Any successful trade has two distinct elements: price and volume. In times of market volatility it’s common for everyone to focus on the first element, price. This number is accessible and easy to understand. But without knowing the volume available behind that price, it’s largely theoretical.

As a crypto trader, you need to know how much is available, as well as at what price.

This is roughly what we mean by liquidity. Can the market handle the volume that you want to transact at a price you want to trade, and will that price not then adversely move the market? It’s an incredibly important aspect of the markets, which is difficult to assess in decentralized finance (DeFi), especially when swapping assets.

Market participants are in the daunting position of having to trawl through different bridges, chains, decentralized exchanges (DEX) and liquidity aggregators to find the execution necessary to complete their trade (particularly if the sums involved are large).

Many people have tried to rely on multichain liquidity aggregators to achieve their aims, but have found them to be sub-optimal. That is because multichain liquidity aggregators have individual bridges between individual chains, and so these chains are singularly connected in pairs with the bridges themselves becoming bottlenecks.

Cross-chain aggregation is a much better approach. This implies access to a spider web of interconnected chains that leads to seamless, multinetwork operations while pulling liquidity from multiple chains at the same time for any given transaction.

Chainge currently stands as the only true cross-chain liquidity aggregator. Its advanced smart router is the only one that aggregates liquidity across several chains for any given swap regardless of the chain(s) your assets are on.

Other aggregators with similar “cross-chain” claims in reality have a single-chained approach to aggregation and can only aggregate liquidity from DEXs on one single chain at a time followed by bridging the assets post-swap. Whereas Chainge can automatically divide any transaction into fractions on multiple liquid chains, thus providing access to the most liquidity and the best prices.

How does Chainge do this? It seamlessly pulls liquidity from several chains simultaneously by leveraging the DCRM technology of the Fusion blockchain. DCRM was built by four leading cryptographers: Rosario Gennaro, Ph.D., professor of computer science at CUNY; Steven Goldfeder, Ph.D., department of computer science at Cornell University; Louis Goubin, professor of computer science at the University of Versailles; and Pascal Paillier, Ph.D., CEO and senior security expert at CryptoExperts.

The DCRM architecture is built specifically for token portability and token exchange across all networks. It mimics how centralized exchanges work by essentially creating a clearing layer between transactions. The protocol already has custody of different crypto assets on an external blockchain. When users want to move their assets, the Fusion chain will use these external wallets to distribute the funds.

Fusion is the only blockchain capable of seamlessly connecting with every chain, and therefore the only chain that supports a DEX that can pull liquidity from any chain simultaneously – the word “simultaneously” being key here.

Comparing the market

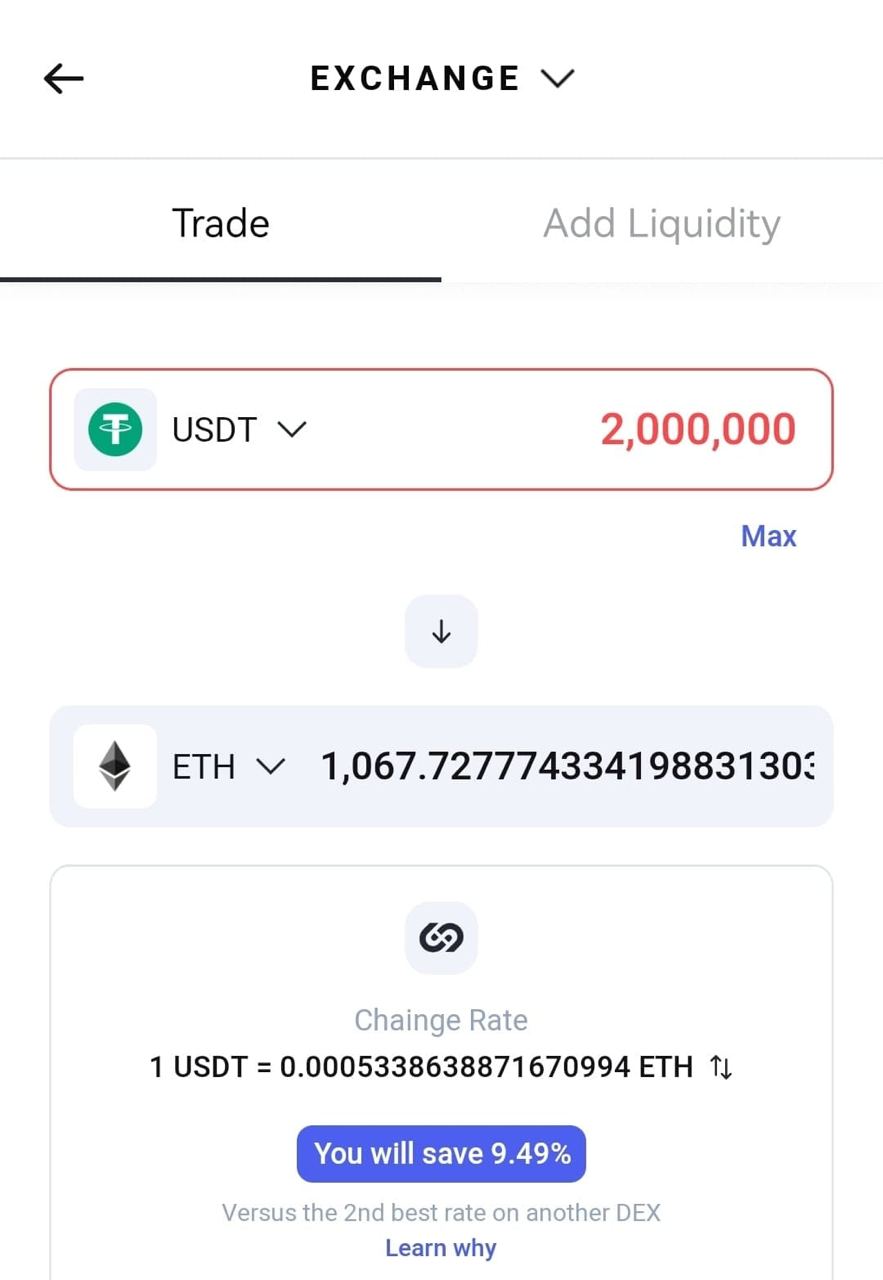

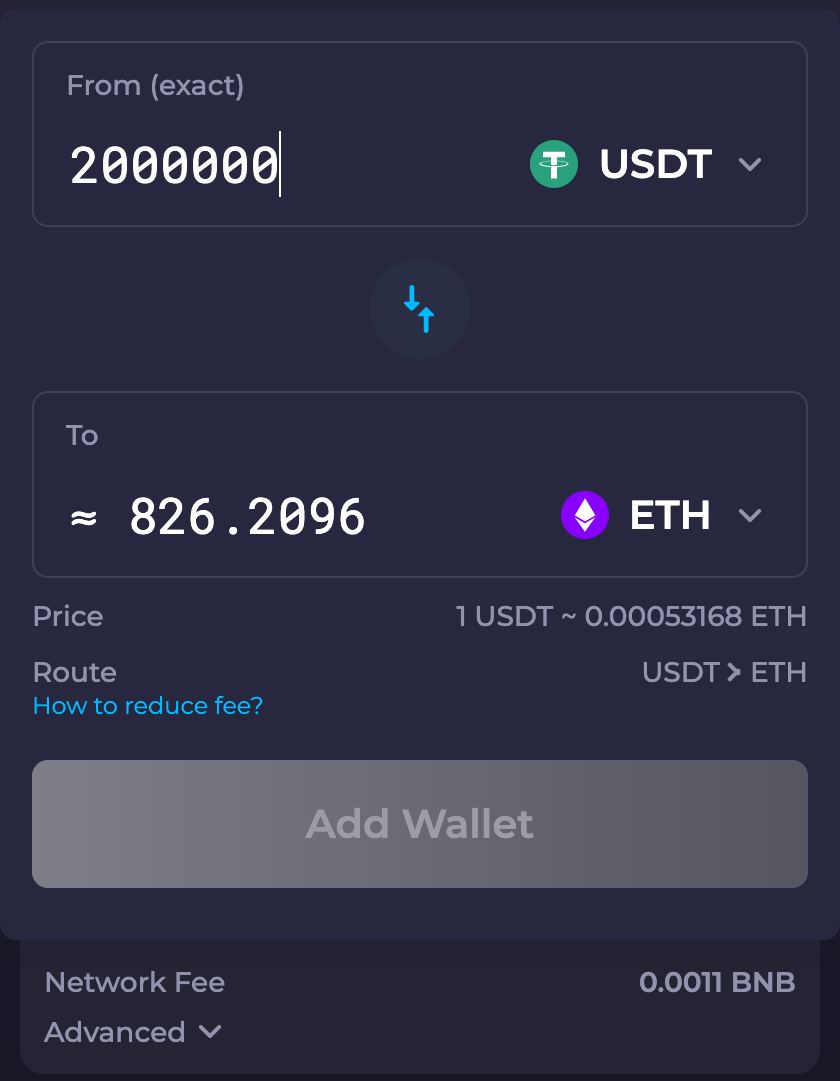

“Multichain” aggregators only aggregate liquidity from one single chain at a time or use a bridge to then cross-chain the assets post-swap. As a result, the slippage can be huge for large sums. Look at this comparison.

* Data collected on 08/17/2022

What this shows is that for a large sum (in this case $2 million equivalent), using Chainge to swap USDT in ETH can result in a transaction that is far more valuable than when using another aggregator. The price gap is not necessarily as striking when sums are lower, because some alternative platforms can access relatively decent liquidity for small trades from one chain, so the difference in returns are not as “painful.”

Nevertheless, the slippage is still there and very much noticeable, particularly for frequent traders or crypto connoisseurs struggling with interoperability issues and constantly losing money on their swaps.

Overall this shows that liquidity and true interoperability are key determinants of success when it comes to DeFi trading. They are as important as price, since they directly impact it. By harnessing ground-breaking technology, Chainge can access a far greater depth of liquidity than other aggregators and with that, deliver far superior results to its users.

Forget high slippage. Forget bridges. Trade in the Chainge Finance app – the only cross-chain DEX you’ll ever need.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2MYCDCXLRVFFJAUAGVU6XYQNG4.jpeg)