The token of the decentralized exchange GMX surged close to its all-time high Wednesday as Binance and FTX, two of the world’s most widely used crypto exchanges, announced plans to list the token.

GMX jumped to as high as $60 from around $40, data on crypto price tracker CoinGecko shows, the highest since January, when the price hit $62. The token has since pared some of the gains, changing hands at $48 at press time. Trading volume soared, reaching $150 million in the last 24 hours, almost 20 times more than the previous day, CoinGecko data shows.

GMX is a decentralized exchange (DEX), meaning that investors can buy and sell tokens on the platform without an intermediary by using smart contracts. The platform offers low fees and so-called zero price impact trading, which allows more capital-efficient trading without slippage, which is the difference between the expected price of a trade and the actual price.

The protocol gained popularity among cryptocurrency traders as it defied this year’s market rout. As other decentralized-finance protocols saw their total value locked (TVL) – an important metric for how much capital a platform can capture – deflate, GMX’s TVL has grown consistently, and now stands at a record-high $455 million, according to crypto data provider DefiLlama. Holders of the GMX token earn 30% of all the trading fees accrued on the exchange.

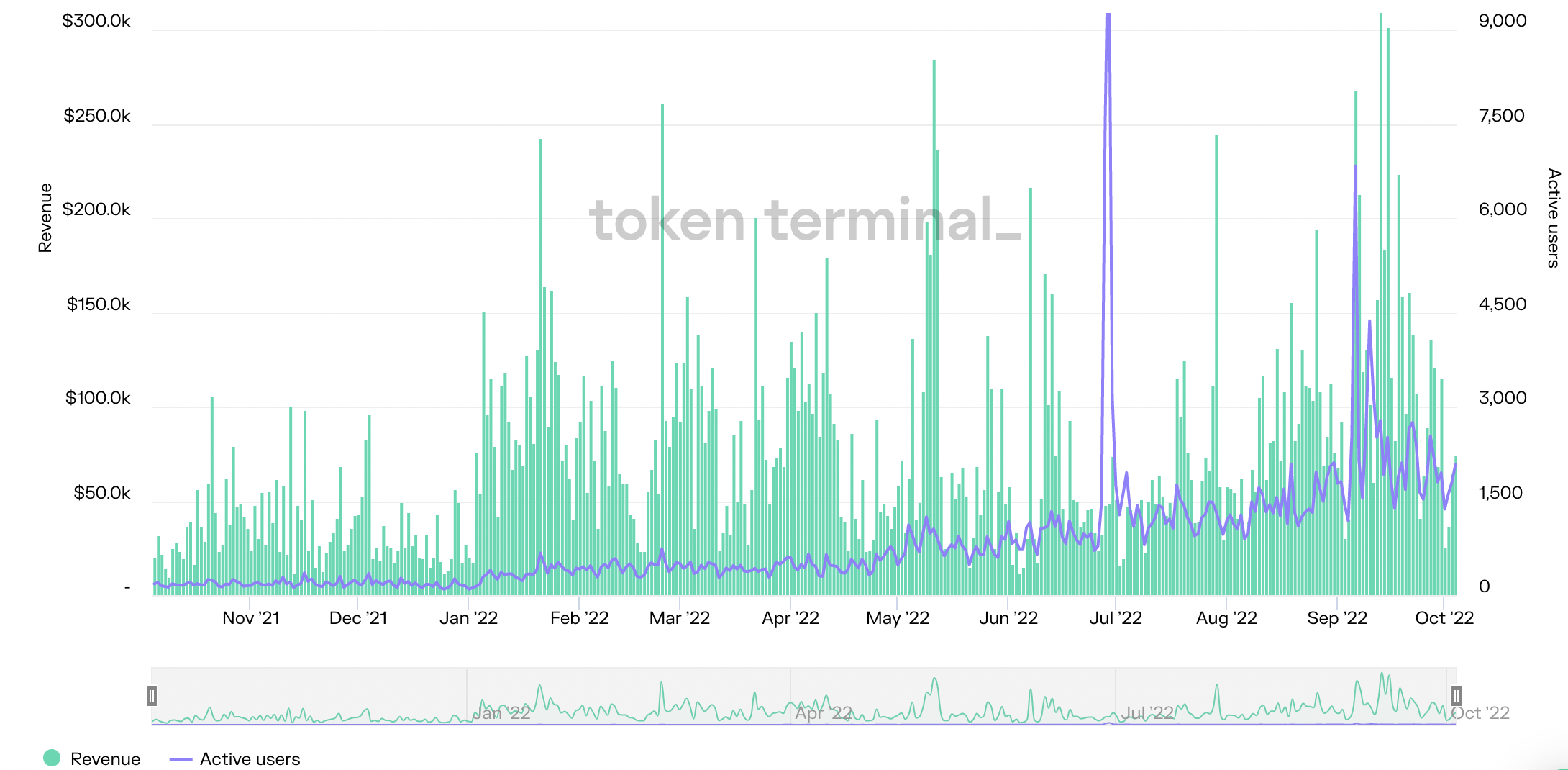

GMX has stood out by increasing its protocol revenue and the number of its active users despite the rout in crypto markets. (Token Terminal)

Notoriously, in early September, a savvy trader exploited a loophole on GMX’s smart contract code to manipulate the price of AVAX, the Avalanche blockchain’s native token, netting over $500,000 to $700,000 in profits, CoinDesk reported.

Traders could deposit GMX and trade against BTC, USDT and BUSD pairs on Binance starting Wednesday at 10:00 UTC, the exchange said in a statement. FTX said it would allow trading in the token starting at 14:00 UTC.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/A3UII4KUOZFGDCQII3W4YDPLP4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PK332AQM2RFU3FSZGUBM56SZUI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCC42C4A2VEGVHTXRSWLCA5EIU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KVE34ILYZVCXDAYYL34VUOBX7U.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LA4HCFBXBANHBLNPLOES3NZ2I.jpg)