Celsius Network, the troubled crypto lender that has halted customer withdrawals because of liquidity troubles, paid down $95 million of its debt to the Aave and Compound decentralized finance (DeFi) platforms.

The maneuver freed up $172 million of collateral that had been locked in the platforms as collateral. Celsius used a similar treasury-management tactic last week on the Maker platform to free up $480 million in collateral.

- Data on Nansen Portfolio tracker shows that a wallet linked to Celsius transferred $35 million in DAI – MakerDAO's dollar-pegged stablecoin – and $40 million in Circle's USDC stablecoin in various transactions. The wallet also paid down another $20 million in USDC late Sunday to the Aave protocol, according to data on the blockchain transaction tracer Etherscan.

- Celsius also exchanged some interest-bearing token derivatives on Aave for 1,647 WBTC ($33.4 million worth) and about $1.6 million combined of BAT and xSUSHI, a derivative of decentralized exchange SushiSwap's native token that pays interest on the exchange's staking platform.

- The recent credit crisis in the crypto markets hit centralized crypto lenders hard, with Voyager Digital filing for bankruptcy protection and BlockFi seeking a credit lifeline and bailout from crypto exchange FTX. Celsius halted all customer withdrawals starting June 12 to avoid a run on its deposits, while cutting jobs and hiring restructuring experts.

- Celsius, however, now appears on its way to pay off the rest of its debt to DeFi protocols to reclaim the digital assets pledged against the loans as collateral.

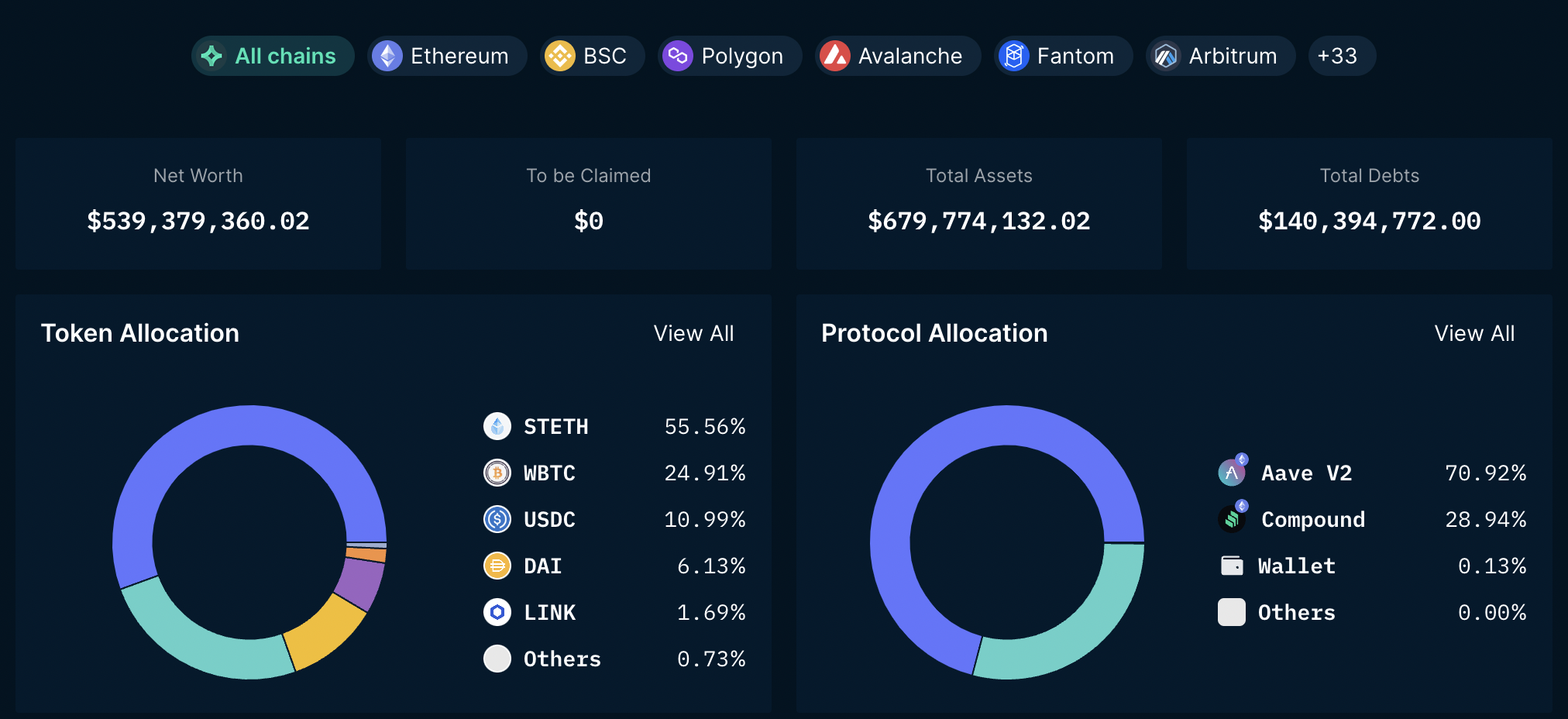

- After the moves, the firm still owed $140 million to Aave and Compound, reduced from $235 million as of last Friday, according to DeFi data platform Zapper's dashboard.

- The collateral that Celsius locked up against those loans stood at $680 million, shrinking from $950 million, and should be freed up theoretically if Celsius fully pays off rest of the debt.

Celsius still owed $90 million and $50 million in stablecoins to DeFI protocols Aave and Compound as of Monday. (Nansen)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)