Withdrawals from the FTX crypto exchange were so rapid and vicious that the overall balance of digital assets on the venue has tumbled 87% over the past five days, data shows.

The blockchain-era version of an epic bank run culminated Nov. 8 when the exchange led by Sam Bankman-Fried announced a halt to withdrawals. (On Thursday there were fresh reports that some withdrawal requests were suddenly getting processed, although some Twitter posters wrote that they have since been shut off.)

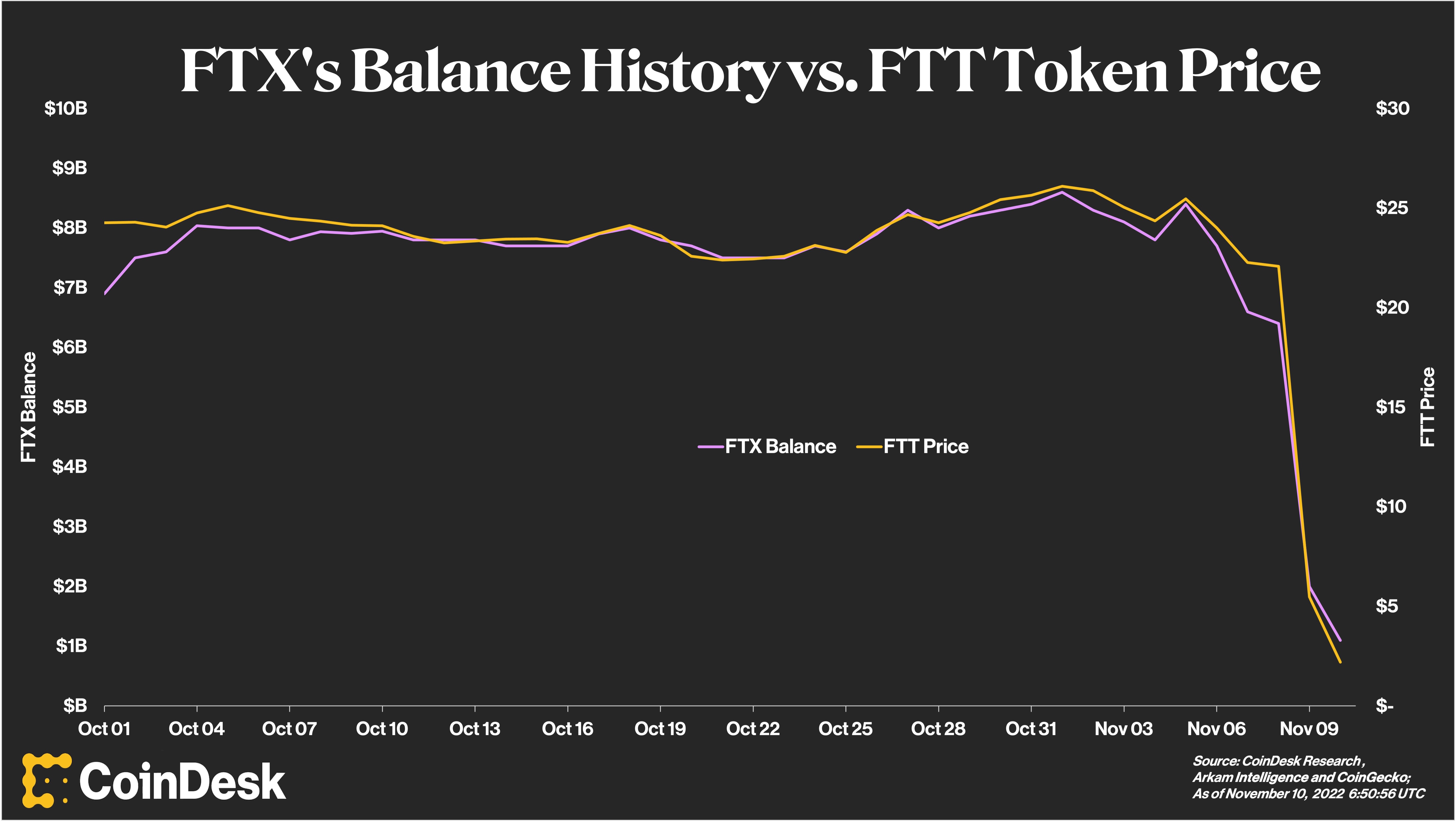

The data, from Arkham Intelligence, might be a conservative estimate of FTX’s balance history because there may be wallet addresses that haven’t been disclosed to the public.

(CoinDesk Research, Arkham Intelligence and CoinGecko)

FTX’s average total balances between Oct. 1 and Nov. 4 was $7.9 billion, and stood at $8.4 billion as of Nov. 5, Arkham data shows. The balances then dropped considerably to $1.1 billion as of Nov. 10.

The rush for the exits coincided with a steep plunge in the price of the FTX’s in-house exchange token, FTT.

From Oct. 1 through Nov. 4, the FTT price ranged from a lower bound of $22 and an upper bound of $26. Then, all of a sudden, the floor fell out: FTT had sunk to about $2 as of press time.

Sam Bankman-Fried (SBF) tweeted Thursday that FTX “saw roughly $5 [billion] of withdrawals on Sunday.”

The immense scope of this black swan-style event serves as a key reminder of just how rapidly confidence can erode in the parallel financial universe of digital assets – where there are no central banks to bail out the key players – as happened in 2008 when nearly all of Wall Street ran short of liquidity and had to turn to the Federal Reserve for emergency funding.

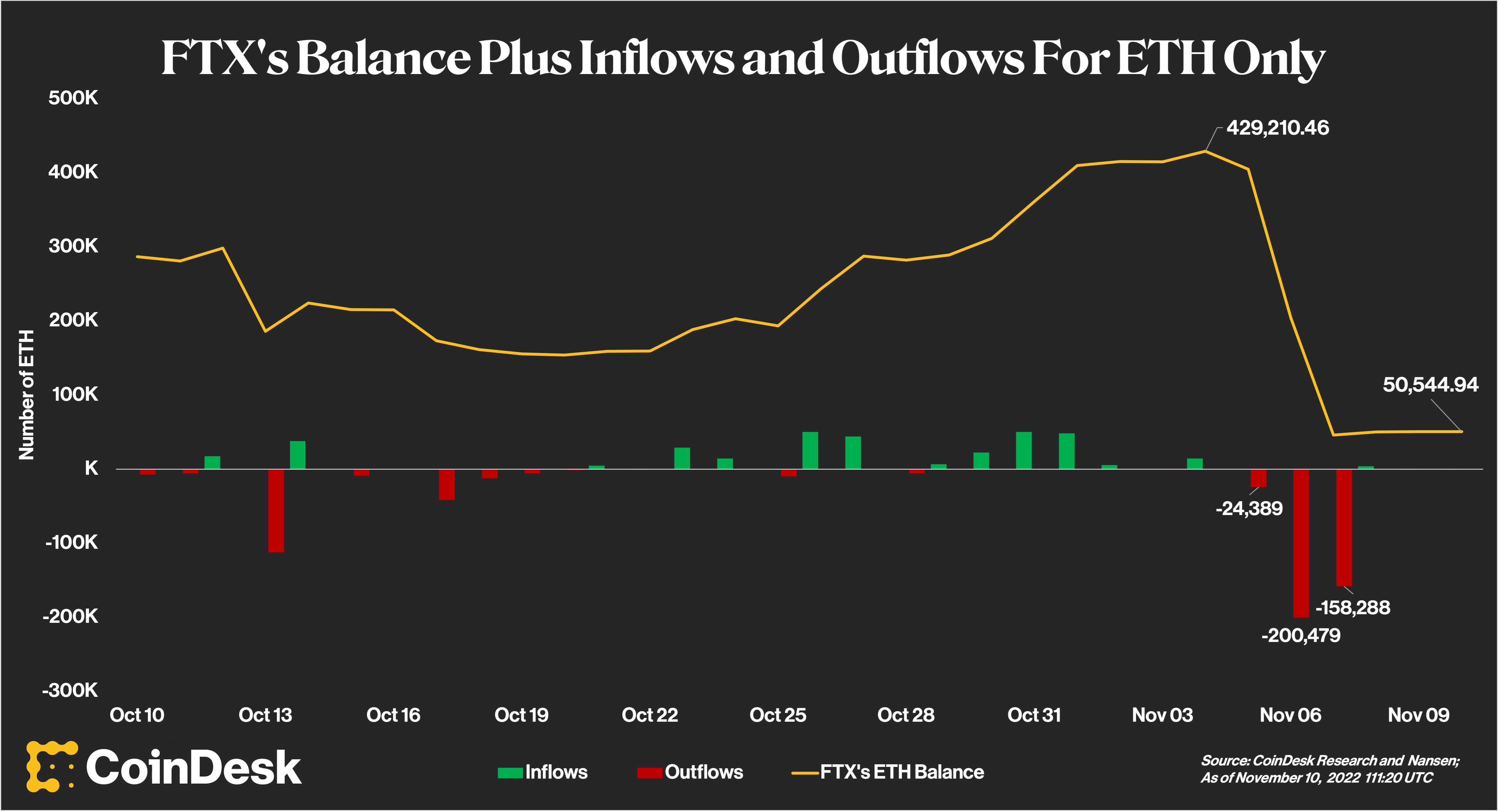

FTX’s ETH Balance

(CoinDesk Research and Nansen)

Drilling down, the balance of ether (ETH) on FTX has fallen some 88%, according to the blockchain analytics firm Nansen.

As of Nov. 10 at press time, FTX holds 50,544.94 ETH ($66.5 million) at time of press, down from 429,210.46 ETH ($564.8 million) on Nov. 4, the data shows.

From Oct. 21 to Nov. 4, users deposited 290,820 ETH and withdrew 15,803 ETH. With 18.4x more ETH deposits than withdrawals in that time period, user confidence in FTX was solid, but this rapidly changed.

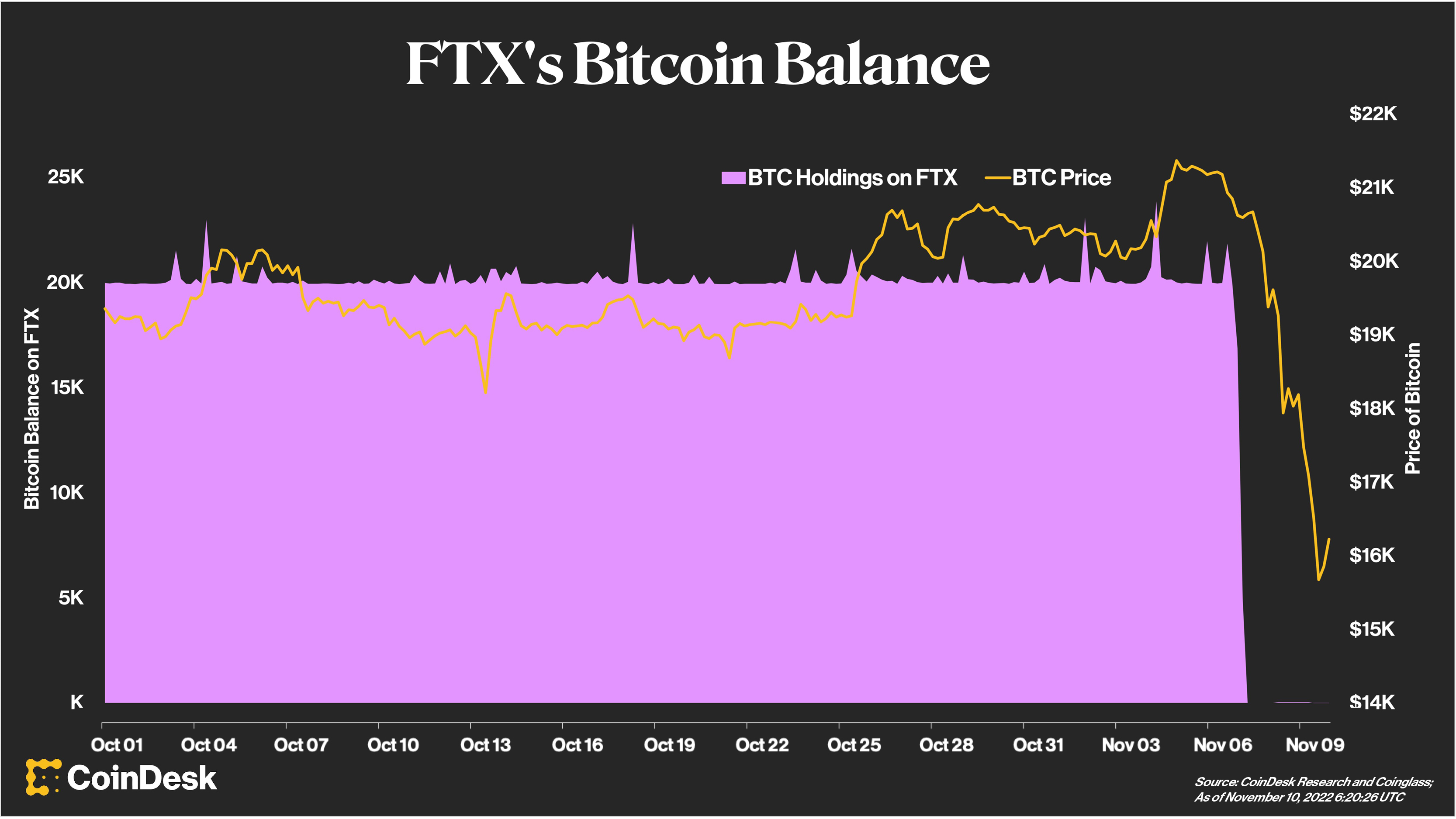

FTX’s Bitcoin Balance

(CoinDesk Research and Coinglass)

It is no surprise FTX’s bitcoin (BTC) balance also took a sharp fall.

Even as bitcoin’s price held steady around $20,000 earlier in the week, FTX’s BTC holdings started nosediving on Nov. 7, according to data from Coinglass. FTX held 21,850 bitcoins across all exchanges on Nov. 6, and by the next day, FTX’s balance dropped to virtually nil.

Around the same time, bitcoin’s price started falling, as crypto analysts fretted that larger cryptocurrencies might get caught up in a broader wave of selling across digital-asset markets.

On Nov. 6, BTC was changing hands around the $21,000 level. It tumbled close to $15,000, but had recovered to about $17,400 as of press time.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UHS5QJHFF5H7BAT2W7SLEDIXPI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KNEXMEOTJ5B3JHUVO35U5GBJKQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/A5UHHGWUXFH4LBRTVXGSYI5HVY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RHZQ7B7AZVCSNPVWTWNTO4BNUM.jpg)