Bitcoin (BTC) has plunged 70% in value since hitting a peak of $69,000 in November of last year.

The ongoing bear market may appear more brutal than previous ones considering several industry heavyweights like Terra, Three Arrows Capital and Celsius Network have buckled under the weight of the market crash. Yet, there is a silver lining.

According to data provider CryptoCompare, both small and large investors have consistently bought the cryptocurrency on the dips, contradicting the continued selling seen during previous bear markets dated November 2013 to December 2014 and December 2017 to December 2018. Both bear markets saw bitcoin plunge more than 80% from record highs.

"As opposed to the last bear market, where all holders across different wallet sizes were panic-selling, in this bear market we have seen a consistent accumulation in almost all accounts," CryptoCompare's quarterly report released on Thursday said.

"Accounts above 10,000 bitcoins have seen a fair increase which is likely due to increased institutional adoption," CryptoCompare added.

Per data sourced from blockchain analytics firm Santiment, nine new addresses owning 10,000 BTC to 100,000 BTC have been created since Sept. 20. These addresses have snapped up 190,000 BTC (worth $3.8 billion) in seven weeks.

Investors and analysts widely use wallets or address-based metrics to gauge changes in demand and supply. On-chain data has its limitations and inferring definite conclusions about market activity from the same is challenging. For example, a user/exchange can control multiple addresses. In other words, every new address does not represent a new investor. Crypto exchanges often hold user coins in multiple addresses.

Volatility subsides

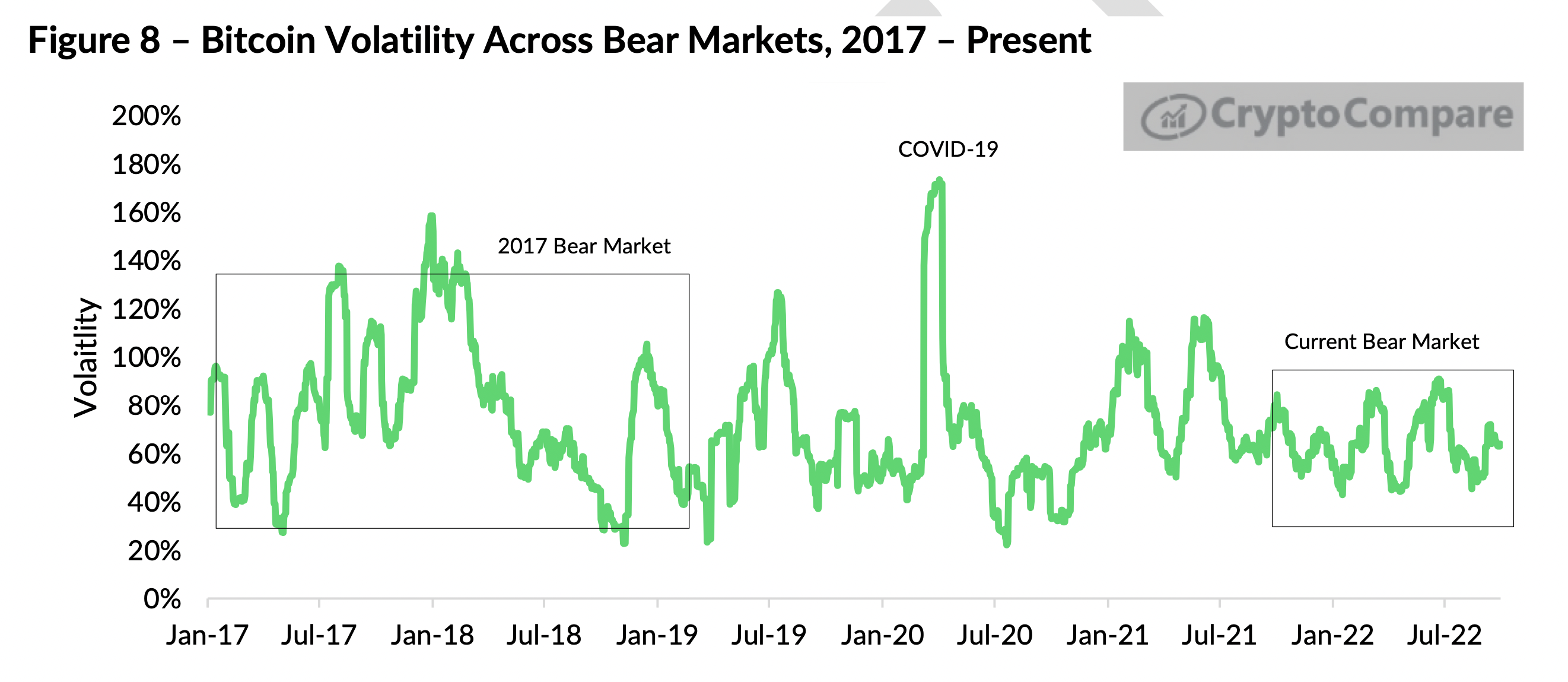

Chart shows bitcoin has become less volatile. (CryptoCompare) (CryptoCompare)

Another positive takeaway from the latest market swoon is the decline in bitcoin's volatility.

The annualized realized volatility has averaged 63% in the past 12 months. That's lower than the average of 79% seen during the previous bear market, according to CryptoCompare.

Realized volatility measures daily changes in the price of a security over a particular period of time. Its backward-looking and different from implied volatility, an options market gauge representing traders' expectations for price turbulence in coming days, weeks, or months.

If that's not enough, bitcoin's 20-day realized volatility recently matched Wall Street's tech-heavy index Nasdaq, the first such instance since 2020, per data sourced from charting platform TradingView.

Skeptics have long criticized bitcoin for being too volatile to be a good store of value. So, a continued decline in price turbulence would be a welcome development.

"Bitcoin's volatility has been steadily stabilizing in a bounded range compared to the last bear market. While this may suggest cryptocurrencies are maturing as an asset class, such patterns also typically precede a large spike in volatility – such as in November 2017," CryptoCompare noted.

Early this week, Arcane Research and crypto services provider Matrixport told clients to buy straddles to capture returns from a potential volatility explosion.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E76TQBPM2BA7TMHG7GK456KXLY.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KM2WPEUGZRDKNB3SPWFSIE5BO4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMEYPPCWPFBYHKOBLQ3ADQWLFI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D4PY3FY4ANDU5LZFEKBYBQOEZQ.jpg)