Crypto investors are eagerly awaiting the Merge, the Ethereum blockchain’s long-awaited technology upgrade.

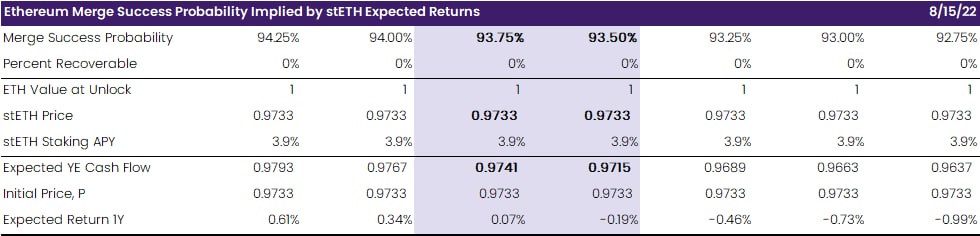

According to Enigma, the current price of stETH – a type of ether derivative known as "staked ether," which is a token issued by Lido protocol that users can trade freely even when their ether is staked on the Ethereum blockchain – implies a nearly 6.25%-6.5% probability the Merge will come with major bugs or delays.

Enigma’s pricing model treats stETH as a bond of 1 ETH as principal that yields a 4% return annually. If the Merge is successful, an investor who bought stETH gets 1.04 ETH in a year.

With stETH changing hands at 0.973 ETH at press time, the price implies only a 93.5%-93.75% chance of the Merge going through smoothly and on time, Enigma estimates. This percentage is lower than what many market watchers are expecting because all the dress rehearsals went well.

“The market has high confidence in the Merge,” John Freyermuth, analyst at Enigma Securities told CoinDesk. “But until that risk premium shrinks to match the staking yield, stETH price supports the view that the Merge is not priced in."

Enigma Securities said the current stETH price suggests a 93.5-93.75% chance for the Merge to succeed. (Enigma Securities)

Ethereum’s transition to a proof-of-stake consensus mechanism is set to fundamentally alter the blockchain of the second-largest cryptocurrency by market capitalization.

It will eliminate mining, reduce the network’s energy consumption by about 99.95% and turn ETH into a yield-bearing asset. At press time, the Merge is scheduled to go live at some point in September.

“I am completely confident that it will go well,” Ben Edgington, global product lead for institutional Ethereum staking service Teku at software firm ConsenSys, told CoinDesk. “Every testnet Merge that we've done and every test scenario we have run over the last six months has met these criteria for a successful Merge.”

“Right now, different actors are betting on whether or not the Merge happens, as a sentiment bet,” said Lex Sokolin, head economist at ConsenSys. “If it does happen, that shifts us to a new regime.”

Writing Off ETHPOW

The discount on stETH to ether also narrowed to around 3% from the lows of 7% in June, when the token was caught in the middle of a liquidity crisis that led to the insolvency of crypto hedge fund Three Arrows Capital and crypto lender Celsius Network.

The current stETH price shows “incredibly low-risk premia that's packed with the Merge execution risk, smart contract risks and any systemic risk,” Enigma’s Freyermuth said.

According to Enigma, crypto traders are mostly discounting the impact of a potential fork of the Ethereum blockchain by proof-of-work miners, or that an airdropped "ETHPOW" or "ETHW" token would have any significant value. The logic there is that the stETH discount has narrowed, not increased, since the possibility of a fork began to swirl through the crypto-industry discourse over the past couple weeks.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DJLLHM4JPVGMNBFBJ3AII7PYIY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)