The epic comedown of Sam Bankman-Fried’s FTX crypto exchange and Alameda Research trading firm is making waves in the market for the Solana blockchain’s SOL token – to the point where some investors have apparently become so nervous that they’re demanding back tokens they had “staked” or deposited into the blockchain’s underlying security protocol.

Earlier this week, when concerns started to grow over the state of the two businesses’ finances, crypto market analysts began to speculate that Alameda might need to sell some of its SOL tokens to raise liquidity. The fears sent the SOL price tumbling – as traders rushed to get ahead of the selling pressure.

Now, apparently, the dynamic has risen to another level: Solana validators who provide security to the blockchain are set to unlock nearly $800 million worth of their SOL holdings as the end of the token lock-in period known as “Epoch 370” approaches – in fewer than 13 hours.

And analysts are speculating whether investors might dump these soon-to-unlocked SOL tokens as soon as they recover them. SOL's price recently plunged 42% to less than $14 in the past 24 hours.

“A reduction in the amount of SOL staked might indicate that investors are looking to sell all or part of their position,” Sean Farrell, head of digital asset strategy at research firm FundStrat wrote in a note on Tuesday evening following the bailout news. “Due to these factors, we think it is wise to reduce exposure to Solana (SOL) in the immediate term.”

Solana Compass’ blockchain data showed that about 55 million SOL tokens, worth around $776 million, are scheduled to unlock.

There’s about 76% of eligible SOL tokens currently being staked on the blockchain. The scheduled unlocked tokens represent around 15% of the token’s circulating supply in a single unlock.

An “epoch” on the Solana blockchain refers to the time period when staking rewards are earned and then issued. Validators will lock in their stake on the blockchain during this period, which takes about two days, and can choose to unlock the tokens once the epoch is over.

Solana’s price drop accelerated Tuesday as the giant crypto exchange Binance first said it intended to buy FTX and continued Wednesday as CoinDesk reported that Binance was leaning toward not completing the takeover. Last week, CoinDesk reported that a copy of Alameda's balance sheet showed that the firm held $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.”

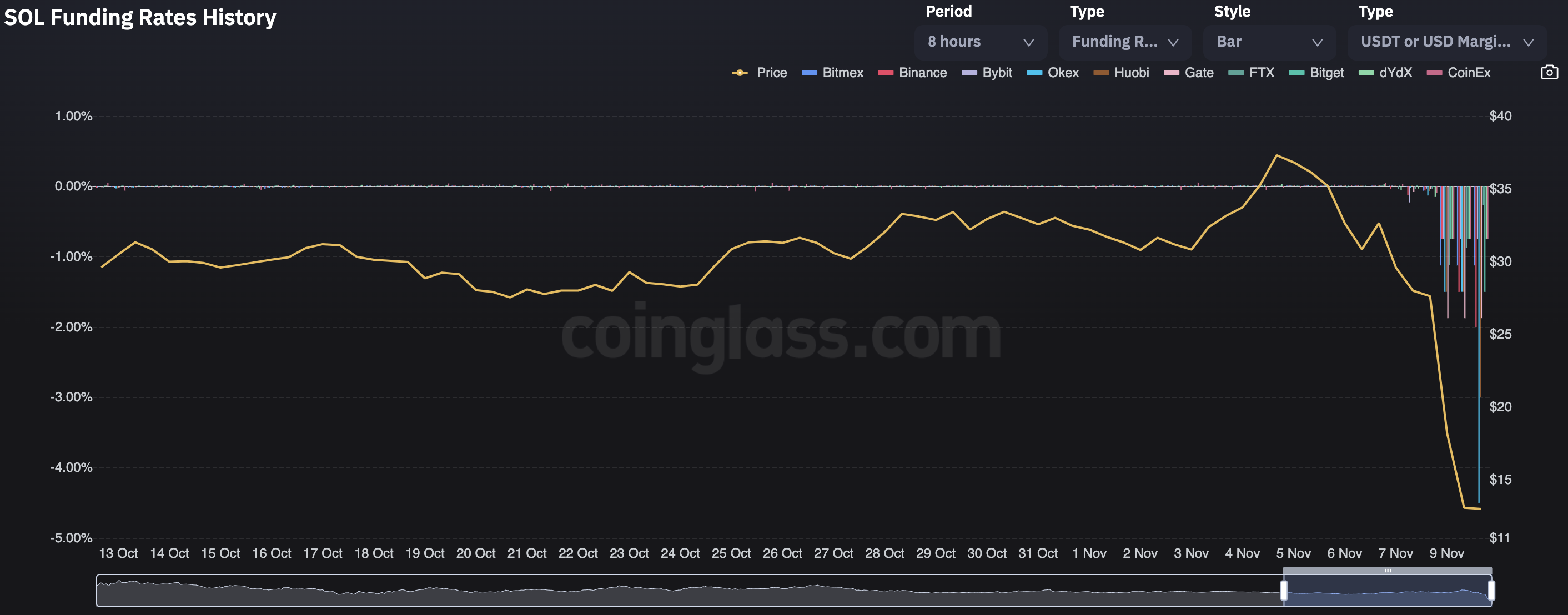

SOL’s funding rates sharply dropped as low as -4% on Wednesday in anticipation of the unlock, according to Coinglass.

SOL's funding rates dropped on Wednesday. (Coinglass)

FundStrat’s Farrell said he expected there is an ability for the Solana ecosystem to “eventually recover and remove itself from Alameda’s shadow.”

“But the current liquidity overhang is quite substantial,” he said.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WXI5ROYMSRCJDOHHO4MCL3ERVE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E2HY566Y5NHMFNEKNOQ54DGUYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2P32IVFKOFGTVEMTYT7TMIPXL4.jpg)