Voyager Digital's native coin, voyager (VGX), surged Thursday after CoinDesk reported that leading digital assets exchange Binance's U.S. arm is relaunching a bid to purchase the bankrupt crypto lending platform.

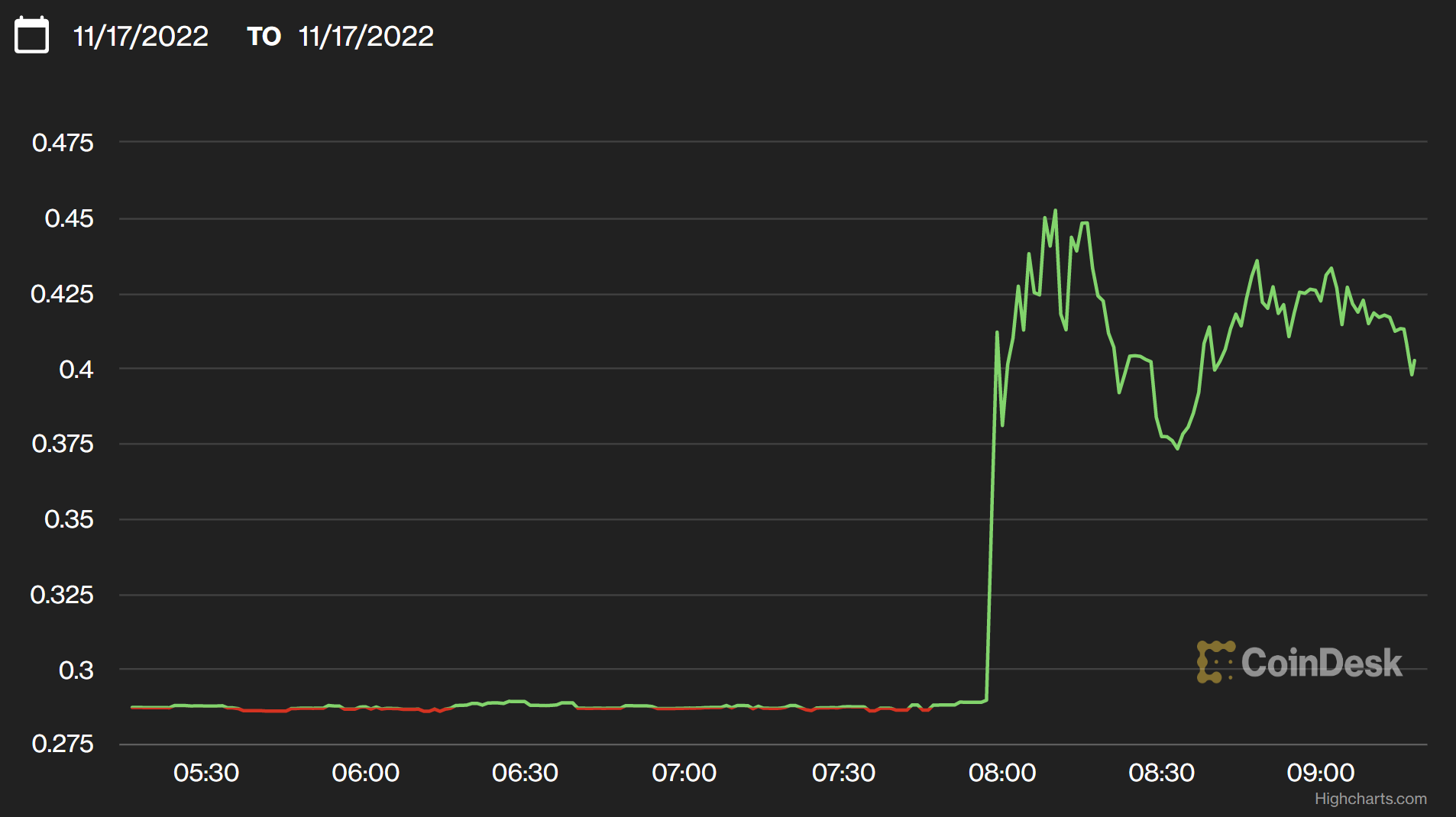

- VGX jumped more than 55% to $0.45, the highest level since Oct. 21, according to CoinDesk data.

- The token is still down 85% this year.

Voyager Digital's VGX token. ((CoinDesk))

- Voyager ended a deal to be bought by FTX, agreed in September, after the Sam Bankman-Fried-led crypto exchange collapsed last week.

- FTX beat out Binance and Wave Financial with a bid valued about $1.4 billion.

- Voyager filed for Chapter 11 bankruptcy protection in early July, citing more than 100,000 creditors and between $1 billion and $10 billion in assets and liabilities.

- Many crypto lenders, which had doled out large loans to the now-defunct hedge fund Three Arrows Capital, have suspended withdrawals and filed for bankruptcy in the past four months.

UPDATE (Nov. 17. 09:44 UTC): Adds chart, value of FTX offer.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/O7HCJ425TZF3RMSFSJ3M5QQE5Q.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SJABZZ3OUJAYHAU47NKOETWGWI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RRFE2MMY4FCGLDUT6RNRF4CPT4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/O6UV3KGTZ5DLTDZPO7ABYSLLYY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FPZTYQS6IBCUDJRI6LED2CAN6Q.jpg)