Decentralized platform Abracadabra.money's magic internet money (MIM), a U.S. dollar-pegged stablecoin, dropped below $1 early Tuesday as crypto exchange FTX's native token FTT tanked.

- MIM briefly fell to as low as 95 cents during the early Asian hours, hitting the lowest since at least Terra's crash in May, according to data source CoinGecko.

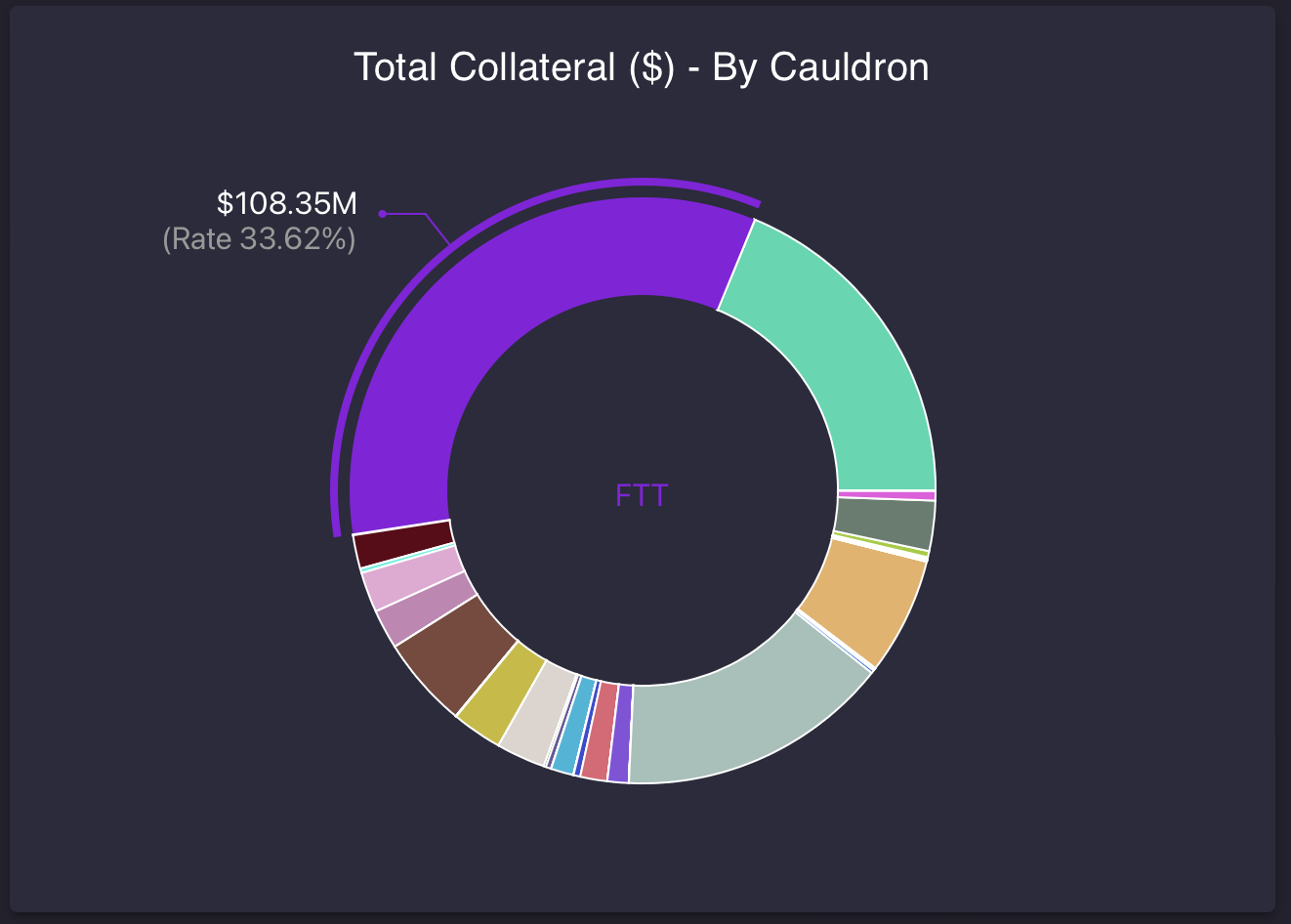

- FTT is the largest collateral backing MIM, accounting for 33% of the total locked in Abracadabra's "cauldrons," according to the official Abracadabra's website.

- Cauldrons allow users to borrow MIM using another asset as collateral. Each cauldron is collateral specific.

- "FTT is the single largest collateral asset for MIM with total value locked now standing at $120 million. The liquidation price for FTT is $6.76 (-61% from current levels)," Lewis Harland, a portfolio manager at Decentral Park Capital told CoinDesk.

- FTT dropped below $22, an offer price suggested by FTX's sister concern and trading firm Alameda's CEO Caroline Ellison to Binance CEO Changpeng "CZ" Zhao on Sunday. The token went on to hit a 21-month low of $15 on Alameda contagion fears.

- At press time, FTT was changing hands at $17.20 while MIM traded at around 99 cents.

- "FTT is the largest collateral asset for MIM, so FTT decline is not great news for Abracadabra," Pseudonymous DeFi researcher @DefiIgnas tweeted.

FTT is the largest collateral asset for MIM. (Abracadabra.money) (Abracadabra.money)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DXU3EWYTARGMFCXOQQDHCOYKFA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DMG6DBTBSNHYRJNLOYIOQDROGI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WPOA436X5VFCJP7L6E6TJB3C3M.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NSR4PQEPWFE4TKREBA3ADD6BSY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E7NJWFN545GJPLKQHC6YF3PUWA.jpg)