The growing push for crypto firms to adopt proof-of-reserves balance sheet validation emulates a practice long used in the physical commodities world.

The initiative, which none other than Binance CEO Changpeng Zhao has been pushing and that venture capitalist Nic Carter addresses in this CoinDesk opinion piece, would require exchanges to verify their assets. FTX’s implosion over the last 10 days – a result of propping up the affiliated trading firm Alameda Research with its own FTT tokens – raised the question about an industry-wide epidemic of balance sheets being out-of-whack or improperly managed. The current, intense period of reassessment will likely morph from “who uses proof-of-reserves” to “who uses it most often.”

The commodities industry has been using validation for years to assure investors of their solvency and build confidence in those markets and companies. That bitcoin and ether are often referred to as “digital gold” and “digital oil” now seems more appropriate than ever.

Oil and gas entities attest to their reserve balances at the end of each year. Investors, analysts and traders are accustomed to reading through these attestations and determining the extent to which a firm’s valuation may or may not have changed.

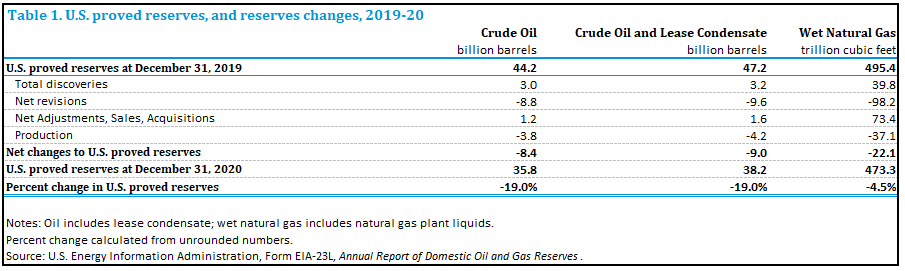

Below is the most recent oil and gas proved reserves report for the U.S., released Jan. 13, 2022. As you can see, the U.S. proved reserves declined 19% between Dec. 31, 2019 and Dec. 31, 2020.

U.S. Proved Reserves (Energy Information Association)

“Proved reserves” are widely recognized as having a 90% chance of successful extraction. Lower tier categories, “probable” and “possible” reserves, denote much lower probabilities of success, but are often justifiably excluded from a company’s valuation.

Standardization of definitions and methodology in determining reserve balances is key for the system’s success, ensuring that analysts and investors can evaluate entities versus each other, and monitor trends on an apples-to-apples basis.

The myriad issues that the crypto sector has faced over the last six months appear to be individual- and entity-based, and not asset-based. Bitcoin and ether continue to operate as intended.

Cryptocurrencies' efficacy as mediums of exchange, units of account and vessels to store value remain intact. Decentralized finance, which operates on code, fared especially well during the turmoil, although the odds of DeFi being carved out of the criticism caused by centralized failures are low. Crises have a way of sweeping up everything in their path.

Below ground, above board

The analogy between a crypto-based proof-of-reserves audit, and that of an oilfield is not perfect.

A dollar value is often assigned to an energy company's reserves by projecting out future cash flows and discounting them by 10%. For centralized crypto firms, marking the daily value of reserves to markets could be more straighforward.

Oil reserves also require extraction, which creates the delineation between proved, probable, possible and other reserve categories; there's some degree of subjectivity when it comes to geological modeling tools and rock formations hundreds or thousands of feet below the ground. Proof-of-reserves for digital assets more closely resembles an audit of assets that have already been extracted.

Finally, a natural lag exists in the auditing of energy reserves. The table above, while most recent, reflects U.S. energy reserves as of 2020.

Proof-of-reserves can be executed far more frequently within crypto – maybe even weekly or daily or in real time. Certain exchanges have already gone as far as adopting daily attestation of crypto reserves.

The differences could work to the crypto industry’s advantage, allowing exchange users and other observers to track assets precisely on an ongoing basis. Attestations may serve as a worthy beginning point for crypto that follows a sound process, rather than relying on the strength of personality to foster faith in a fledgling industry that still leaves most people feeling squirmy.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NM4RTEWTARBYTH53WQQDG4JP4Y.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BBWQ4O6335EFBCLS4V7BN7DY2U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/G4HTXHRPDZHSFGJL5PM734WNYU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OZWUVM4V3FGGZISKSSL4C5XOAI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y3I7WQDX5JCPXBWSJI724USETA.jpg)