Traders in Asia awoke to a market partially in the red as the digital assets industry continues to deal with the controversy over trading firm Alameda Research’s balance sheet.

FTX’s FTT exchange token, which makes up a significant amount of Alameda's assets, is down 5% on day as Binance’s CEO Changpeng Zhao publicly feuded with Alameda’s CEO Caroline Ellison about selling off Binance’s FTT holdings.

(CoinDesk)

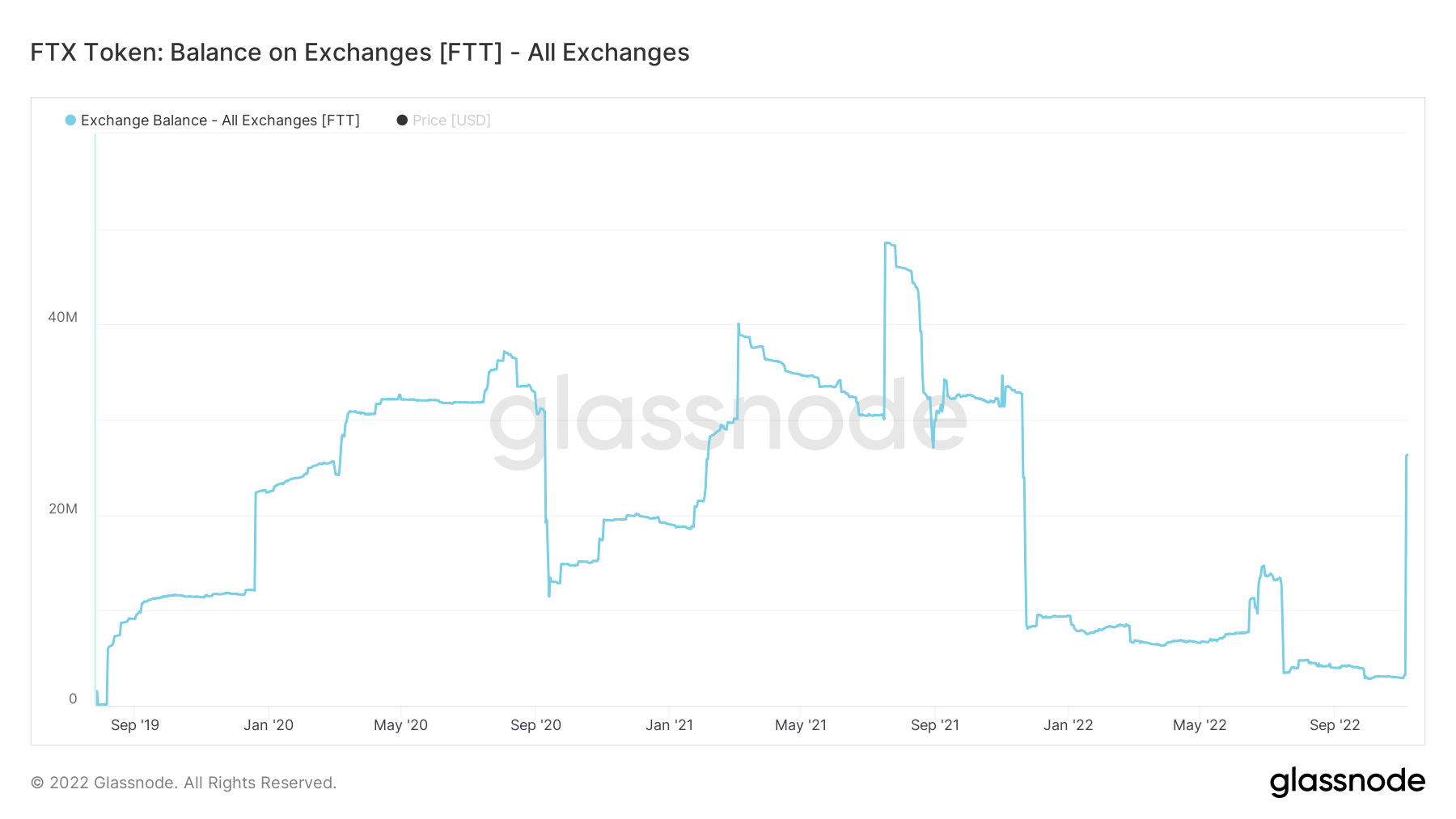

Exchange balances of FTT are also surging, according to data provided by Glassnode. Typically, high exchange balances imply that there's a lot of liquidity for buying and selling tokens. This usually results in a downwards price trend as traders look to sell tokens.

(Glassnode)

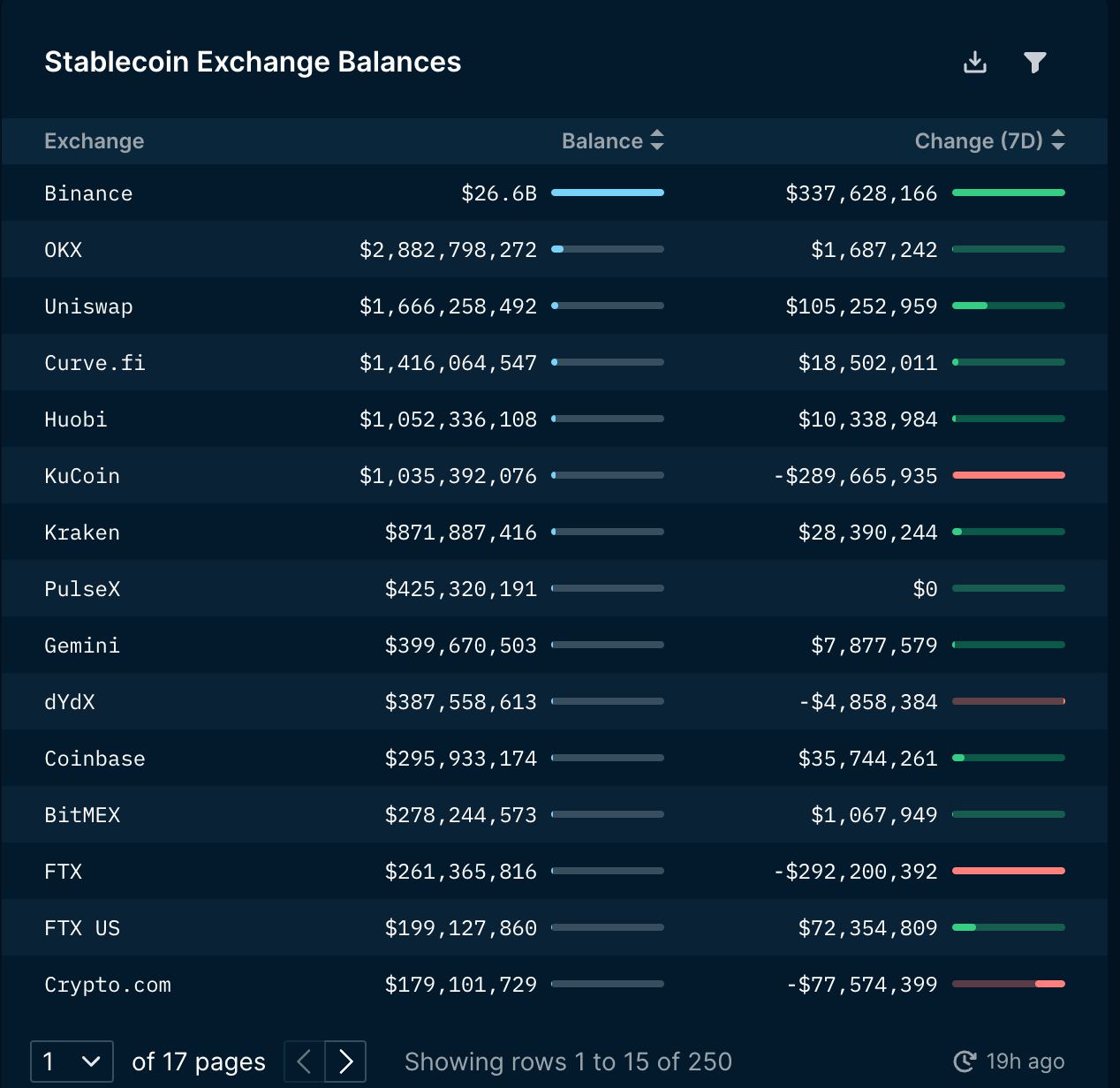

Data from Nansen shows that FTX is suffering from a major spike in exchange outflows. During the last week approximately $292 million in stablecoins have left FTX. Traders could be departing the exchange over fears of liquidity issues, as Alameda is a large market maker on FTX.

(Nansen)

Meanwhile, Solana, a token backed by Alameda and FTX, is down 11% on day. According to a copy of the Alameda balance sheet seen by CoinDesk, Alameda holds $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.”

(Solana)

Also caught in the market turmoil is Binance’s BNB token, which is down 4%.

Perhaps the fears of a full-blown liquidity crisis are overblown as market leaders bitcoin (BTC) and ether (ETH) held steady. Bitcoin's implied volatility, or options traders' expectations for price turbulence over a specific period, continue to trend sideways, indicating little signs of panic.

The current CoinDesk Market Index is at 1,041. Bitcoin, the largest digital asset by market cap, is currently at $20,878, down 1.7% on day.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KM2WPEUGZRDKNB3SPWFSIE5BO4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMEYPPCWPFBYHKOBLQ3ADQWLFI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D4PY3FY4ANDU5LZFEKBYBQOEZQ.jpg)