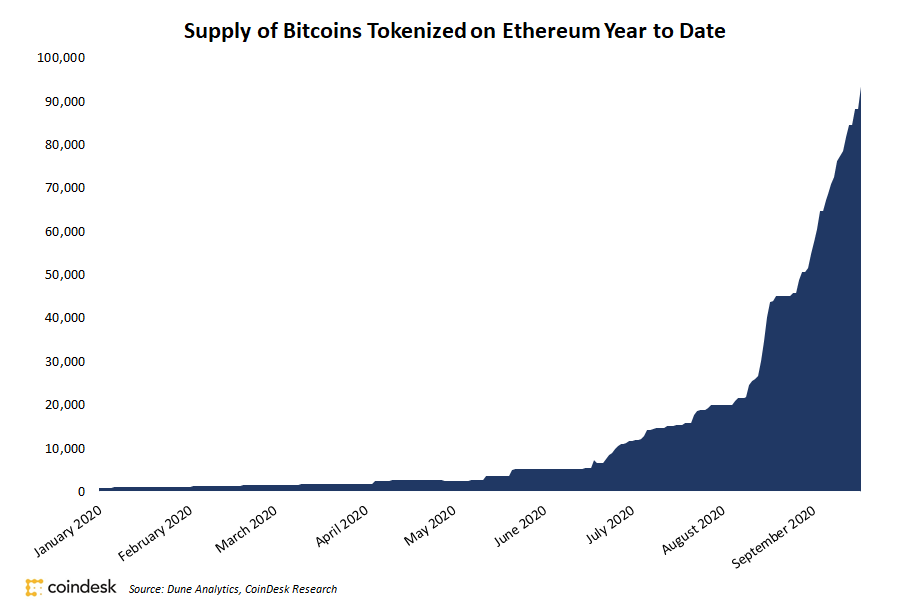

Over $1 billion worth of bitcoin has been tokenized on Ethereum as the total supply of tokenized bitcoin (BTC) passed 92,600 on Thursday, or 0.42% of the total BTC supply. In January, less than 1,200 BTC were tokenized worth less than $7 million.

- Wrapped bitcoin (WBTC), the largest tokenized bitcoin project, has minted over 60,500 tokenized BTC since its launch in early 2019, representing over 65% of the total tokenized BTC supply.

- “Huge buying demand” over the counter is one reason for the rapid increase in supply of tokenized BTC, according to Sam Bankman-Fried, CEO of FTX and co-founder of Alameda Research, the exchange’s sister company.

- OTC demand for WBTC started at FTX with the advent of decentralized finance’s yield farming craze, said Bankman-Fried. Demand continued to grow as the total value held in DeFi protocols increased.

- Nearly 70% of all WBTC minted in August were claimed by Alameda Research, as CoinDesk previously reported.

- RenBTC, the second largest tokenized bitcoin project, has issued 22,000 tokenized bitcoins since May, according to data queried on Dune Analytics.

Total supply of bitcoins tokenized on Ethereum since Jan. 2020

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YWCEXBFRTVEZNAHRGCN7VYNV2M.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PJTR3KRDWJCRVE3QREM6KUOK7A.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PFTJB3CBBZCGPEUSNCEZ7F3Z7U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHKY64D5QFBAJGUWPLIG2A2IME.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/T5HXBLVHUZAI3AJQABR3HTE4JA.jpg)