Celsius, the crypto lender that has halted withdrawals and is reportedly cutting jobs to stave off a liquidity crisis, has been aggressively repaying debt on one of the largest decentralized finance (DeFi) protocols, blockchain data shows – possibly to get back bitcoin-equivalent tokens that had been posted on the platform as collateral.

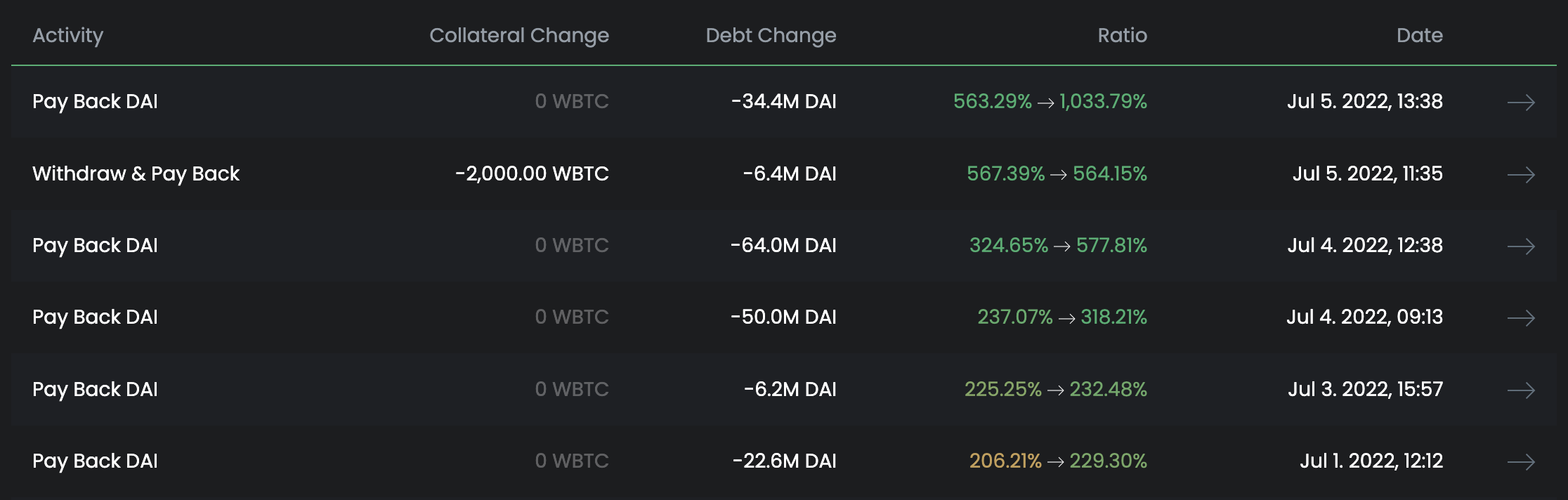

Since July 1, according to the on-chain data, Celsius has paid down $183 million of its collateralized debt to Maker, one of the largest decentralized lending platforms. Transactions on the blockchain data tracker Etherscan verify the downpayments originated from a wallet linked to Celsius. The debt was repaid in the Maker protocol's native stablecoin, DAI.

The transactions resulted in not only the extinguishment of the debt but the release from Maker of 2,000 wrapped bitcoin (worth $40 million) that had been posted as collateral, the data shows. Wrapped bitcoin (WBTC) is a token configured for the Ethereum blockchain that represents bitcoin (BTC) – the largest cryptocurrency by market cap and thus one of the most liquid.

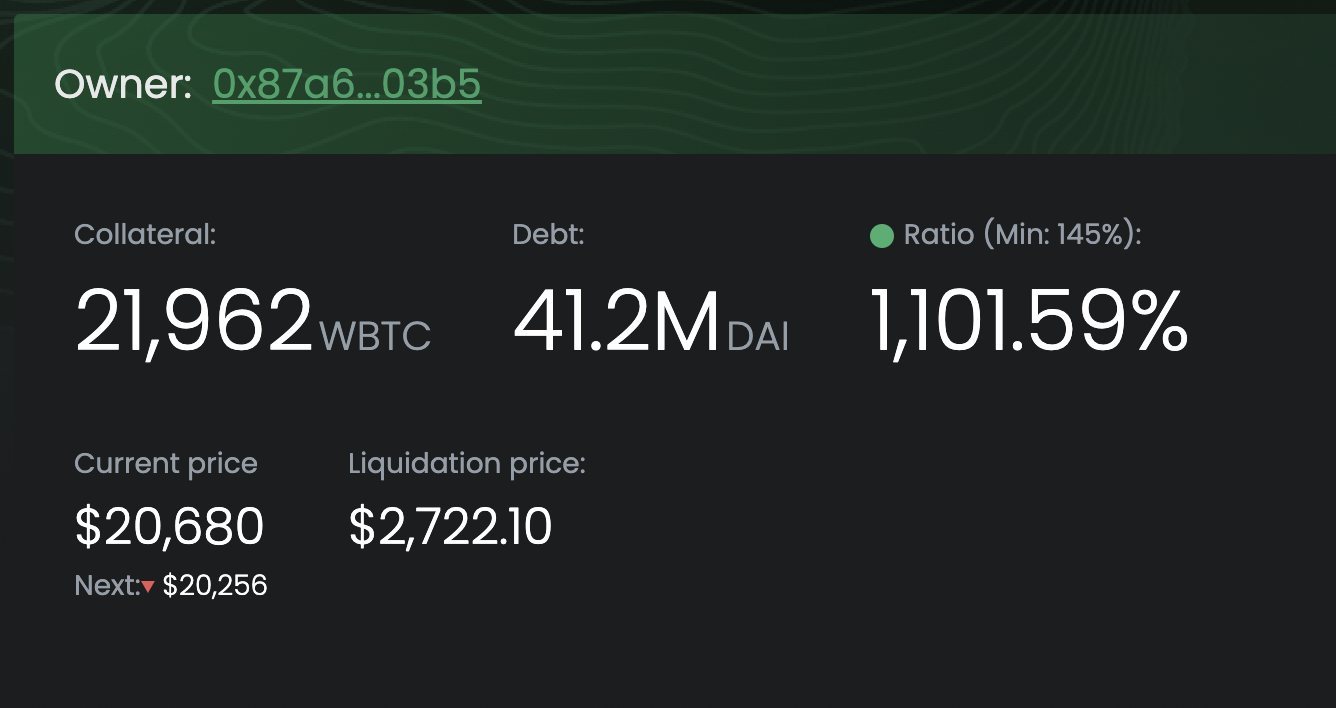

Celsius still owes 41 million DAI (about $41 million worth) in loans to Maker, but it has about 22,000 wrapped bitcoin (about $440 million worth) posted against those loans – so there could be an even bigger potential kicker if the rest of the debt were repaid.

“By repaying the debt, Celsius is possibly freeing up collateral (BTC) that then can be sold on centralized exchanges or via over-the-counter to meet creditor demands and customer withdrawals,” Fundstrat analyst Walter Teng told CoinDesk.

“Given that DeFi loans are overcollateralized, it makes sense for them to do this, as the value unlocked from paying back their loans (collateral less loans) is greater than the value of the loans themselves (should they opt to not repay).”

Celsius representatives didn't immediately return emails requesting comment on the blockchain data or the transactions.

Celsius paid down $183 million of its debt to Maker since July 1. (DeFi Explorer)

The beleaguered crypto lender is scrambling to protect and preserve its assets to avoid insolvency, after a hit to its finances from the implosion of the Terra blockchain and its UST stablecoin in May, and then in June from the failure of the once-top tier crypto hedge fund Three Arrows Capital.

Celsius suspended withdrawals and transactions for its 1.7 million users starting on June 12, hired restructuring consultants and reportedly cut 150 jobs. Regulators have opened investigations of the company.

The native token of the Celsius platform, CEL, has tumbled 80% this year.

Read more: How Crypto Lender Celsius Overheated

As of May 2022, the firm had lent out more than $8 billion to clients and had $12 billion in assets under management.

Loans on decentralized finance platforms such as Maker are generally overcollateralized, which means that the borrower pledges more assets in value to the lender than the value of the loan.

Another benefit of the loan paydowns is that it reduces the price point (of wBTC) at which the Celsius collateral would automatically be liquidated by the Maker protocol.

After the payments, the liquidation level of the Celsius wBTC collateral dropped to $2,722, according to the website DeFi Explore. WBTC now trades at $20,200, making the loan 1,101% (about 10 times) overcollateralized.

Celsius still owes $41 million to Maker collateralized by almost 22,000 WBTC ($440 million). (DeFi Explore)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)