Aave, a big decentralized lending platform, has invoked new rules to protect itself from several risks that could stem from a surge in borrowing demand for ether (ETH) from crypto traders betting on the Ethereum blockchain’s upcoming technological overhaul.

Between Aug. 30 and Sept. 2, the Aave community overwhelmingly voted to stop loaning ether, setting aside democratized finance's free market principle to mitigate protocol-wide risks that may arise from Ethereum's upcoming transition to a proof-of-stake (PoS) consensus mechanism from a proof-of-work (PoW) one, dubbed the Merge. The upgrade is slated to happen between Sept. 13-15.

"Ahead of the Ethereum Merge, the Aave protocol faces the risk of high utilization in the ETH market. Temporarily pausing ETH borrowing will mitigate this risk of high utilization," the proposal highlighted by research firm Block Analitica said.

The utilization rate refers to the percentage of the pool loaned out. The rate will likely rise as users could borrow ETH before the Merge to receive free money or the potential Ethereum fork token ETHPOW.

Some Ethereum miners are contesting the planned transition to PoS and looking to split the chain into a PoS chain and a PoW chain. A PoW chain would have ETHPOW as its native token, which would be distributed to ETH holders for free.

According to Ian Unsworth, a researcher at Binance.US, users are borrowing ETH from lending protocols, specifically AAVE. If the trend continues, the already elevated utilization rate of over 70% could jump to 100%, CoinGecko's Bobby Ong said.

High utilization will make liquidations challenging

A spike in the utilization rate would mean most ETH has been loaned out, leaving little for liquidators as collateral to process regular liquidations of ETH borrow-based positions.

"High utilization interferes with liquidation transactions, thus increasing the chances of insolvency for the protocol," Block Analitica said in the proposal.

While calling the borrowing suspension a good move, Ian Solot, a partner at crypto hedge fund Tagus Capital, said, "The part of the problem is that if markets become very volatile and ETH borrowers need to be liquidated, there may be a scarcity of ETH due to high utilization, making it harder for liquidations to go through effectively."

Liquidations are forced closure of positions due to a decline in the value of the collateral. Aave describes liquidations as a process that occurs when a borrower's health factor goes below 1 because their collateral value doesn't cover their loan/debt value.

ETH-funded recursive trades become unattractive

The bump in the utilization rate could lift ether borrowing rates to levels where the popular ETH-stETH recursive borrowing positions on Aave become unprofitable. That, in turn, could lead to the mass unwinding of positions, injecting volatility into the stETH market.

In recursive trades, users despot ETH into liquid staking protocol Lido in return for the staked ether token (stETH), which is then deposited as collateral on Aave to borrow more ETH. This borrowed ETH is again moved to Lido for more stETH, which is again deposited as collateral on AAVE to borrow ETH. The cycle continues. This leveraged position analogous to carry trading loses appeal once the ETH borrowing rates rise above the annualized staking rewards, which are now at 3.9% on Lido.

"Once the ETH borrow rate reaches 5%, which happens shortly after 70% utilization rate, stETH/ETH positions start becoming unprofitable," Block Analitica said in the Aave ETHPOW risk mitigation plan published last month. "This means that we would see a lot of stETH to ETH redemptions and in turn a downward push on the stETH price, which will already be under pressure due to regular stETH holders switching to ETH to gain upside on ETHPoW work.

"All of this can lead to a downward price spiral of stETH, which can create cascading liquidations at Aave," Block Analitica added.

The largest ETH borrower and the two second-largest ETH borrowers on AAVE have stETH as collateral, according to data tweeted by Binance.US' Unsworth. At press time, more than $900 million worth of stETH is locked on AAVE as collateral for borrowing ETH.

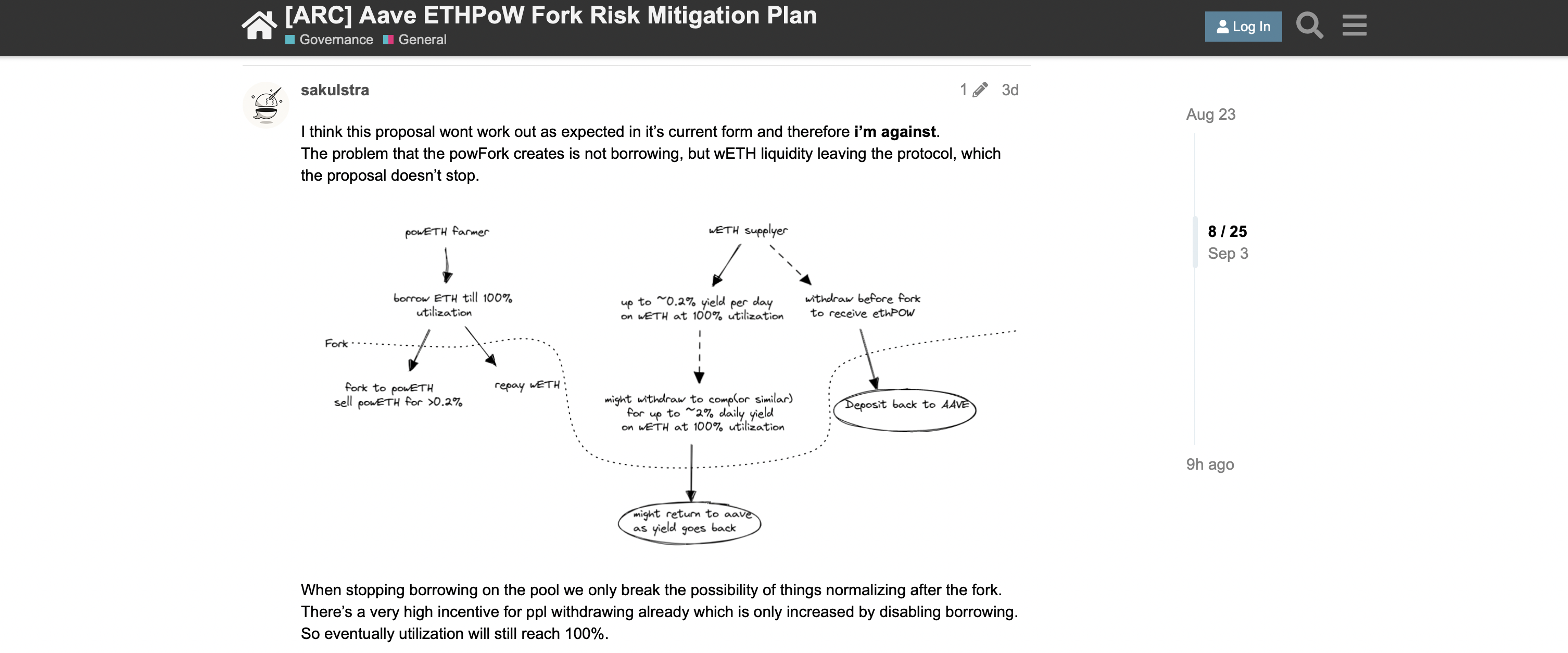

Aave also faces the risk of wrapped ether (wETH) liquidity providers withdrawing coins to get in position for a potential Ethereum fork token ETHPOW. Some community members are unsure whether suspending ETH borrowing would help address that potential problem.

A community member explains why the decision to suspend ETH borrowing may not help avoid liquidity exodus.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IY3P7VY3KFEF7N3XBVMKHU6LUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)