Traders are scurrying to hedge against a potential slide in crypto exchange FTX's native token, FTT, in the wake of Binance's decision to liquidate FTT holdings and controversy surrounding Alameda's balance sheet.

Open interest, or the dollar amount dedicated to futures and perpetual futures tied to FTT, has more than doubled from $87.56 million to $203 million since early Asian hours, reaching a 12-month high, according to CoinGlass.

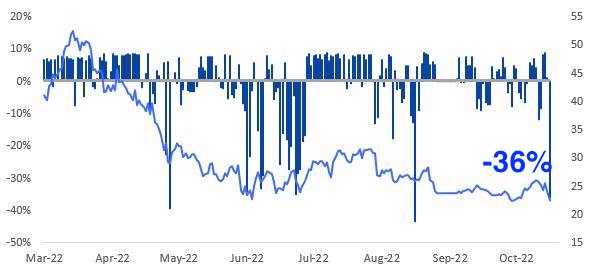

The funding rate, or the cost of holding bullish long positions or bearish short positions, has dropped sharply to an annualized -36%, per data provided by Matrixport Technologies. A negative funding rate implies shorts or bears have the upper hand and are willing to pay funding to longs to keep their positions open.

The combination of rising open interest and the negative funding rate suggests traders are taking short positions on FTT.

"FTT’s funding rate has dropped to -36% annualized as opening interest has doubled. Many new shorts seem to have been put on," Markus Thielen, head of research at Strategy at Matrixport, said. "Trading volumes in the FTT spot market has increased from $58 million to $3 billion."

Chart shows the funding rate has dropped to an annualized 36%, suggesting that leverage is skewed on the bearish side. (Matrixport Technologies) (Matrixport Technologies)

Griffin Ardern, volatility trader from crypto asset management firm Blofin, said, "Last week, Alameda's balance sheet was questioned, and Binance also announced that it would liquidate FTT and other assets related to the FTX exchange. That appears to have caused a panic among investors, who chose to hedge their assets such as FTT."

"FTT holders have to stop losses by shorting perps," Ardern added. The token was down 4% on the day at $22 at press time, according to CoinDesk data.

On Sunday, Binance CEO Changpeng Zhao tweeted that he will be liquidating the remaining FTT tokens acquired as a part of the exit from Alameda's sister company FTX last year.

"Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books," Zhao tweeted, referring to CoinDesk's scoop about Alameda holding $3.66 billion worth of unlocked or illiquid FTT tokens on its balance sheet.

"Liquidating our FTT is just post-exit risk management, learning from LUNA," Zhao added.

Terra's LUNA token (now known as LUNC) crashed in May, destroying billions of dollars in investor wealth.

According to crypto exchange Phemex, Alameda owns over 50% of the FTT token, and a continued slide in the cryptocurrency's price could have market-wide ramifications.

"As the price decreases, Alameda will be the only buyer. The main takeaway is despite a recent price spike in cryptocurrencies, if there’s another potential big-time player getting margin called, it could reignite fear that a LUNA-type situation could occur before the end of 2022," Phemex said in a daily market note.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/G4HTXHRPDZHSFGJL5PM734WNYU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)