Price Action

Crypto markets spent much of Monday in the red, with Solana’s SOL token among the biggest losers.

SOL, was recently down more than 6% over the past 24 hours amid speculation that it might be entwined in the ongoing drama surrounding Sam Bankman-Fried’s FTX exchange and his trading firm, Alameda Research. According to a copy of the Alameda balance sheet seen by CoinDesk, Alameda holds $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.” One theory is that Alameda might try to dump its SOL tokens in a bid to raise fresh liquidity, wrote CoinDesk’s Jocelyn Yang.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today's crypto markets. Subscribe to get it in your inbox every day.

Bitcoin and ether, the two largest cryptos by market capitalization, had a quieter day, falling about 2% and 1%, respectively, over the past 24 hours. BTC remained comfortably over its most recent $20,000 support level after jumping over $21,000 late last week as investors’ looked with hope at signs the U.S. Federal Reserve would scale back from its current diet of hefty, 75 basis point interest rate hikes.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, was trading roughly flat.

A day ahead of the U.S. midterm elections, stocks started the week on an up note as the tech-heavy Nasdaq and S&P 500, which has a strong technology component, rose nearly a percentage point, while the Dow Jones Industrial Average (DJIA) closed up 1.3%.

Safe haven gold joined the crowd in the green, albeit barely, inching up 0.1%. Brent crude oil, a widely watched measure of energy markets, held over $98, the perch it assumed late last week.

Latest Prices

● CoinDesk Market Index (CMI): 1,039.65 −1.6%

● Bitcoin (BTC): $20,685 −2.0%

● Ether (ETH): $1,576 −1.7%

● S&P 500 daily close: 3,806.80 +1.0%

● Gold: $1,678 per troy ounce +0.3%

● Ten-year Treasury yield daily close: 4.21% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

FTX/Alameda Questions Hold the Spotlight as US Midterm Election, Inflation Data Loom

By Glenn Williams Jr

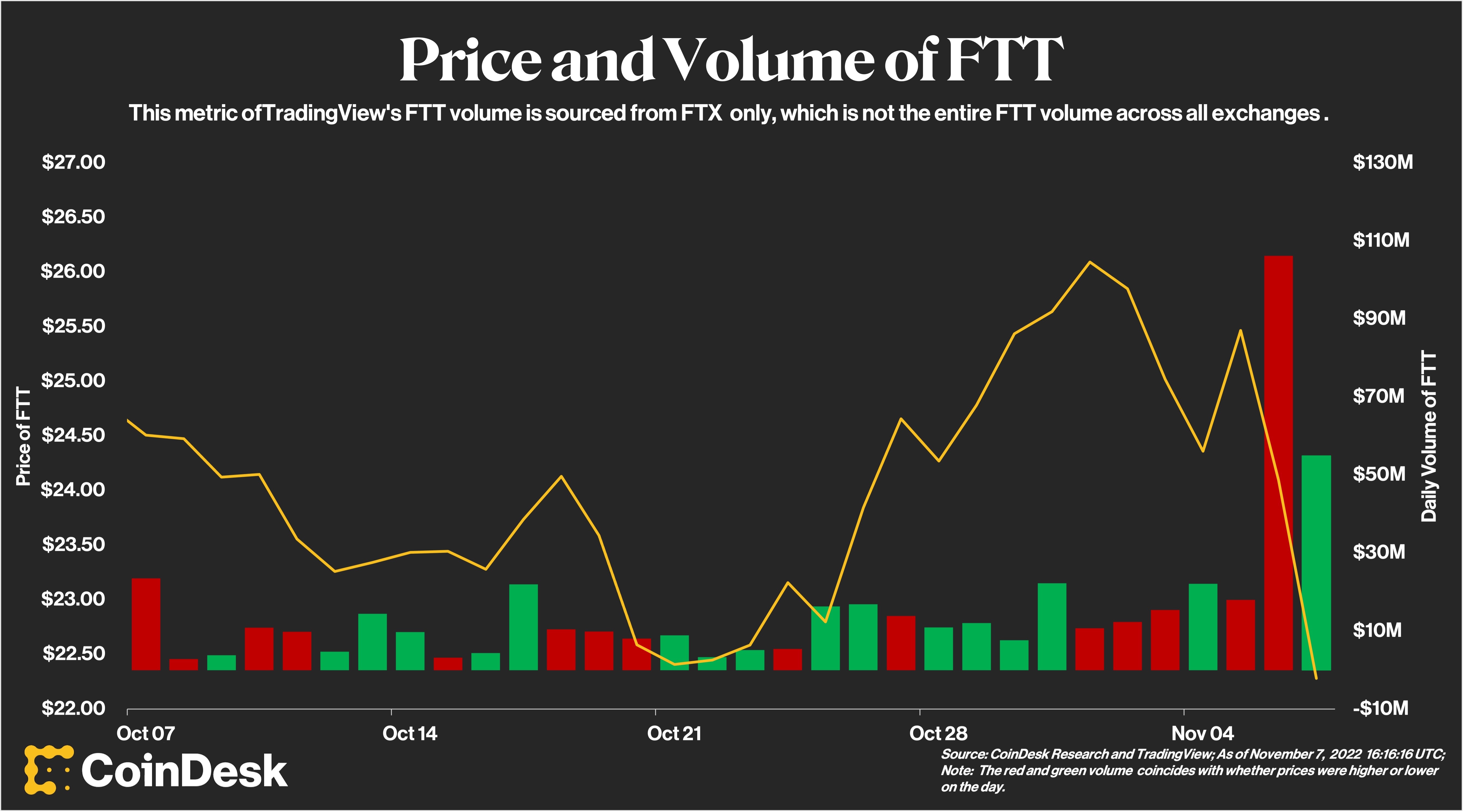

Price and Volume of FTT Chart (CoinDesk/Sage Young)

FTT’s $22 price is significant when considering the asset’s trading volume. The Volume Profile Visible Range (VPVR) tool determines an asset’s potential areas of support and resistance. It provides a visual representation of trading volume by price level, and indicates areas of high or low agreement on price.

An asset’s price tends to move slowly in “high volume node” areas, as there is generally sufficient market demand at those particular price levels. Prices often move rapidly through “low volume node” areas and can lead to rapid increases or decreases dependent on market direction.

What this implies for FTX is that if its price cannot be defended at the $22 level, buying demand doesn’t appear again until close to $10.

Altcoin Roundup

- Solana Falls, and Speculation Centers on Links to Sam Bankman-Fried’s FTX, Alameda: Solana’s SOL token was one of the biggest losers in digital-asset markets on Monday, falling 4.7% in the past 24 hours. Crypto traders are forming all sorts of theories as to why. Read more here.

- LBRY Sold Tokens as Securities, Federal Judge Rules: Crypto startup LBRY violated securities laws by selling its native LBC tokens without registering with the U.S. Securities and Exchange Commission (SEC), a New Hampshire judge ruled on Monday. Read more here.

Trending posts

- Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look at what financial media “gurus” fail to notice about bitcoin.

- Open Interest in FTT Futures Doubles as Binance Moves to Liquidate FTX Token Holdings: Open interest has doubled to $203 million, with bearish bets in demand, as Binance's entry into the FTX-Alameda drama has caused panic among investors.

- Here’s What Crypto Traders Expect From the Midterms: Republicans are increasingly confident they will take control of the U.S. Congress and it could be bullish for crypto, according to some analysts and traders.

- US Seizes 50K Bitcoins Related to Silk Road Marketplace: The bitcoin, which was obtained in 2012 and which was valued at $3.36 billion when it was discovered in November, is now worth $1.04 billion.

- Bitcoin Miner Iris Energy Faces Default Claim on $103M of Equipment Loans: The company has said it will default on the debt Tuesday unless it can reach a restructuring agreement with its lender.

- Ethereum Apps Could Soon be Launching on Competitor Solana: Neon Labs is nearing the launch of its long-awaited Ethereum Virtual Machine for Solana.

- From NFL to NFTs, Tim Tebow Gets Into the College Game With Solana-Based Platform: The two-time college football national champion and Heisman Trophy winner seeks to capitalize on the athletes' freedom to get endorsement deals.

- Stablecoin Issuer Paxos Plans to Hire at Least 130 in Singapore, Bloomberg Reports: Co-founder Rich Teo told Bloomberg the firm is planning a three-year expansion built around Singapore as its hub for growth outside the U.S.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TIPBIVDQKZGEFPK2QDCVZA4Z3Q.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KCUS3RQDPRFJ5AFEA62VATWLGM.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/O6DAWDSWZNFPNFK5DXL6ZLN364.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NUAZ7RBAUND2XLUT24YQG2PD7A.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TOEEP5PE2JAXVOBO4ZLYNMCYOY.jpg)