Crypto markets paused their recent two-day ascent, following an unexpectedly strong GDP report in the U.S. that failed to shake investors from underlying concerns about inflation and a potential steep recession.

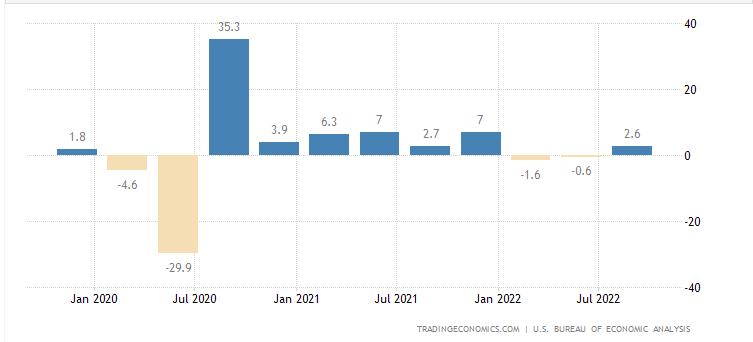

U.S. economic growth expanded 2.6% in the third quarter, versus expectations for 2.4% growth.

The economic expansion is a reversal from the 1.6% and 0.6% contractions in the first and second quarters. But consumer spending and the once-hot housing market have been slowing as rising prices and interest rate hikes have an increasing impact on the economy.

Quarterly GDP (Trading Economics/U.S. Bureau of Economic Analysis)

BTC declined 1% during the 13:00 UTC hour, but rose 0.92% in the following hour. ETH performed similarly, decreasing 1.72% immediately following the GDP release but then rising 1.17%.

Traditional markets were mixed. The Dow Jones Industrial Average (DJIA) started the day up 1.5%, trading immediately higher at the 9:30 a.m. ET open. The S&P 500 opened 0.64% higher following the GDP report. The Nasdaq composite, to which bitcoin remains strongly correlated, fell 0.30%.

A portion of the Nasdaq decline is likely due to the 21% drop in Meta Platforms (META) shares, following poorer-than-expected third-quarter earnings results.

As the calendar shifts to November, investor attention can next move to the October consumer price index data, to be released Nov. 10.

According to the CME FedWatch tool, the probability of a 75 basis point (bps) interest rate hike by the Federal Reserve at its next meeting has declined from 92.5% to 88.4% since Wednesday, while the probability of a 50 bps increase rose from 7.5% to 11.6%.

The shift in sentiment will likely have little effect for the next Federal Open Market Committee meeting, where any rate hike will be set. A 75 bps rise still seems highly likely on Nov 2. But observers believe increasingly the FOMC will pivot to a more dovish stance early next year, perhaps influenced by the U.S. neighbor to the north. Canada’s central bank raised its interest rate by 50 bps on Wednesday instead of by an expected 75 bps because of concerns about the slowing pace of that country’s economy.

Macroeconomic uncertainty continues to plague crypto assets, so the BTC-DXY chart will be a solid one to consider in determining the next steps.

A reversion to a more inverse relationship between BTC and the dollar index (DXY) has occurred over the last few days. Thus, strength in the U.S. dollar is likely bad news for the BTC price, while weakness in the USD will likely have the opposite effect.

The 4% decline in the DXY since Sept. 27 hints a growing appetite for riskier assets as investors start to pivot away from the USD.

Bitcoin also appears to be forming potential support at $20,000. The Volume Profile Visible Range tool shows a high-volume node forming at $20,500, which would overtake the prior high volume node at $19,300.

These nodes indicate areas of significant price agreement and can often highlight areas of support and resistance for an asset.

Bitcoin 10/27/22 (TradingView)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/U44RUUAADRDJLJCF7FYN3OYMJE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)