This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

The fallout continued from this month’s crypto crash, with the Bahamas arm of Sam Bankman-Fried’s FTX exchange filing for bankruptcy in in the U.S. and a report that the digital-asset lender BlockFi was reportedly preparing a potential bankruptcy filing because of its exposure to FTX. Online investing platform BnkToTheFuture has dropped a plan to acquire the crypto lender Salt Lending due to FTX exposure. The political backlash is growing, too. Lawmakers in Washington grilled U.S. financial regulators on Tuesday.

The FTX debacle has brought deep dislocation in digital-asset markets, and analysts are racing to make sense of it all and what comes next. The art of “on-chain analysis” – the practice of extracting data from on-chain transactions and then interpreting it – is one of the first areas to get tested; historically, outflows from big crypto exchanges meant that investors were getting more bullish, moving their coins to long-term custody or storage to hold for the medium or long term. But a recent uptick in outflows might mean that investors are losing faith in the exchanges. Data also shows that crypto traders are increasingly turning to decentralized-finance (DeFi) protocols for their exchange and lending needs.

It’s now been more than a week since the price of bitcoin hit a two-year low at around $15,600, and questions are invariably forming on whether the market bottom is in. The largest cryptocurrency’s price has inched back up to $16,600. Price charts suggest a drop down to $13,000 is still possible, and traders in the Chicago Mercantile Exchange’s bitcoin futures market appear to be piling into a big “short” trade – bets on further price declines. What’s clear from the data over the past two weeks is just how much cryptocurrencies trade in sync when there’s a big market shakeout: Check out this analysis of the correlations between CoinDesk Market Index (CMI) sectors. On the other hand, the idiosyncratic drivers might be creeping back: The decentralized-exchange protocol Serum’s SRM tokens doubled in price Tuesday as key backers of the project rallied around an emergency fork in response to last Friday's hack at FTX.

Chart of the Day

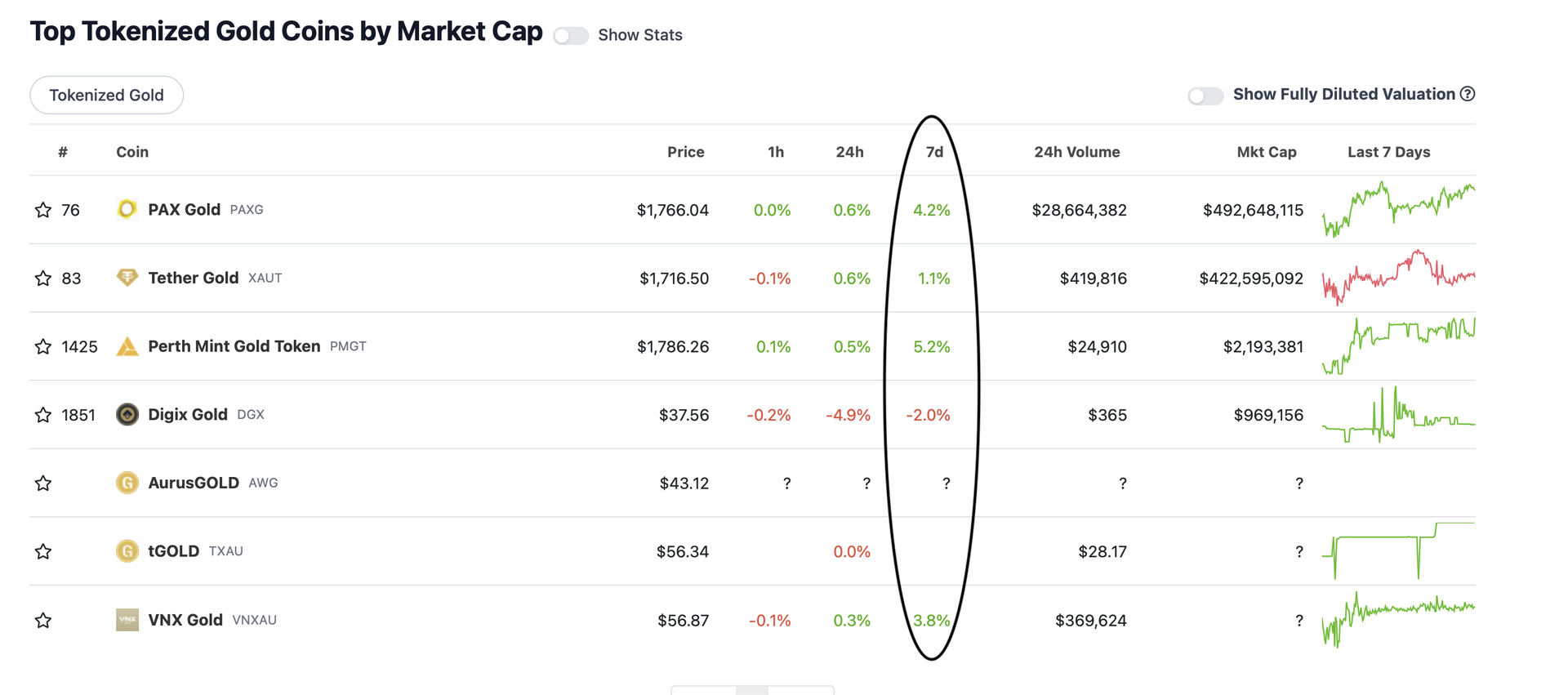

(Source: CoinGecko)

- The chart shows gold-backed cryptocurrencies like PAXG and XAUT have put in a positive performance in the past seven days, decoupling from the broader market swoon.

- These cryptocurrencies might become safe havens as other tokens reel under the pressure of FTX's collapse and gold prices rise on the back of a weaker dollar.

- Gold has gained 9% this month, reaching a three-month high of $1,768 per ounce, while the dollar index has dropped nearly 5%.

– Omkar Godbole

Trending Posts

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T6KU2TINPJHMTEZVITXXDWA56I.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/O6DAWDSWZNFPNFK5DXL6ZLN364.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NUAZ7RBAUND2XLUT24YQG2PD7A.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TOEEP5PE2JAXVOBO4ZLYNMCYOY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UJH3OSMX6BBT3G7APQIQUIRU2I.jpg)