Almost $1 million in CEL and USDC has been sent to UniSwap and MetaMask since the beginning of October from wallets belonging to former Celsius Network CEO Alex Mashinsky, according to data compiled by Nansen.

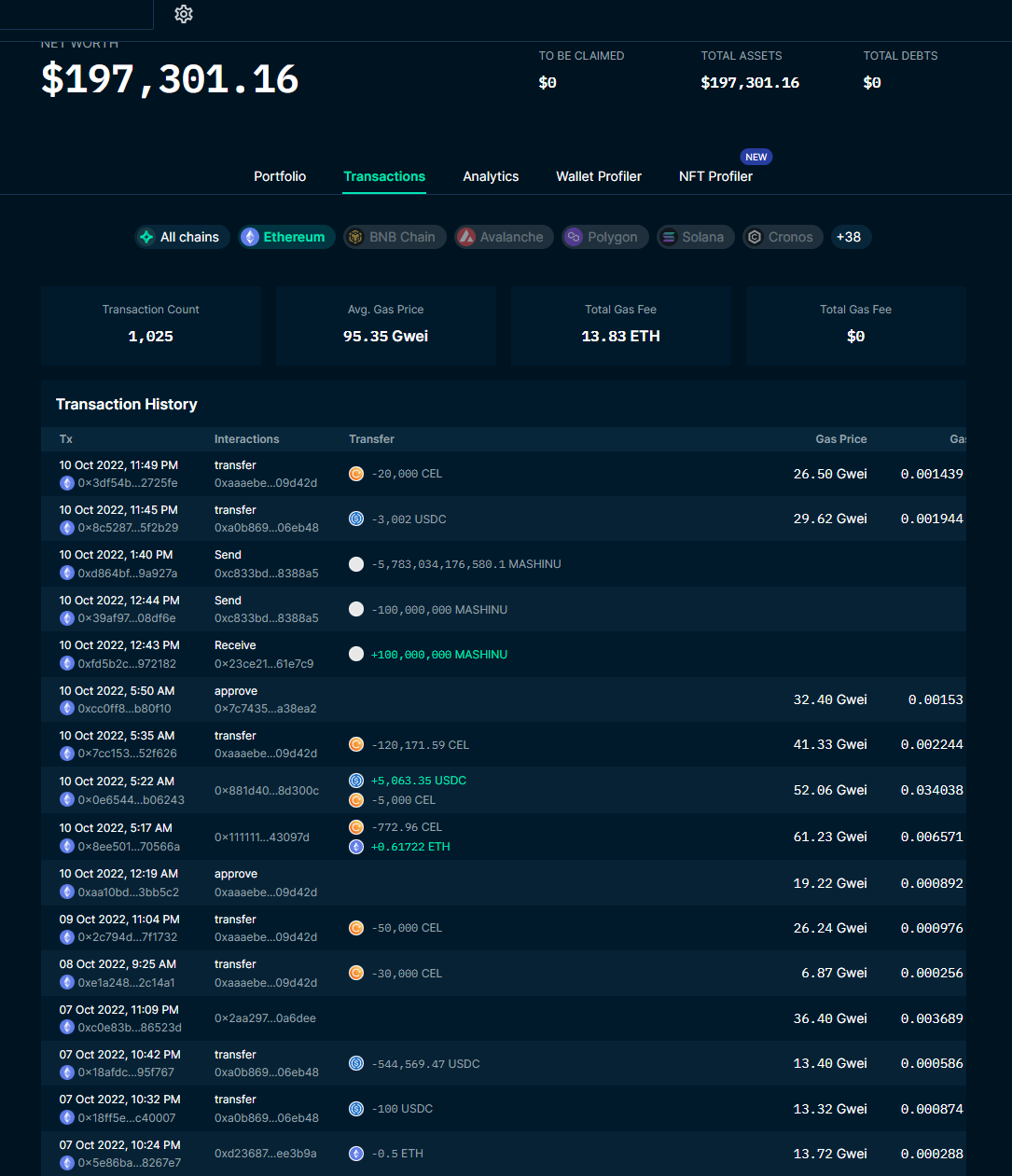

Some of the transactions from Alex Mashinsky's crypto wallets (Nansen)

On-chain data from analytics platform Nansen identifies wallets belonging to Mashinsky showing a steady stream of Celsius' CEL token and Circle's USDC stablecoin leaving his six wallets over the last month.

Coffezilla, a blockchain sleuth that exposes crypto scams on YouTube, claims to have spotted another wallet controlled by Mashinsky that has moved approximately $225,376 in CEL and USDC during the last month. Ownership of this wallet has not been confirmed by Nansen, however on-chain data shows that it has been funded by a confirmed Mashinsky wallet.

This is in addition to the $28,242 moved by Mashinsky in August over the course of a few days, as CoinDesk has previously reported, and the nearly $27 million that was withdrawn by executives in two tranches before the firm declared bankruptcy.

Mashinsky did not respond to a request for comment by CoinDesk by press time.

According to on-chain data, Mashinsky’s collection of wallets still contains $197,301 worth of crypto, primarily comprised of CEL and USDC.

When will Celsius reopen custody Wwthdrawals?

Given its heavy exposure to beleaguered crypto hedge fund Three Arrows Capital, Celsius faced financial difficulties during the summer’s broader market downturn and froze withdrawals in June before filing for bankruptcy protection on July 13.

The question on the minds of its users – especially as Mashinsky and other executives cash out – no doubt is about withdrawals.

But they might be waiting a bit longer.

Earlier this month, the trustee tasked with overseeing the company’s bankruptcy called a motion to reopen withdrawals “premature.”

“At this juncture, there are too many questions regarding the debtors’ cryptocurrency holdings to approve any withdrawals or sales,” attorneys for the Trustee’s office wrote in the objection. “Those questions arise both from the debtors’ lack of transparency … [and] the Debtors’ failure to file schedules and statements of financial affairs.”

Late last week, U.S. Bankruptcy Judge Martin Glenn, who is overseeing the case, ordered an independent examiner to produce a report by mid-November detailing Celsius’ financial management and handling of customer accounts.

This report will determine the schedule as to when customers will be able to withdraw their holdings.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E5J66ZP3K5BPVHUIFHI3IMXVBA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)