Bitcoin’s (BTC) seven-day performance is running cooler than usual following a previously reliable moving average crossover.

The cryptocurrency has been trading in a narrow range since June, and finding signs of significant movement – up or down – has been challenging. A recently occurring moving average crossover is worth monitoring, however.

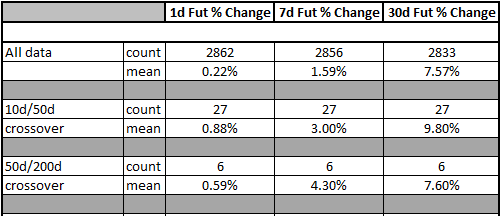

On Oct. 28, BTC’s 10-period moving average crossed above its 50-period moving average. BTC’s price dating back to Jan. 1, 2015 shows this trend occurring 27 times over 2,862 trading days.

Following each occurrence, BTC’s price increased by 3% on average for every seven days. BTC prices were about 10% higher on average for 30-day periods following the same signal.

A comparison to all trading data over that period suggests that investors who have gone long BTC following that signal have slightly outperformed a buy-and-hold strategy.

Moving average crossover data (CoinDesk)

Whether this holds true for the most recent crossover is uncertain. Friday's prices would need to breach $21,216 to maintain the prior seven-day average. To align with past 30-day performance, prices would need to approach $22,615 by Nov. 28.

The 10/50 moving average crossover has performed in line with the famed golden cross, though there have been far fewer opportunities to do so.

A golden cross occurs when the 50-day moving average for an asset crosses above its 200-day moving average and often indicates a bullish trend in asset prices.

The rationale behind examining a cross of the 10- and 50-day moving averages is simply to identify if a more commonly occurring signal is available.

The graph below shows that the golden cross has occurred just six times since 2015, with average seven- and 30-day gains averaging 4.3% and 9.5%, respectively.

Bitcoin’s declining volatility over the last 12 months is likely working against the signal, however. BTC’s "average true range" is 41% lower than the next most recent crossover, and over 70% lower than when the signal occurred in March and in October 2021.

According to Kraken Intelligence’s latest Monthly Market Recap and Outlook report, BTC’s annualized volatility has reached its lowest level for 2022.

Simply put, while the signal is likely positive, the reduced volatility has halted price movement.

Bitcoin's price chart for Friday (TradingView)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3Y3WS4YHYJACREHKXD57V6VILM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KM2WPEUGZRDKNB3SPWFSIE5BO4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMEYPPCWPFBYHKOBLQ3ADQWLFI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D4PY3FY4ANDU5LZFEKBYBQOEZQ.jpg)