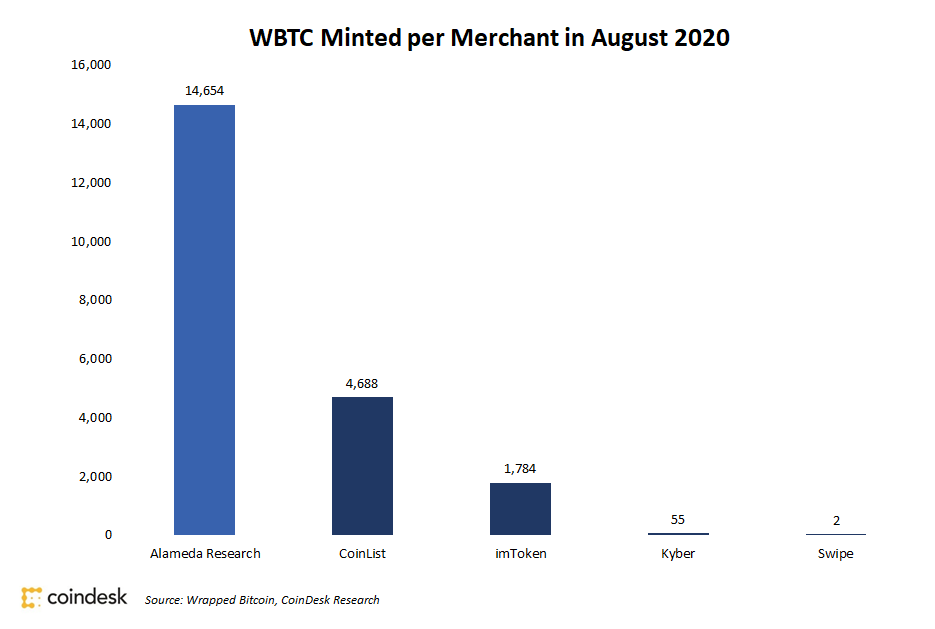

As the decentralized finance (DeFi) craze continues, growth in the supply of bitcoins tokenized on Ethereum is keeping pace, with one company – Alameda Research – gobbling up nearly 70% of wrapped bitcoin (WBTC) minted in August.

- Alameda’s accumulation of 14,654 WBTC last month came after the quantitative trading firm lobbied in July for an increase in the amount of collateral placed to earn interest on the Compound platform from 0% to 40%. Notably, the firm had not minted WBTC prior to August.

- The proposal was introduced and later approved after a previous proposal from Alameda to increase collateral to 65% was rejected.

- At the time, the firm said WBTC would diversify the assets used for collateral on the platform and increase interoperability between Compound and MakerDAO, which also supports WBTC as collateral.

- Alameda co-founder Sam Bankman-Fried has called wrapped bitcoin the “easiest bridge” between Bitcoin and Ethereum’s decentralized finance ecosystem.

- A straw poll passed Thursday in favor of increasing the number of dai, MakerDAO’s stablecoin, that can be minted from WBTC from 80 to 120 million. Some 14% of dai is derived from WBTC currently, according to Daistats. The motion is now set for an executive vote.

WBTC minted per merchant in Aug. 2020

- “Alameda has a tremendous reach within the market,” said Kiarash Mosayeri, product manager at BitGo, the company that helped spearhead Wrapped Bitcoin. “It's great to see another robust onramp help make Bitcoin more available for use on trustless protocols,” he told CoinDesk, speaking about the growing demand to use bitcoin in the Ethereum-base DeFi ecosystem.

- Alameda's sister company, FTX, supports conversion between bitcoin and wrapped bitcoin on its derivatives exchange. Also Binance, a notable investor in FTX, announced its support for wrapped bitcoin on Monday.

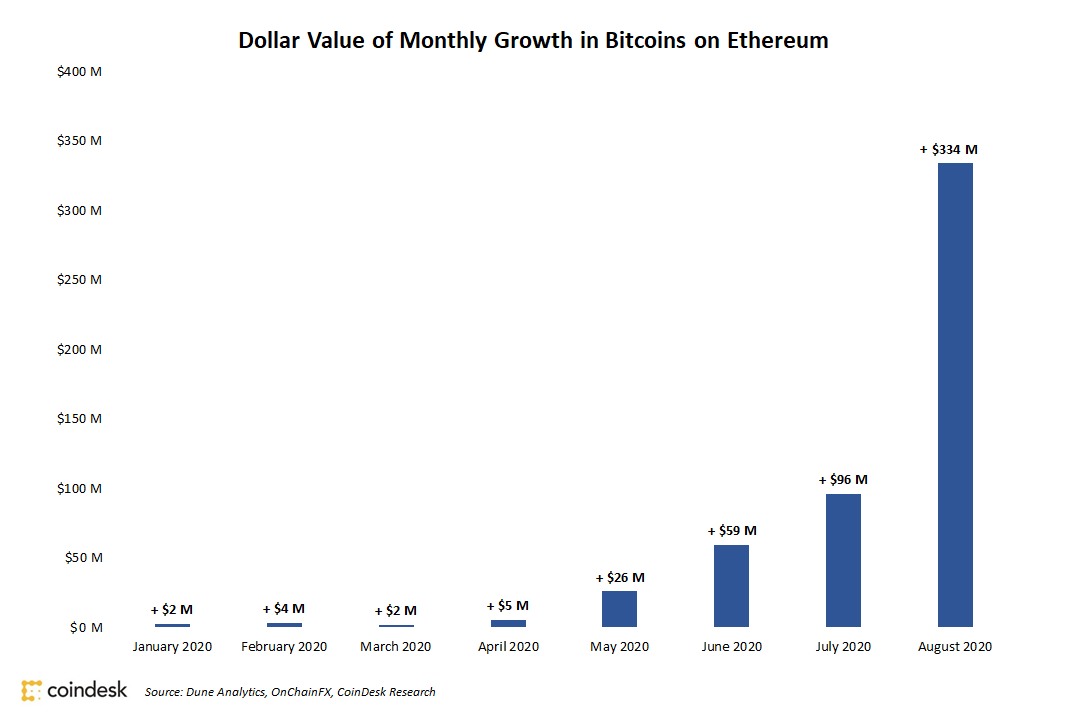

- Beyond wrapped bitcoin, the aggregate supply of all tokenized bitcoins tripled in August, as already strong demand to denominate DeFi-based trades and loans in bitcoin continues to grow.

- Following July’s growth, DeFi gained over 26,000 freshly tokenized bitcoins in August with a total supply of nearly 55,000 tokenized bitcoins worth more than $333 million, according to Dune Analytics.

Monthly value of new tokenized bitcoin supply since Jan. 2020

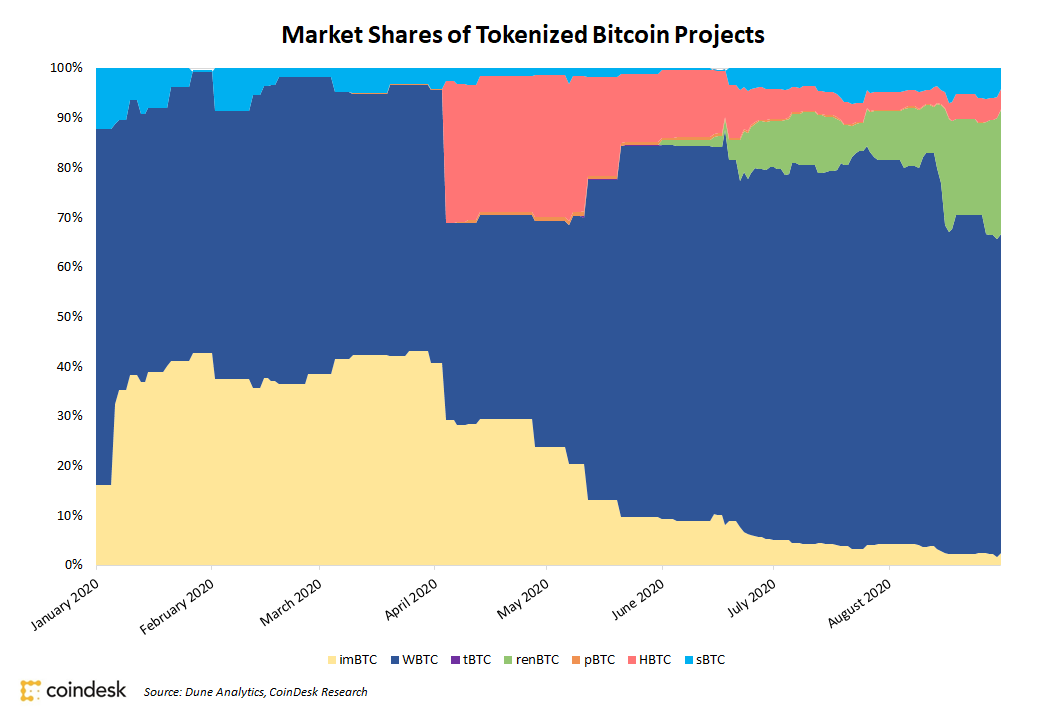

- Notably, the supply of renBTC, the second-largest tokenized bitcoin project, exploded from just under 2,000 renBTC in July to over 13,500 renBTC in August.

- Wrapped Bitcoin, still the dominant form of tokenized bitcoin, represented nearly 70% of the total supply of bitcoins on Ethereum.

Historical market shares between tokenized bitcoin projects

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TTRT3LVG5JFRRAN764AWGQK5FM.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFEHNV7HU5CCPFROJKQIPWNYJU.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YLVK7NL7PJAVRJVREC7DTR6XME.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EXPOIBREMFHSHA7CVOGJ5TDWUY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)