Bitcoin's price was up about 0.3% over the past 24 hours, the latest surge in an upbeat week that saw the largest cryptocurrency by market capitalization climb about 8% in value.

The spike came amid new hopes that the U.S. Federal Reserve would be able to scale back its monetary hawkishness sometime early next year, and a few mildly encouraging economic indicators.

Ether's price recently increased 0.6% from Thursday, same time, and was up approximately 19% over the past week.

As October closes, investors may wish to look back before taking stock of the current and likely future crypto climate.

On June 13, BTC plunged 15%. Fears about inflation had heightened and the U.S. Federal Reserve was days away from boosting interest rates 75 basis points for the first time since 1994.

Lender Celsius Network had just announced a pause in user withdrawals, and hedge fund Three Arrows Capital was a day out from announcing troubles that ultimately led to its liquidation.

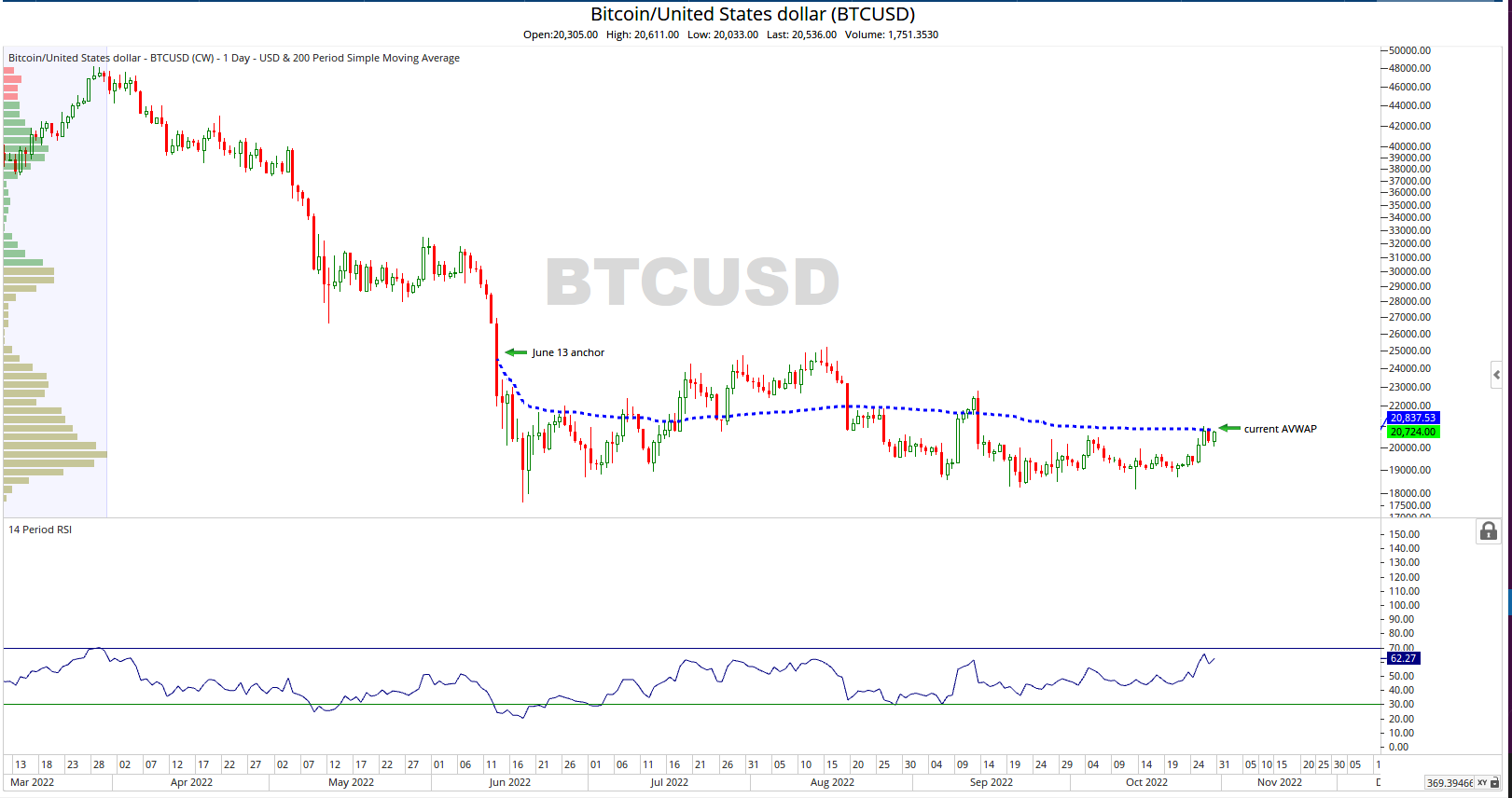

Anchored Volume Weighted Average Price (AVWAP), a technical tool developed by Brian Shannon, CMT, allows users to track an asset’s Volume Weighted Average Price (VWAP) from a moment of their choosing, including dates and specific events.

Since June 13, BTC's price has begun to approach the AVWAP level. The implication is that through all the turmoil, and incorporating asset volume, investors who went long BTC from June 13 forward are, on average, moving closer to break-even status.

AVWAP levels can often serve as levels of support and/or resistance, so prices surpassing this mark could be significant.

Using AVWAP for ETH, and anchoring from June 13, shows the price surpassed AVWAP levels on Oct. 25. ETH has also begun to outperform relative to BTC, as the ETH/BTC ratio increased 3% over the last seven days.

BTC AVWAP 10/28/22 (Optuma)

The surge in crypto prices late this week was also characterized by increased momentum.

Momentum, in this case characterized by the 14-day RSI, is accelerating at a slightly faster pace than prices BTC and ETH prices, which is a bullish signal.

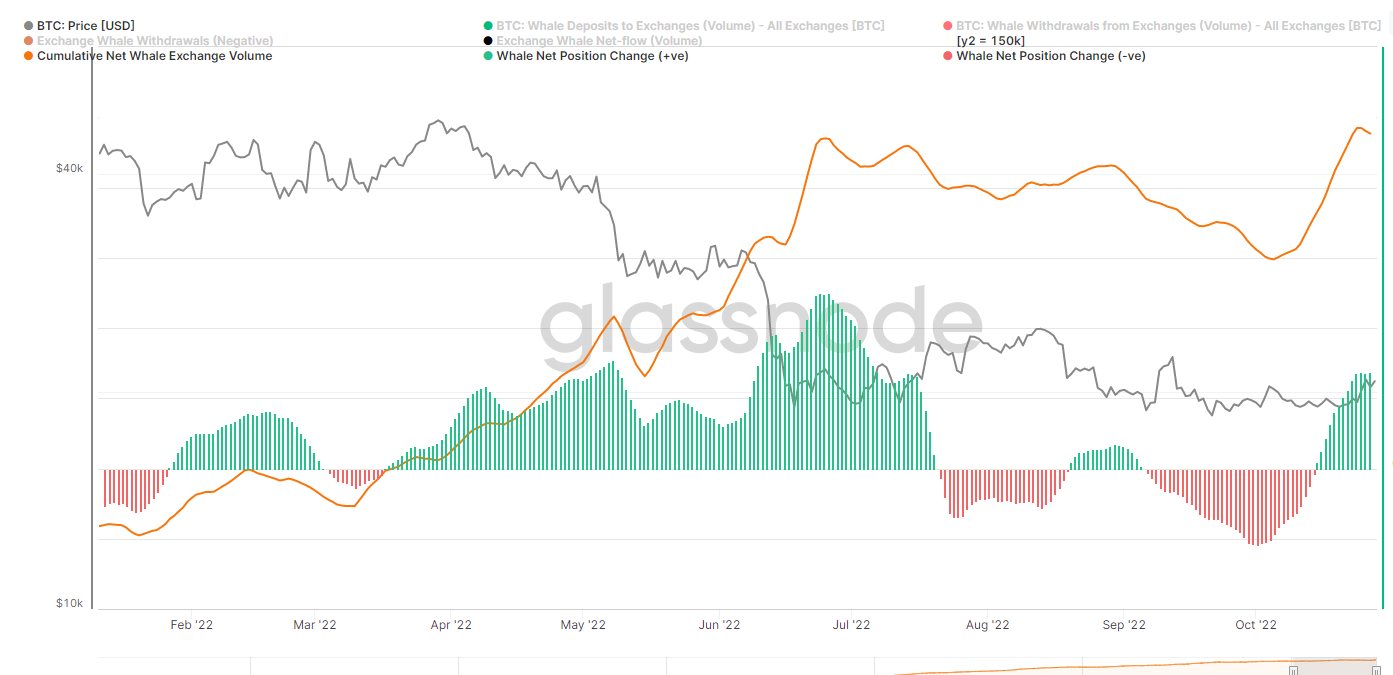

Investors should also weigh on-chain analytics to ensure they are adopting a measured approach. Over the past week, large BTC holders have been moving coins onto exchanges.

For investors with a bullish outlook, this isn't the best sign because coins are often moved to exchanges to ready them for rapid sale.

However, this trend may just be a preventative measure ahead of Nov. 10 consumer price index data. Still, the move to exchanges appears to have stabilized as of Oct. 25.

"Whale" movement of BTC to exchanges (Glassnode)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LXGLB7XI6BD2RD3LSDD55LARQA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)