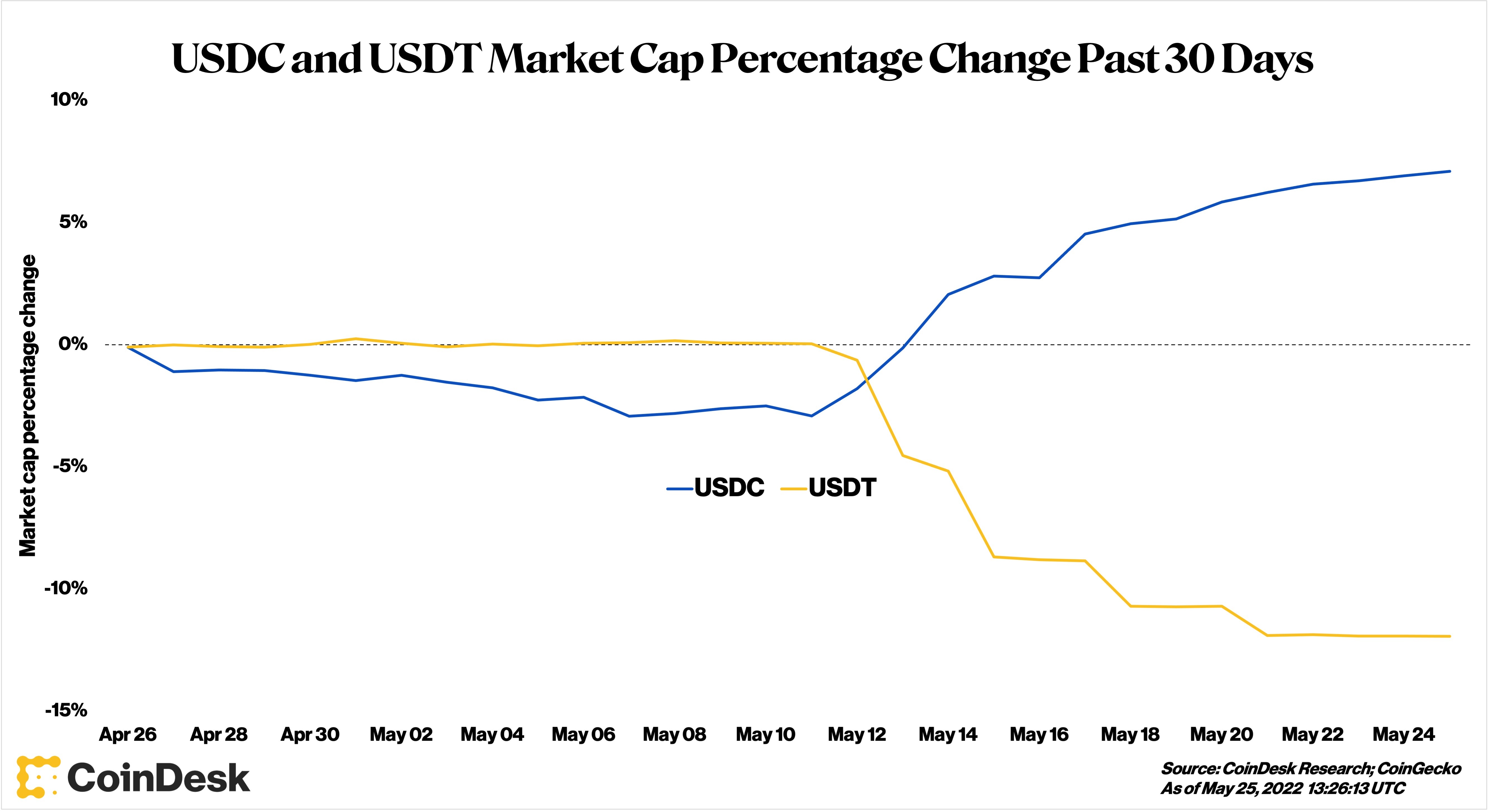

USDT has suffered $10 billion in redemptions overall since the UST failure, which shook investors' trust in the stability of stablecoins in general. Redemptions pushed down the overall circulating supply of USDT to $73 billion from $83 billion in 10 days. In the same period, USDC’s supply rose to $53 billion from $48 billion.

USDC has gained in market capitalization at the expense of USDT's market share. (CoinDesk)

Amid the flurry of events as UST's worth dropped to nearly zero within days, USDT briefly lost its peg to the dollar. Even though its price quickly recovered to $1, the wobble renewed uncertainty about what assets back the value of USDT.

Most decentralized finance (DeFi) transactions take place on the Ethereum blockchain, and USDC has been the stablecoin of choice in DeFi.

For example, DAI, the largest decentralized and overcollateralized stablecoin, is holding USDC instead of USDT in its treasury. DAI, the currency of the blockchain protocol MakerDAO, has a market capitalization of more than $6 billion and keeps its 1:1 exchange ratio to the U.S. dollar by amassing much more crypto assets than the market value of all the DAI tokens in circulation.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OEFQEMSVV5GXZIPNADFCMQEEHU.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PN2SE2FZFVG3ZPSQW2KBZYRG6Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OPZDNUGXP5GONKCYHWLXROPHHE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DD6MIOZG7BAQND4ACGPFCGVDNE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SP4G4JCRJBFB5L5E2OWIUSDMQA.jpg)