Cryptocurrency exchange Kraken has said the cost of responding to law enforcement requests for user data is rising sharply year on year.

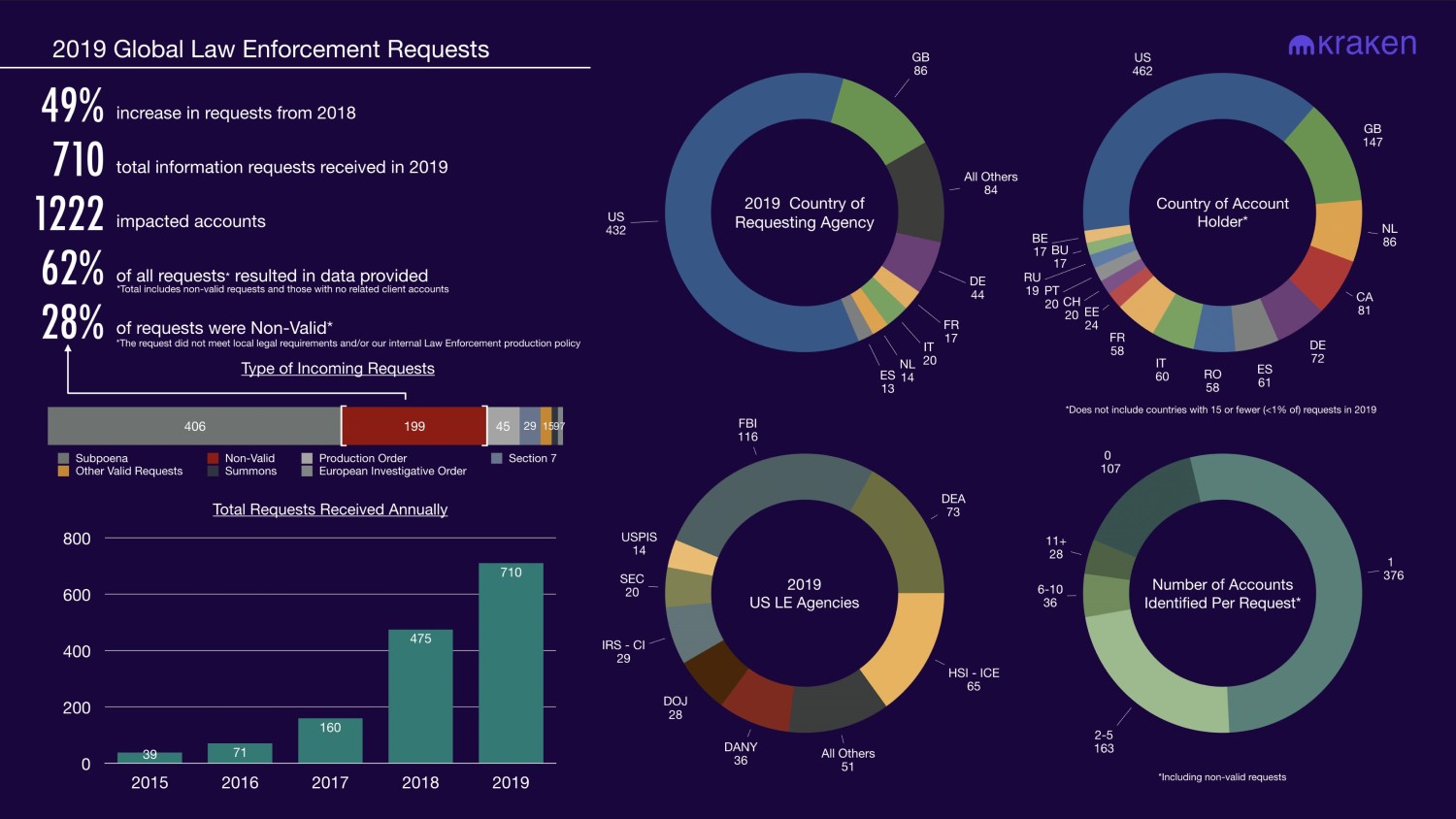

In a tweet on Tuesday, the firm posted an infographic teasing its new 2019 Transparency Report, indicating it had received 710 information requests in total – 49 percent more than in 2018. Last year, the exchange received 475 requests and just 160 were dealt with in 2017.

The country issuing most requests in 2019 was the U.S. with 432 (almost 61 percent of the total). The FBI issues most requests of the U.S. agencies, followed by the Drug Enforcement Administration (DEA) and Immigration and Customs Enforcement (ICE).

The U.K. was the second nation in terms of request volume, with 86 (12 percent), followed by Germany (44) and Italy (20).

Source: Kraken

Further set out in the infographic, of 1,222 user accounts affected by requests, 62 percent had data returned to the issuing agency. The remaining 28 percent were "non-valid," meaning they "did not meet local legal requirements" or Kraken's policy on law enforcement requests.

Kraken co-founder and CEO Jesse Powell said in a tweet the cost of servicing such law enforcement requests in a "high-wage market" (the firm is based in California) was more than $1 million in 2019.

"Several things contribute to the cost. Older business with more than eight years of data, millions of accounts, high security around accessibility of personal data, the good stuff is all encrypted and hard/slow/impossible to search/export in bulk (upside being its that way for hackers too)," he said in another post.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EMWB7H3CYFCORH2QRL7D5NVK7E.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HI6IDDOJZVG5BB23XMNWG25B2Y.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4QH3FLPBL5HLJB3OGTJW4QW5ZY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RAUG3YMJGJHIBJ5R67ZOBANUME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LRHYROYTOVGUFDD3UYF4CHIG5U.jpg)