I wasn’t really keyed into other things during Consensus 2022 and the World Economic Forum, so here’s some of the stuff I missed over the past few weeks.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

20,000 people

The narrative

The attorneys in crypto are going to be pretty busy, it seems.

Why it matters

The market is taking a downturn but legal activity, not so much. There's a lot happening that may shape guidance and laws that crypto entities have to follow in years to come.

Breaking it down

We brought 20,000 people to Austin, Texas, and all I got was a lousy tan line.

JK. Consensus happened! We had 20,000 attendees, 500+ speakers, 27 stages(?) and a bajillion meetings. And, as is tradition, I wrote two stories in bars at night. Only one had an embarrassing typo! It’s pretty surreal to think that the most chaotic Consensus was 2018, which was widely seen as the most popular for years afterward. We had somewhere between 8,000 and 10,000 people I believe.

So anyways, it was a pretty busy few weeks. I apparently missed a lot between Consensus and Davos. A quick rundown follows.

PoolTogether, a decentralized finance (DeFi) startup facing a lawsuit for allegedly violating New York gambling laws, is selling non-fungible tokens (NFT) for its legal fund.

Nate Chastain, the former OpenSea staffer who quit last year after it came to light he may have bought NFTs from collections prior to his company listing them, now faces federal wire fraud and money laundering charges. I believe this is a first.

ForUsAll, a 401(k) provider in California, sued the U.S. Department of Labor on allegations of violating the Administrative Procedures Act (APA) when it issued guidance telling providers to “exercise extreme care” before adding cryptocurrencies to potential retirement funds.

Custodia, the Wyoming-based crypto bank founded by Caitlin Long (and previously known as Avanti), sued the Federal Reserve on allegations it violated a one-year deadline for approving master accounts. Custodia applied last year.

Grayscale (a sister company to CoinDesk) tapped Don Verrilli, a former Solicitor General for the U.S., presumably in anticipation of its own potential APA proceeding should the Securities and Exchange Commission reject its spot bitcoin exchange-traded fund conversion application next month.

Coin Center sued the U.S. Treasury Department, Internal Revenue Service and various officials on allegations that the transaction reporting rule enshrined in last year’s infrastructure bill is not constitutional.

Binance.US is being sued by 2,000 investors in LUNA and terraUSD on allegations it misled those same investors by listing the pair of tokens.

Biden’s rule

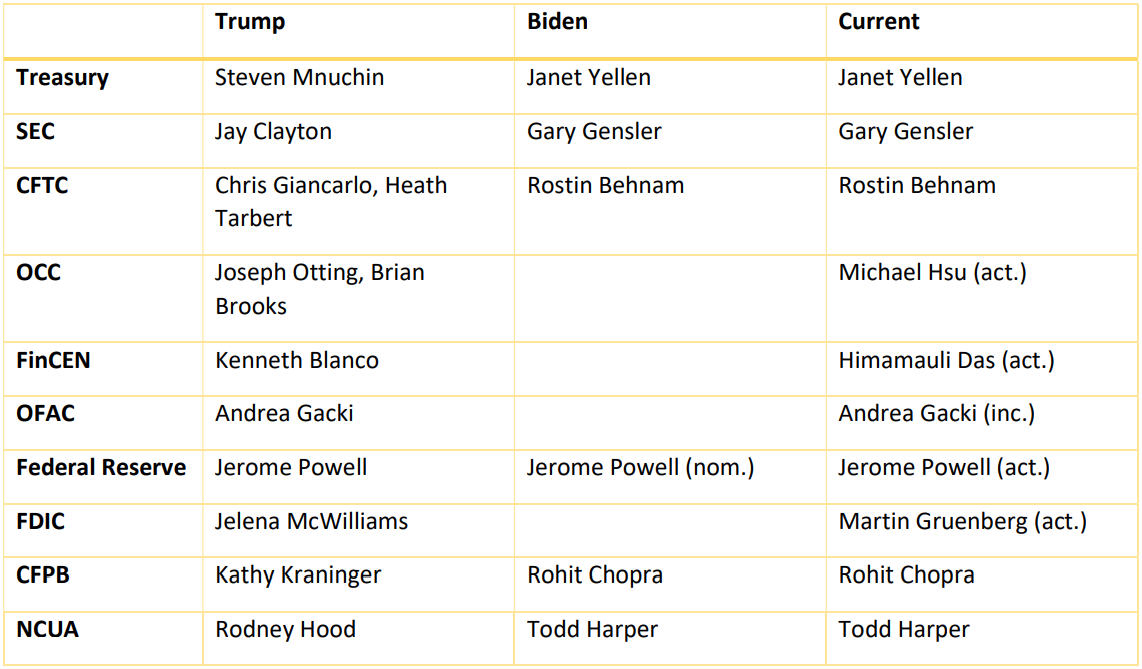

Changing of the guard

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

The Senate confirmed Jaime Lizárraga and Mark Uyeda as commissioners with the Securities and Exchange Commission.

Elsewhere:

- Three Arrows Faces Possible Insolvency After Unforeseen Liquidations: Report: Three Arrows Capital is the subject of insolvency rumors.

- How Crypto Lender Celsius Overheated: Oliver Knight details the run-up to Celsius’ announcement it was suspending withdrawals earlier this week.

- Crypto Lender Celsius Hires Restructuring Attorneys, WSJ Reports: So, this doesn’t mean bankruptcy, but it does suggest Celsius may be in trouble.

Outside CoinDesk:

- (Politico) The blow-up of Celsius and other crypto lenders may lead to another regulatory backlash.

- (The New York Times) The Times took a look at Tether (USDT) and its role in the broader crypto ecosystem.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See y’all next week!

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NXK47UDKCNBTJHTUDF3LTXXXYU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C7UC7UF4WRG73LR4SJTW7EQBNI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EJTP22MPVVH4RGGUF3VPCFMQBU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TPIELPTEOFCFBMZMK37FF3FBA4.jpg)