IPOR Labs AG is launching a protocol to bring transparency and stability to the volatile decentralized finance (DeFi) credit market, the creator of blockchain-based derivatives software announced Tuesday.

Through the Inter Protocol Overblock Rate (IPOR) traders will be able to hedge, arbitrage and take directional positions on the interest rate movements to manage risk across their credit portfolios on the Ethereum blockchain.

“Decentralized finance (DeFi) has immature markets that need market transparency for all actors,” Darren Camas, CEO of Zug, Switzerland-based IPOR Labs, told CoinDesk.

The protocol offers the "IPOR Index," a standardized benchmark rate based on smart contract transactions and its own interest rate derivatives decentralized exchange (DEX).

(IPOR)

IPOR is an algorithmic model of The London Interbank Offered Rate (LIBOR), but for DeFi. The LIBOR was once a benchmark interest rate that global banks lend to one another in the interbank market for short-terms loans, but it was discontinued in 2021.

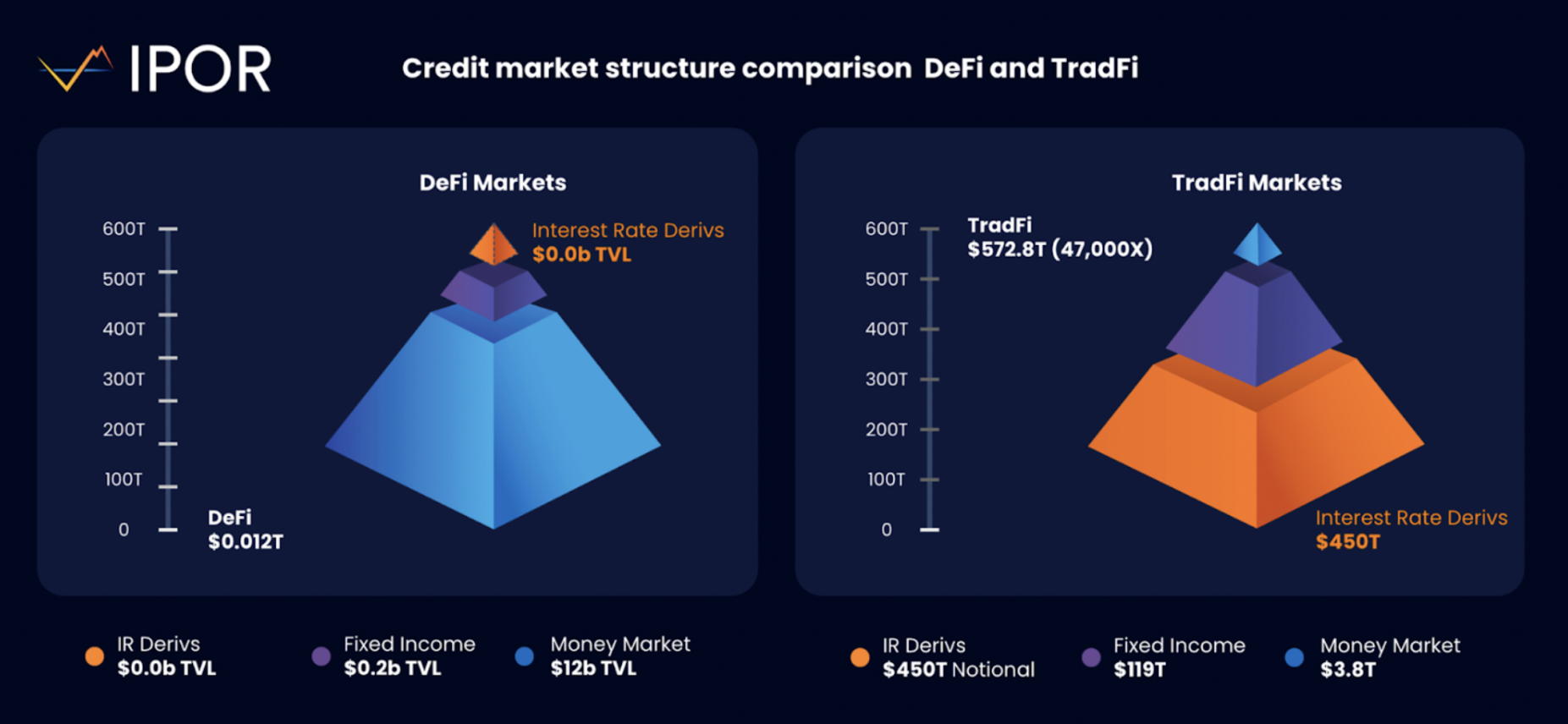

Darren said the IPOR is crucial in the current market for institutional participation. “We need to connect the institutional fixed income world to DeFi, and for this to happen they need risk management tools and transparency,”

IPOR consists of two parts. One is the IPOR index, a LIBOR-like benchmark interest rate sourced directly from DeFi smart contracts. Camas explained that unlike the LIBOR, which was discontinued due to manipulation by traders and inside banks, the IPOR Index is based on auditable and real-time smart contract interactions.

The second part is the DEX, which IPOR says is the first derivative instrument. It is based on the IPOR index and is a 28-day cancellable swap that uses a peer-to-pool model between a trader and the liquidity pool as underwriter for both pay-fixed and receive-fixed contracts.

“In the wake of the market collapse due to multiple [U.S. Federal Reserve interest] rate hikes, and the downfall of bad actors such as Three Arrows Capital, Celsius Network and Terra, risk management comes to the forefront of crypto, particularly in the credit markets,” Camas said.

“Where [centralized finance] becomes the villain, DeFi has taken a hero role, particularly in the credit markets where major platforms have functioned flawlessly during the market downturn,” he added.

Investors in IPOR include multi-stage hedge fund Arrington Capital.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EASRTZHDJ5CETPQZRIGXIUMYFM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JBYO5LSILBBOBLPJ7T7MPHUL6U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FFPY6ZJMFBCLXEAG7ILKKF3NBM.webp)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZK7ETSI4G5GNHDXHUA7MNGHQAE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MLCW3YQ3SJA7PHGSKKPVGMT6WU.jpg)