Amid the bitter cold crypto winter, will FTX’s crumbling affect crypto prices in the short term or indefinitely prolong the harsh weather? And how does the movement in crypto prices this week compare with other challenges this market has faced in its brief history?

The first question is difficult to answer. Industry-shaking events earlier this year exacerbated a price plunge already in the making, although bitcoin (BTC) established a safe zone during the summer, with support in the $19,000-$20,000 range.

As the impact of the FTX crypto exchange’s insolvency has sunk in, contagion fears have sent bitcoin’s price plunging to a two-year low, and ether’s dropping to midsummer levels. But crypto has survived other storms, rebounding to new highs within months or years. And price movement remains stubbornly difficult to predict.

Crypto asset management giant Galaxy Digital announced a $77 million exposure to FTX, with $48 million potentially locked in withdrawals. Prominent crypto firms Genesis (like CoinDesk, owned by Digital Currency Group), Wintermute, and Multicoin are also said to have exposure to FTX.

Regulatory scrutiny rises

And now regulators, already alarmed by this year’s failures of crypto heavyweights Three Arrows Capital, Celsius Network and Voyager Digital, are weighing in.

For instance, the U.S. Department of Justice, Securities Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have begun probing what caused FTX's insolvency, and whether outright fraud was involved.

In Congress on Thursday, U.S. Rep. Maxine Waters (D-Calif.), who heads the House Financial Services Committee, called for stronger crypto regulation. She said that “now more than ever, it is clear that there are major consequences when cryptocurrency entities operate without robust federal oversight, and protections for customers.”

The term “robust” will likely startle investors, including those within decentralized finance (DeFi), despite the sub-sector’s relative lack of participation in any of the recent turmoil.

Will traditional finance (TradFi) companies, which have shown an increasing interest in crypto, be swept up in the current mess?

Contagion spillover to TradFi, whether real or perceived, will likely further increase scrutiny from regulators.

Volatility defying conventional wisdom

Meanwhile, crypto prices have been volatile, although markets have seen worse in their brief history.

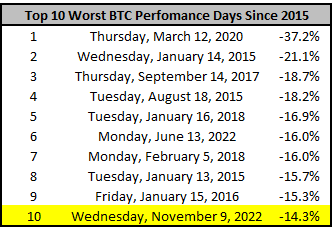

BTC’s Nov. 9 decline was its 10th-largest decrease since 2015, although it's only the second-largest decline for 2022, highlighting how tumultuous the year has been.

(CoinMarketCap)

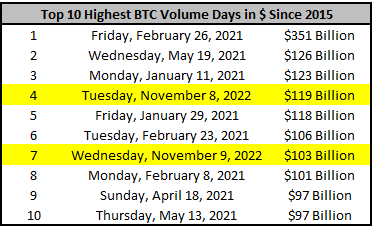

Trading volume was the seventh highest over the last seven years on Nov. 9, and fourth highest on Nov. 8.

(CoinMarketCap)

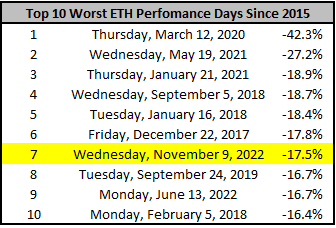

For ETH, the 17% decline on Nov. 9 was its seventh largest since 2017.

(CoinMarketCap)

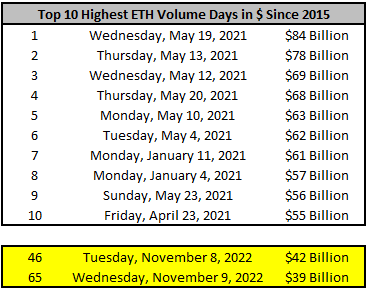

Trading volume on Nov. 8 and Nov. 9 don’t crack the top 50 highest days over the last five years.

(CoinMarketCap)

At first glance, this is surprising. Percentage declines during one of the most pivotal moments in cryptocurrency history barely cracking the top 10 was unexpected.

A possible explanation is that investors holding BTC and ETH are continuing to "hodl" their assets. The percentage of profitable bitcoin and ether addresses has dropped to 50% and 47%, respectively, according to data from Glassnode.

Or the trend could simply highlight the resiliency of certain assets overall. Both BTC and ETH rose sharply on Thursday, following a CPI report that showed inflation in the U.S. is slowing by more than expected.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XQDMRHYZ2NHXDJ3XWSOVMNN2CI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KM2WPEUGZRDKNB3SPWFSIE5BO4.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMEYPPCWPFBYHKOBLQ3ADQWLFI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D4PY3FY4ANDU5LZFEKBYBQOEZQ.jpg)