Axie Infinity, which experienced a meteoric rise in popularity last year as one of the first crypto-focused computer games, could face significant selling pressure as $215 million worth of the project’s AXS tokens are unlocked in the coming days.

Players earn Axie’s in-game cryptocurrencies and non-fungible tokens, which they can sell, trade or use to level up their characters.

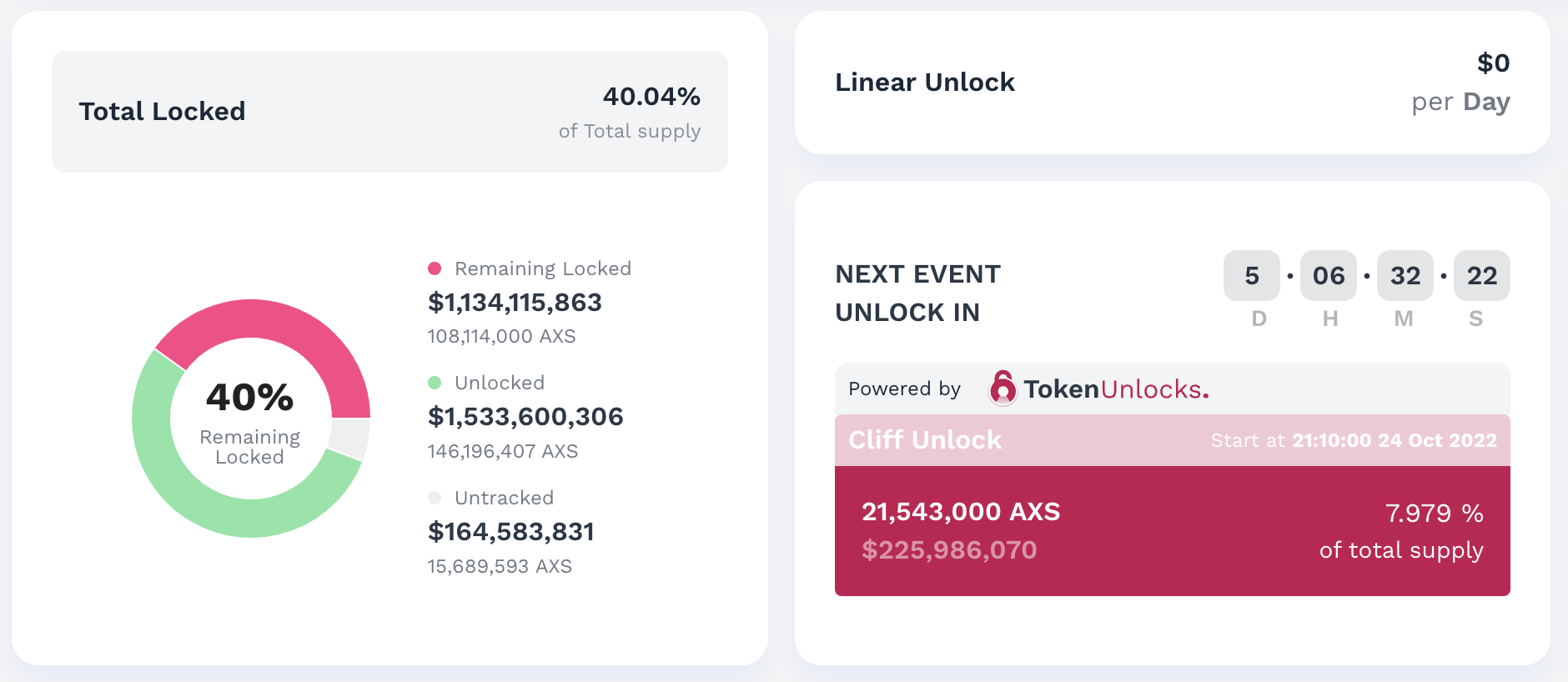

Some 21.5 million tokens, almost 8% of the total supply, will be freed up when the vesting period expires Oct. 24, according to data site TokenUnlocks. Aleksander Larsen, chief operating officer of Axie developer Sky Mavis, told CoinDesk the unlock schedule is based on transaction block numbers, which he projected to take place on Oct 26.

A vesting period is when early investors and insiders are required to hold their investments for a minimum period of time, partly so they can’t cash out just as new investors arrive. When the vesting period expires, holdings become unlocked and investors can sell. In digital asset markets, the token’s price can sometimes face steep selling pressure during such times.

According to TokenUnlocks, almost half of the soon-to-be-unlocked AXS tokens will be directed to members of the developer team ($57 million), advisers ($25 million) and early investors in a private sale round ($20 million). These holders, in theory, may decide to realize profits and sell tokens.

At press time, 40% of Axie Infinity's AXS tokens are locked before the upcoming unlock date. (TokenUnlocks)

The other half, some 11 million tokens, are dedicated towards future staking rewards, play-to-earn rewards and ecosystem funds, TokenUnlock shows. These tokens will not be issued to circulation immediately, according to Larsen.

Sky Mavis, the blockchain gaming studio that developed Axie, “recently staked 11 million AXS and will stake our upcoming token unlock as well,” Larsen told CoinDesk.

Selling pressure on AXS

The AXS price has dropped following prior unlocking dates, blockchain sleuth Lookonchain pointed out in a tweet.

Axie Infinity sold 10.5 million tokens to raise $864,000 in a private token sale in the middle of 2020, according to the project’s white paper. That math works out to an average price of 8 cents per token. AXS was trading at around $10 at the time of writing, so those who invested in the private offering are ostensibly sitting on hefty paper profits.

“Even if investors in the private sale dump AXS at $10, they're still making 125x. So selling after unlocking is very likely to happen,” Lookonchain said.

The list of investors in the private sale include crypto investment firms Arca, DeFiance Capital, Delphi Digital, Hashed and now-insolvent Three Arrows Capital, according to a press release by Axie at the time.

Prices skyrocketed on the game’s native token, AXS, rising 42-fold over just five months to as high as $169 in November, according to crypto price tracker CoinGecko.

The project’s popularity proved to be fleeting. The majority of players abandoned the game and in-game transactions cratered since then, data by DappRadar shows. AXS lost 94% of its market value in less than a year, and now it trades at $10.

In March, Axie Infinity’s custom built sidechain, called Ronin Network, suffered one of the largest crypto exploits ever, with losses amounting to $625 million.

Read more: The Bigger Problem With Axie Infinity

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WPOA436X5VFCJP7L6E6TJB3C3M.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NSR4PQEPWFE4TKREBA3ADD6BSY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E7NJWFN545GJPLKQHC6YF3PUWA.jpg)