Price Action

Bitcoin (BTC) held steady during U.S. trading hours, gaining 0.3%, even as the Standard & Poor’s 500 Index slipped.

Crypto traders are looking ahead to the next big economic event, the Federal Reserve’s monetary policy decision due out Wednesday at 2 p.m. ET.

“Personally I’m not ready to 100% call a bottom here yet, as I would like to see exactly how the economy reacts in the fourth quarter to a 3% to 4% federal funds rate,” Nick Mancini, director of research at Trade the Chain, told CoinDesk TV.

One thing that may or may not be discussed but should be: As speculation mounts over when the Federal Reserve might pivot dovish, some economists, including former U.S. Treasury Secretary Lawrence Summers, are warning that any such move might lead to weakness in the U.S. dollar versus other global currencies. That, in turn, could drive up prices for imports – possibly frustrating the Fed’s primary goal of bringing down inflation.

The CoinDesk Market Index rose 0.1%. Dogecoin (DOGE), the biggest gainer in October when its price doubled, slipped 0.5% on the first day of the new month.

Latest Prices

● CoinDesk Market Index (CMI): 1,026.83 +0.5%

● Bitcoin (BTC): $20,440 +0.3%

● Ether (ETH): $1,576 +0.7%

● S&P 500 daily close: 3,856.10 −0.4%

● Gold: $1,651 per troy ounce +0.9%

● Ten-year Treasury yield daily close: 4.05% −0.0

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

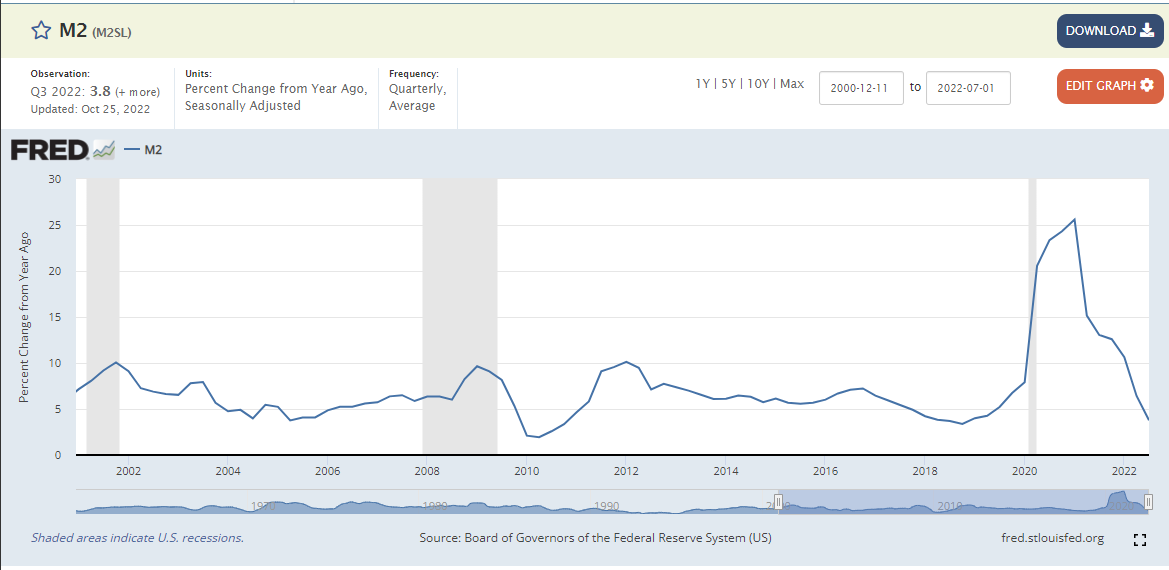

Money Supply Growth Is Falling, an Encouraging Sign for Fed Progress

By Glenn Williams Jr

M2 percentage change (FRED Database)

Crypto observers hoping for a more dovish turn in monetary policy may look optimistically at a percentage decline in the M2 money supply growth from a year ago.

The parabolic increase in U.S. money supply during 2020 is largely behind the current inflationary environment. The reduced supply growth could be evidence that recent Federal Reserve measures are working.

Bitcoin and ether were trading sideways on Tuesday, albeit slightly to the green, a day ahead of the Federal Open Market Committee’s latest interest rate decision.

Altcoin Roundup

- Elon Musk Tweet Sparks Flurry of Twitter-Themed Dogecoin Tokens: A new class of Shiba Inu-inspired tokens was birthed on BNB Chain and Ethereum Tuesday following a related tweet by technology billionaire Elon Musk. The price of over 67 of such tokens dropped more than 90% following their issuance, on-chain data shows. Read more here.

- Uniswap Surpasses Bitcoin as Fed Rate Hike Decision Nears: Uniswap is a decentralized crypto exchange (DEX) that runs on the Ethereum blockchain. Its native token UNI was recently up 5.1% over the past 24 hours and has risen more than 10% during the past week. Read more here.

Trending posts

- Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look at how to build a decentralized web.

- Crypto Finance Firm Galaxy Digital to Cut One-Fifth of Workforce: Sources: The company's shares have fallen 80% in the past year.

- DeFi Debt Marketplace Credix to Open a $150M Stablecoin Credit Pool to Digital Lender Clave: Clave will use the pool to originate loans to Latin American businesses and consumers.

- Crypto VC Firm CoinFund Looks to Raise $250M Seed Fund: SEC filings show the firm is raising money for a new fund less than three months after launching a $300 million VC fund.

- DeFi Protocol Voltz Opens Door for Passive Traders With Liquidity Optimizer Vault: The new product will give traders the opportunity to earn passive liquidity provider returns without the risk of impermanent loss, Voltz's CEO said.

- Bitcoin Miner Argo Blockchain Loses More Wall Street Bulls After Financial Woes: Two analysts downgraded their recommendations on Argo's shares.

- South African Supermarket Chain Pick n Pay Now Accepts Bitcoin Payments: Report: The retailer is taking payments from any Lightning Network-enabled wallet.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YQQVLGMLYRF3ZHR4CV5U34RWYE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)