Crypto investors will be noting two significant macro events this week: the Nov. 8 midterm elections and the Nov. 10 Consumer Price Index (CPI) report.

How crypto prices will react to the midterms is unclear. Democrats and Republicans are more focused on gaining control of the House of Representatives and Senate than debating crypto policies.

Investors will be eyeing whether the CPI veers much from an expected 6.5% increase that will signal inflation remains untamed, potentially testing anew cryptos’ status as an inflation hedge.

FTX questions

Meanwhile, the crypto industry breathlessly considered questions about the solvency of crypto exchange FTX and the impact on its sister company, Alameda Research. As CoinDesk reported over the weekend, much of Alameda’s equity appears to consist of FTX’s FTT token. The outsized percentage of FTX’s value tied to an asset issued by a related entity has raised concerns about a repeat of issues that have already sent three of the industry’s biggest brands this year – crypto lenders Celsius Network and Voyager Digital and hedge fund Three Arrows Capital – into bankruptcy.

FTX CEO Sam Bankman-Fried tweeted unequivocally that FTX and its assets “are fine.”

"FTX has enough to cover all client holdings," he wrote. "We don't invest client assets (even in Treasurys). We have been processing all withdrawals, and will continue to be."

When Binance CEO Changpeng Zhao announced earlier that his crypto exchange would liquidate all remaining FTT on its books, Alameda CEO Caroline Ellison responded that her company would “happily buy back” FTT at $22 from them.

At the time, FTT was trading in a $21 to $24 range. An offer to bid at $22 aligned with market conditions.

Still, FTT’s $22 price is significant when considering the asset’s trading volume. The Volume Profile Visible Range (VPVR) tool determines an asset’s potential areas of support and resistance. It provides a visual representation of trading volume by price level, and indicates areas of high or low agreement on price.

An asset’s price tends to move slowly in “high volume node” areas, as there is generally sufficient market demand at those particular price levels.

Prices often move rapidly through “low volume node” areas and can lead to rapid increases or decreases dependent on market direction.

What this implies for FTX is that if its price cannot be defended at the $22 level, buying demand doesn’t appear again until close to $10.

It can be argued that another significant decrease in activity exists below $10, until approximately $5.

(TradingView)

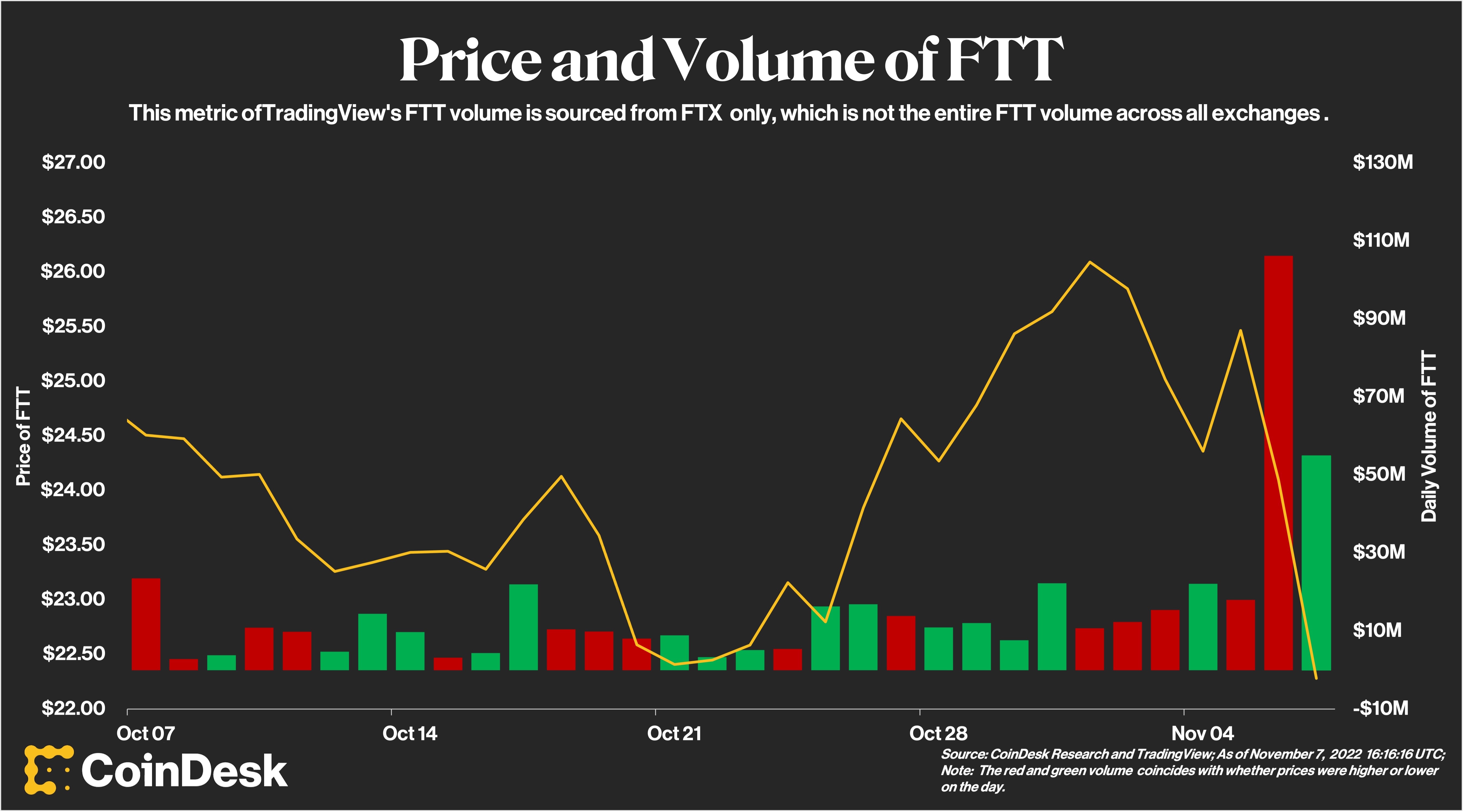

FTT’s recent price decline dovetailed with a significant spike in volume, which is generally a bearish sign.

Price and volume of FTT Chart (Sage Young/CoinDesk)

Whether the FTX and Alameda rumors have substance remains unclear. FTT’s price was recently 0.26% higher, actually outpacing BTC.

The most important question is whether a decline in FTT, and potential insolvency of FTX and Alameda would have a negative spillover impact on the prices of BTC and ETH.

This would likely only take place if FTX and/or Alameda had to liquidate BTC and ETH holdings to shore up its liquidity.

Little in bitcoin or ether’s current price action indicates as such.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FUEF3WVXPRH6RNPOH5LEZRNRZU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KM2WPEUGZRDKNB3SPWFSIE5BO4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMEYPPCWPFBYHKOBLQ3ADQWLFI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D4PY3FY4ANDU5LZFEKBYBQOEZQ.jpg)